Topics

Replies

Spotware

29 Sep 2014, 12:23

We recommend you to post a job in Jobs section or contact one of cAlgo consultants.

@Spotware

Spotware

25 Sep 2014, 12:32

There is an overload of AverageTrueRange method that accepts MarketSeries object:

/api/reference/internals/iindicatorsaccessor/averagetruerange-9d2b

We can recommend you to contact one of our Partners or post a job in Development Jobs section.

@Spotware

Spotware

25 Sep 2014, 12:19

We can recommend you to contact one of our Partners or post a job in Development Jobs section.

@Spotware

Spotware

25 Sep 2014, 09:44

Dear Traders,

We had a technical problem yesterday, but it was fixed immediately. Please refresh your charts if you see gaps.

If you observe strange trendbars in backtesting, please remove backtesting cache folder: C:\Users\%UserName%\AppData\Roaming\BrokerName cAlgo.

We apologize for any inconvenience.

@Spotware

Spotware

25 Sep 2014, 09:43

Dear Traders,

We had a technical problem yesterday, but it was fixed immediately. Please refresh your charts if you see gaps.

If you observe strange trendbars in backtesting, please remove backtesting cache folder: C:\Users\%UserName%\AppData\Roaming\BrokerName cAlgo.

We apologize for any inconvenience.

@Spotware

Spotware

24 Sep 2014, 09:56

RE: Multi-symbol robots and indicators

Abhi said:

Hi Spotware Team, nice improvements. I still cannot run average true range indicator on multiple symbols.

Please could you let us know when the feature will be available or if there is a way to get around the problem.

Thanks in advance.

Regards,

Abhi

Please specify what you mean by saying that. You can use multi-symbol data in code of your indicator. You can also add ATR to several charts.

@Spotware

Spotware

24 Sep 2014, 09:08

RE: parameters been apply not working in a normal backtesting

Paulo_Lira said:

when you get optimization parameters , you press apply and make a backtesting with that parameters, results are not same from optimization results... i veryfy sames dates and info...

Do you optimize the time frame? If so, it is a known issue, it will be fixed with next update.

@Spotware

Spotware

23 Sep 2014, 14:32

RE: RE: RE: RE:

AlexanderRC said:

Spotware said:

- Ability to specify which parameters are ignored if some other parameter is set to a specific value to exclude runs with logically identical parameter

You can check parameters in OnStart method and stop cBot if needed.

That will require the cBot to store already tried logical combinations in some "external" store and abandon the run if the new set of parameters matches the one already computed.

Another approach would be to use combined values on a larger scale for the current genetic algorithm to work more efficiently. Consider the following example. There are 3 parameters, A, B and C. A can have values of 0 and 1. If A is 0, B parameter is used. If A parameter is set to 1, C parameter is used. B can have values between 0 and 120, C between 0 and 100. Instead, I can use combined parameter D which would have values from -121 to 100. -121 to -1 values of parameter D would be mapped to values 0 to 120 of parameter B and values of 0 to 100 of parameter D to values 0 to 100 of parameter C.

But both approaches would require deliberate changes to cBots.

For now I will stick to my own library.

Thank you for your suggestion, we will consider it.

@Spotware

Spotware

23 Sep 2014, 09:37

cTrader allows you to run an automated trading strategies (cBots). In order to do that you need to open cBots tab (next to Favorites), drag a cBot over the chart, drop it to the chart, enter parameters and press start.

You can download cBots from cTDN /algos/cbots or create your own cBot in cAlgo.

Related video: http://www.youtube.com/watch?v=bIH3OLBtsFc

@Spotware

Spotware

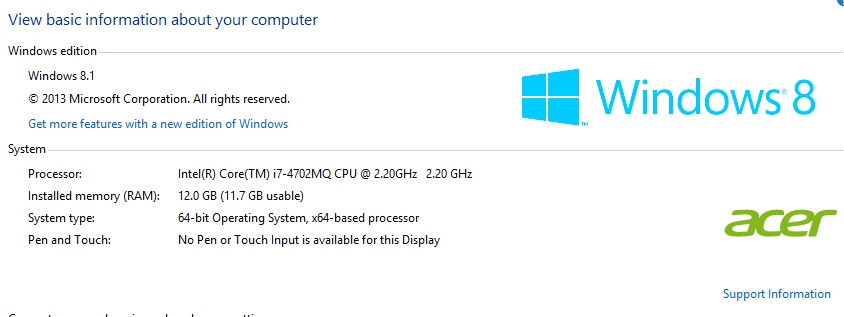

23 Sep 2014, 09:28

The exhaustive search simply backtests each possible set of parameters. It could take a lot of time to perform exhaustive optimization if there are many combinations.

Of course you can speed up optimization process by upgrading your PC, but if it takes 2000 days now, you need 1000x more processors to perform exhaustive search in 2 days.

We can recommend you to reduce parameters count or use Genetic Algorithm.

@Spotware

Spotware

22 Sep 2014, 14:28

RE: RE:

AlexanderRC, thank you for your feedback.

- Ability to specify which parameters are ignored if some other parameter is set to a specific value to exclude runs with logically identical parameters.

You can check parameters in OnStart method and stop cBot if needed.

- Specify some internal parameters of genetic algorithm such as size of initial population, whether crossover and/or mutations are used. Criteria for convergence to optimum fitness value, etc.

We plan to expose such parameters in the future.

- Equity and balance drawdowns in absolute values and all sorts of derived metrics based on those. For example, I do not optimize entry volume as it is chosen after optimization to keep the expected drawdown at a certain value and that calculation depends on the initial balance and optimized drawdown in absolute currency value.

It will be available with next update.

- Ability to specify swaps (including copying current values from the server).

We plan to support swaps in the future.

- Ability to specify some bias towards mutations/crossings in some parameters against the others. For example, it may be wise to try more values for fixed take profit parameter than for the parameter specifying the number of periods in the moving average indicator.

- Ability to spread the work across remote agents running on separate computers (with uploading bar/tick data to the agent and some external data like times when the news were released).

We will consider these ideas.

@Spotware

Spotware

29 Sep 2014, 12:24

We recommend you to post a job in Jobs section or contact one of cAlgo consultants.

@Spotware