Topics

Replies

ncel01

14 Mar 2023, 10:37

Hi,

There you have the reason!

Maybe his broker allows 0.1 or even 0.01 units on indices, meaning that you were trading 10x or even 100x more than him on NASDAQ, reason why your account has blown!

Note that Spotware is not protecting traders regarding this. Equity-to-equity ratio is not applicable when it comes to the minimum trading quantities.

For instance, even if the equity-to-equity ratio is 1:1 and the volume ratio is 1:100, a position will always be open with the min. applicable trading quantity!!

Interesting, isn't it?

Suggestion: I would avoid any broker with min. trading quantities of 1.0 units at all costs as these conditions are not acceptable at all.

@ncel01

ncel01

13 Mar 2023, 23:21

Hi Tadas,

What they have in common, among other:

- A high leverage account (usually 1:500)

- They use the leverage for ROI pumping

Of course the leverage is a problem. Not the only problem but it is a problem, that's for sure.

No matter what your risk management is, the higher the leverage the higher the risk. Furthermore, if the leverare is mainly intended for ROI pumping, it is not used as carefully as it should.

In short:

I can hardly imagine that a provider with a 1:10 leverage strategy, for instance, can have any harmful intention(s), which is not exactly true when it comes to 1:500.

@ncel01

ncel01

13 Mar 2023, 20:13

Hi Panagiotis,

As we know, that's almost true.

Hi Florent,

Be aware that there are exceptions to this "concept" that can be really harmful to the investors.

Example:

I publish a strategy with a broker that allows a min. trading quantity of 0.01 units.

An investor starts following my strategy with the same funds as me: equity-to-equity ratio = 1.

However, if the investor's broker only allow a min. trading quantity of 0.1 units, for instance, the position will still be opened! Yes, besides the fact that volume ratio is 1:10, a position will always be open with the min. trading volume, no matter what the volume ratio is!

Of course, there's no equity-to-equity proportion here when comparing the trading volumes.

As result, the investor's account will be drained due to the high exposure and much lower margin available.

It can also happen that a broker suddenly changes the min. trading quantities. I've noticed recently that a broker increased the min. trading quantities on indices from 0.01 units to 1.0 units! Yes, that's 100x more! Brokers can act like this. Usually they "care a lot" about their clients.

For instance, I can automatically stop opening new positions if my broker increases the min. trading quantities. However, there's nothing I can do if this happens on the investors' side.

On the other hand, Spotware could do something if willing to. The reason why nothing regarding this has been done, so far, will remain a "mistery".

Just to keep you aware!

@ncel01

ncel01

13 Mar 2023, 10:24

( Updated at: 13 Mar 2023, 11:30 )

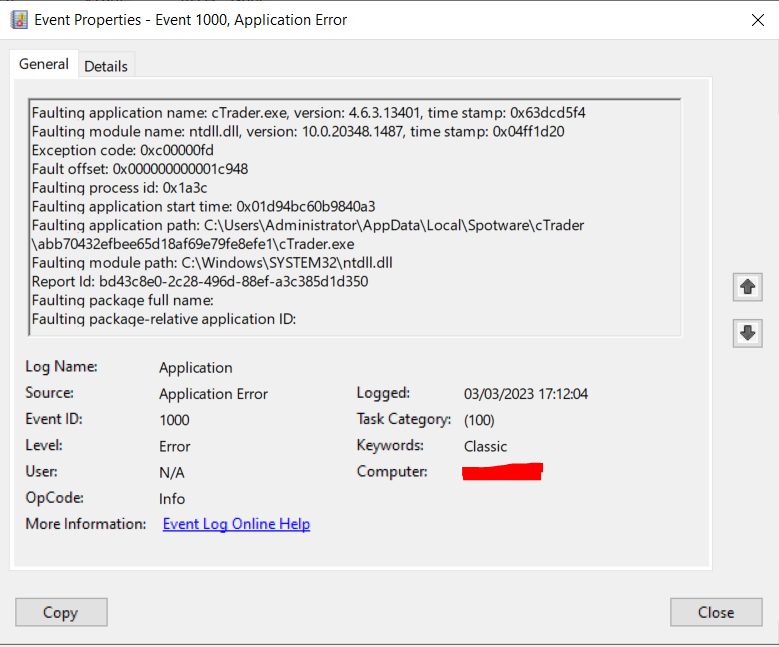

Dear cTrader team,

Being informed that several memory leaks have been fixed on this version is, in fact, something I didn't want to hear.

Reason:

I opened a new cTrader instance (v4.6.4) which was launched with ~300Mb and, in less than 72h including the whole weekend, it was using ~1700Mb.

Furthermore, there was no activity, at all, performed on this instance.

Is it legitimate to think that this will never be solved?

As far as I can see, cTrader memory leaks have been reported, at least, since 2013.

Thank you!

@ncel01

ncel01

13 Mar 2023, 01:27

Dear cTrader team,

Thanks for the update.

Could you plase clarify what is the meaning of the following sentence in the context of a Release Notes communication?

"The following issues were addressed"

Does it mean that these issues will be fixed in the next update?

Thanks for clarifying.

@ncel01

ncel01

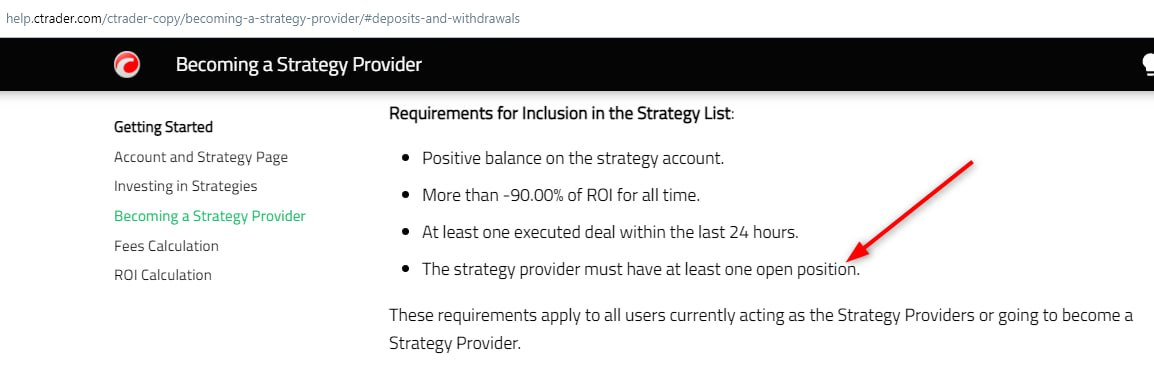

10 Mar 2023, 14:35

( Updated at: 10 Mar 2023, 14:40 )

Hello,

More than a personal preference, this has to do with what is best for the trading community as a whole.

For instance, from my point of view, the requirement to have, at least, one executed deal in the last 24h can be far worse than the one you mention.

You will certainly pay for it, however, you can always hedging positions and have them open while keeping your trading style.

What about executing a deal every 24h? Should I change my trading stile to satisfy Spotware's whims? I don't think so.

Nevertheless, both these requirements can be highly restrictive/harmful and are certainly pathetic.

Maybe, after all, paying more to the brokers, among other, is one of Spotware's intentions here. At least until proven otherwise.

That fact is that, so far, there was no feedback (at all) from Spotware regarding this matter and the reason is evident: they are not in a position to argue about this in a way that is compliant with their own motto nor they are able to convince traders about any good intentions behind such rules, as these are clearly harmful from any trader point of view.

The right thing to do here (in case there is still some good sense left) was, obviously, to revise these criteria in a way that it can be clearly explained/justified for the sake of transparency and credibility. Instead, it looks like Spotware is just expecting this topic to be forgotten in time by not being able to handle it.

Let's see how this will end and what the implications will be.

@ncel01

ncel01

03 Mar 2023, 20:33

( Updated at: 03 Mar 2023, 20:38 )

Hello,

It would be great indeed, to have these events available.

Unfortunately, not every useful tool is available on cAlgo and sometimes we need to work around and be a bit "archaic" to get to something similar.

In fact, I have suggested for something similar a while ago:

For the time being you can try the following code. Let me know if it helps!

using cAlgo.API;

using System.Linq;

namespace cAlgo.Robots

{

[Robot(TimeZone = TimeZones.UTC, AccessRights = AccessRights.None)]

public class DepositsWithdrawals_Check : Robot

{

#region Private Variables

private double myDeposits;

private double myWithdrawals;

private double realisedNetProfit;

#endregion

#region Methods

protected override void OnStart()

{

Positions.Closed += Positions_Closed; // Subscribes to the Positions_Closed event

var cBotClosedTrades = History.ToArray();

foreach (var trade in cBotClosedTrades)

realisedNetProfit += trade.NetProfit;

myWithdrawals = 0; // Abs value ( > 0 ) !

myDeposits = Account.Equity - realisedNetProfit + myWithdrawals; // myDeposits = (deposits - withdrawals) balance when cBot starts

}

// Will update realisedNetProfit and myDeposits everytime a position is closed

private void Positions_Closed(PositionClosedEventArgs obj)

{

realisedNetProfit += obj.Position.NetProfit;

myDeposits = Account.Equity - realisedNetProfit + myWithdrawals;

}

// Selected the desired timeframe for deposits/withdrawals to be checked ( I used OnTick() here. You can use OnBar, etc.)

protected override void OnTick()

{

if (Account.Equity - realisedNetProfit + myWithdrawals > myDeposits) // A deposit has been made

{

myDeposits = Account.Equity - realisedNetProfit + myWithdrawals; // Updates myDeposits

// Do something

}

if (Account.Equity - realisedNetProfit + myWithdrawals < myDeposits) // A withdrawal has been made

{

myWithdrawals = myDeposits + realisedNetProfit - Account.Equity; // Updates myWithdrawals

// Do something

}

else

{

// No deposit or withdral has been made

}

}

protected override void OnStop()

{

}

}

#endregion

}

@ncel01

ncel01

03 Mar 2023, 15:32

RE:

Spotware said:

Hi ncel01,

Your feedback has always been valuable. We are working on several performance optimizations concerning memory management which will be released probably next week. We will pick up on this conversation after the release of the update.

Best regards,

cTrader Team

Dear Spotware,

Good to know. Thanks for informing!

It's not that I want to push this. If not in the next week but next month, within 2 months, etc., that's also okay for me.

What traders need is "guarantees" regarding the performance issues (already reported multiple times), in particular, traders want concrete answers, like if Spotware is aware of these and working on a solution.

Please understand that, so far, your standard approach (replies) to all the questions raised by traders on this matter have not been convincing, since those did not provide any confidence/evidence that this is for Spotware an issue nor that this will be solved in the near future.

I still believe in the platform, otherwise I would not waste any time here trying to, somehow, contribute to make it better to all the traders.

I also believe that cTrader can achieve a state-of-the-art level if core issues like performance/memory leaks are solved.

Other improvements and new features are, of course, always welcome, however, please be aware of what the priorities are and, solving this is certainly the priority!

Your feedback has been appreciated.

Have a great weekend!

@ncel01

ncel01

02 Mar 2023, 21:25

( Updated at: 02 Mar 2023, 21:54 )

Dear Spotware team,

I guess it is time for Spotware to stop implicitly "blaming" traders for the evident "structural" problems of its own applications, no?

Although it can be convenient, it is not very intelligent to adopt the motto "Traders First", while repeatedly imply that cTrader stability/memory issues are due to the users' behaviour.

You make me remember of a person who, not knowing how to dance, blamed the floor.

Solution:

Please change the song as traders are getting tired of the same replies/clichés.

Additionally: once and for all do your homework. That would be appreciated!

At this time, there is more than enough (evident) matter to conclude that cTrader contains serious performance issues/memory leaks:

- RAM keeps accumulating overtime even when there are no cBots/indicators running and there is no user activity.

- Memory is not released when a cBot is stopped.

- Etc, etc.

Remark:

As you can imagine, people are getting saturated to hear that you are never able to reproduce some evident issue. If this is really the case please feel free to share your cTrader version with the community!

If I do not see any improvements on this in a couple of months I am out, as this looks like a ridiculous endless loop.

It can be really frustrating when you spend months/years working on a "Bugatti" (automated trading system), expecting cTrader to be the engine behind it and, after all, you notice that the Bugatti will be pulled by bulls.

Inshort, all that traders do not need include, but is not limited to the following:

- Spotware acting like a broker.

- A trading platform which crashes, among other, on every Jeremone Powell's speech.

Final remark:

For the sake of transparency/credibility, it would be also a good idea that Stopware inform on what is the criteria behind the recent changes for a strategy to be listed, as this is a clear promotion/incentive to an overtrading style.

Thanks for being experts in finance.

Regards.

@ncel01

ncel01

28 Feb 2023, 18:49

( Updated at: 21 Dec 2023, 09:23 )

RE: RE: RE:

Tarwada said:

you're right. this promotes over-trading and encourages people to trade as frequent as possible and that will eventually lead to more losses. we're traders and we know that.

ncel01 said:

Capt.Z-Fort.Builder said:

cTrader Copy official platform has applied a new criterion to hide strategies which have had no open positions since last Saturday(26 Feb 2023).

The search result also doesn't return the strategy name if there is no position!

I don't think it's a fair criterion, for those SPs who only trade intraday or have open positions in a short time (e.g. close average in or less than an hour) Even if they have trade almost every day.

I suggest restoring previous criteria to list all strategies without discrimination and letting users or investors can manually set on/off for the criterion

Hello,

More than discrimination this is about to promote/encourage some particular trading style(s).

I would love to hear what can be the criteria behind such rules. To satisfy some brokers?

As you can see, a killing strategy (ROI > -90%), when overtrading is, to Spotware, very welcome to be included in the strategies list.

Obviously, there is no possible justification for this. At least not a justification compliant with the motto "Traders First".

So far, I feel like I give one step forward and Spotware pulls me 2 steps back due to all the increasing and ridiculous limitations adopted.

Keep on thinking that traders are dumbs does not sound very intelligent at all.

Hi Tarwada,

And that's very compliant with the motto Traders First, isn't it? ????

@ncel01

ncel01

28 Feb 2023, 18:13

( Updated at: 21 Dec 2023, 09:23 )

RE:

Capt.Z-Fort.Builder said:

cTrader Copy official platform has applied a new criterion to hide strategies which have had no open positions since last Saturday(26 Feb 2023).

The search result also doesn't return the strategy name if there is no position!

I don't think it's a fair criterion, for those SPs who only trade intraday or have open positions in a short time (e.g. close average in or less than an hour) Even if they have trade almost every day.

I suggest restoring previous criteria to list all strategies without discrimination and letting users or investors can manually set on/off for the criterion

Hello,

More than discrimination this is about to promote/encourage some particular trading style(s).

I would love to hear what can be the criteria behind such rules. To satisfy some brokers?

As you can see, a killing strategy (ROI > -90%), when overtrading is, to Spotware, very welcome to be included in the strategies list.

Obviously, there is no possible justification for this. At least not a justification compliant with the motto "Traders First".

So far, I feel like I give one step forward and Spotware pulls me 2 steps back due to all the increasing and ridiculous limitations adopted.

Keep on thinking that traders are dumbs does not sound very intelligent at all.

@ncel01

ncel01

14 Mar 2023, 10:44

Hi Ronnie,

In fact, we all are missing something here until proven otherwise.

That's not all. You also need to open/close a position every day!

Spotware has been "improving" a lot lately regarding this and, so far, no explanations have been provided.

@ncel01