Topics

Replies

supafly

17 Dec 2013, 19:46

I have managed to replicate the above code and the robot seems to be working fine but I'm facing other issues. There is no restrictions in my source code on how many simulatenous positions the robot can execute. I checked the results against an older calgo using the older APIs and the only difference is that it cannot open multiple trades. Is there a new feature that restricts the amount of trades?

@supafly

supafly

17 Dec 2013, 19:04

Your documentation doesn't really help me figure out the issue. Before the changes where made, a trade would be executed and then the s/l and t/p would be modified from the PositionOpen method. I have multiple buy/sell scenarios which the robot cycles through and when the criteria of one scenario is met, it executes an order and based on that scenario is uses a specific take profit and stop loss defined in the PositionOpen method.

I'm not sure how i can implement the new changes since some examples:

A. state that i must assign a traderesult variable which contains a boolean value and if that boolean value is true, then you can insert your code that modifies the order. (This though is inconvenient for me since there will be a repetition of code).

B. show this code which I have replicated and doesn't work.

protected override void OnStart()

{

ExecuteMarketOrder(TradeType.Buy, Symbol, 10000,"myLabel", 10, 10);

Positions.Opened += PositionsOnOpened;

}

private void PositionsOnOpened(PositionOpenedEventArgs args)

{

var pos = args.Position;

Print("Position opened at {0}", pos.EntryPrice);

}

@supafly

supafly

29 Nov 2013, 14:40

RE:

I would like to take your word for it but I am placing my trust in your commercial software and assuming my code is safe. The forex industry is already corrupt so I wouldn’t expect anything different from the companies within this industry. Hence why I have asked if you follow any standards to protect the trader’s intellectual property from Spotware. Can you somehow re-assure me and the rest of the calgo users that our code is indeed private?

Spotware said:

It is not possible for the code to be seen by Spotware. Your code is only accessible on the machine where cAlgo is running on.

@supafly

supafly

03 Nov 2013, 21:08

RE: RE: RE: Beautiful

Good point! I cant really go in detail though...

Kate said:

supafly said:

I do not use any indicators, oscillators or any tools, only price analysis.

What kind of price analysis? Actually indicators and oscillators are also price analysis tools.

@supafly

supafly

01 Nov 2013, 13:02

Wisek – Does such a thing even exist? The market is very dynamic and you need to re-adapt to it, not the other way round. I’m guessing only a quant might achieve what you are saying. I have only displayed the results I am getting with recent market conditions.

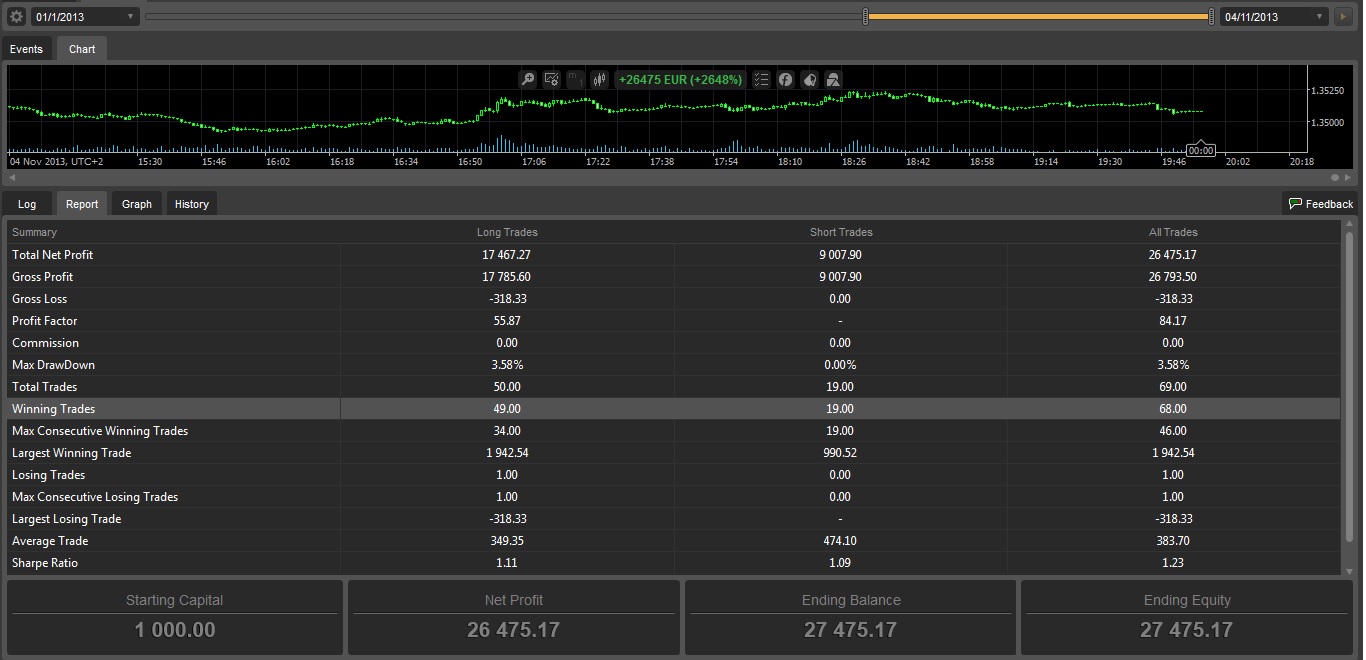

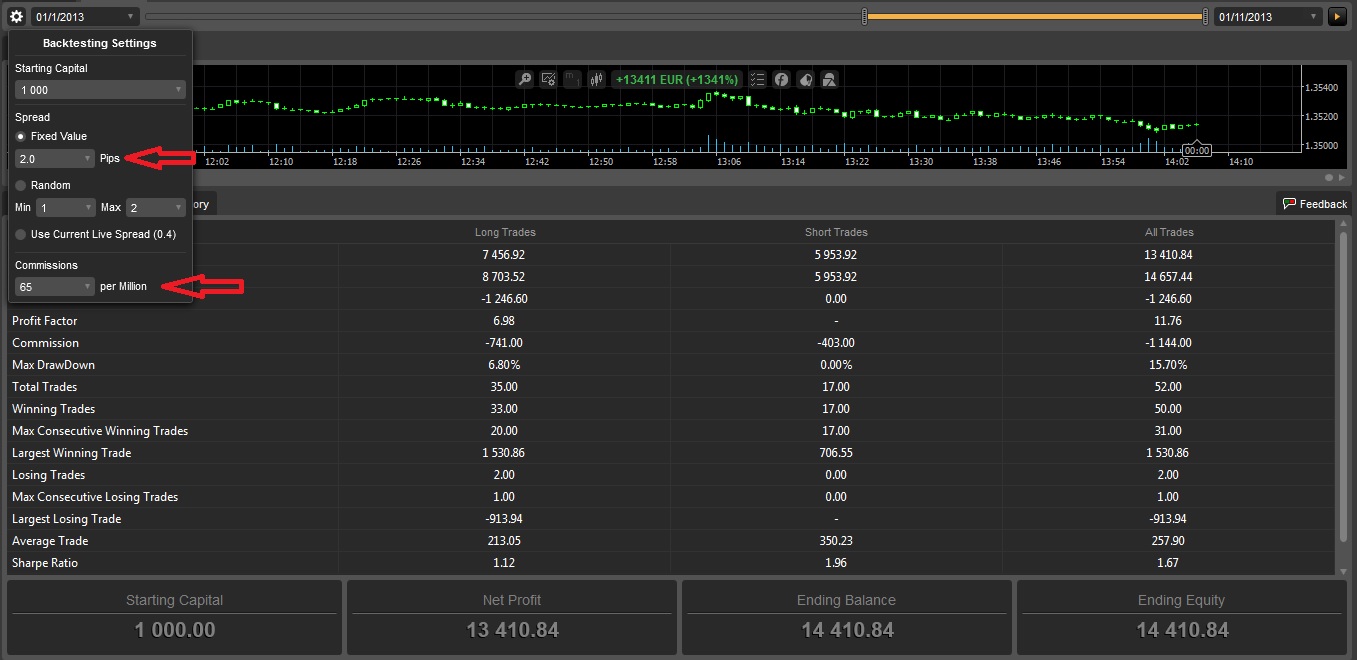

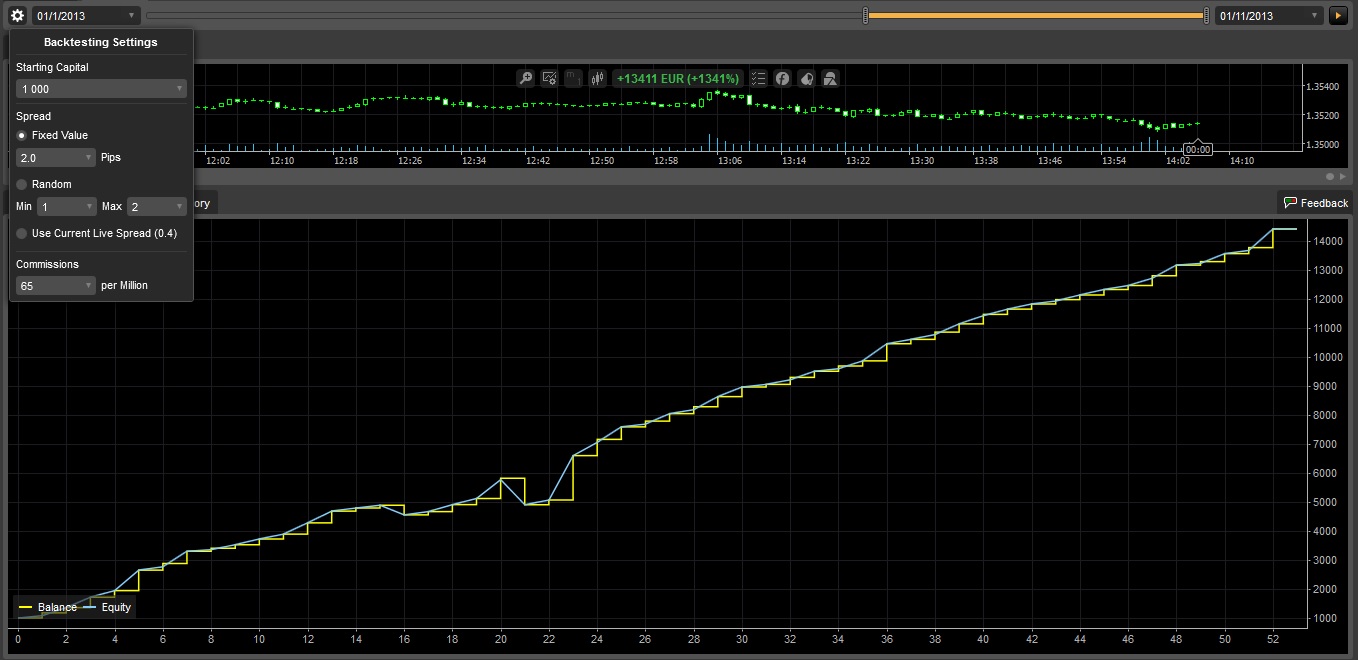

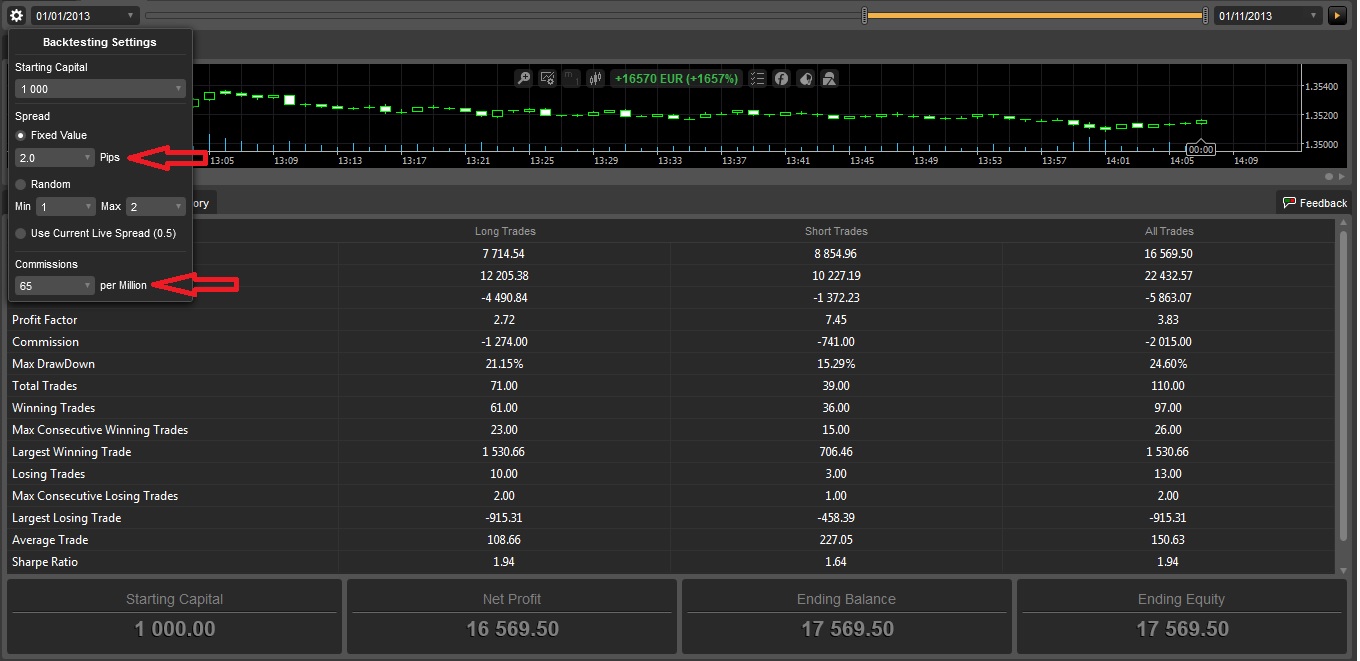

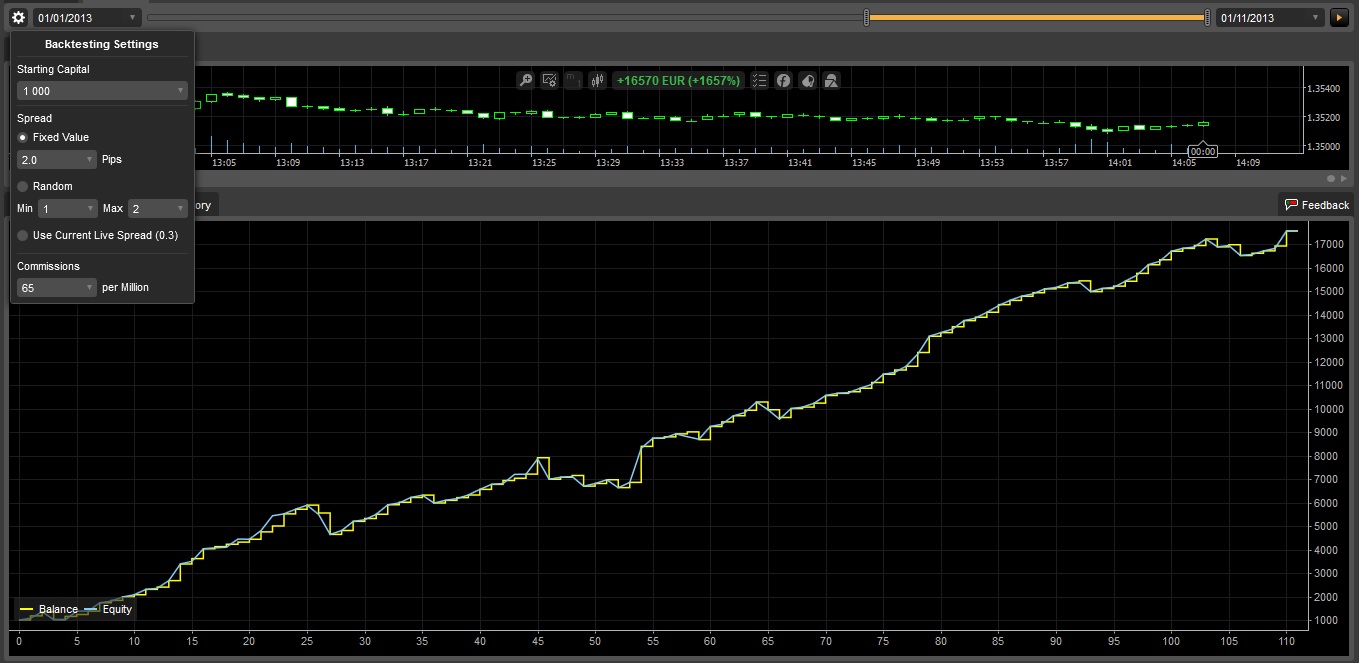

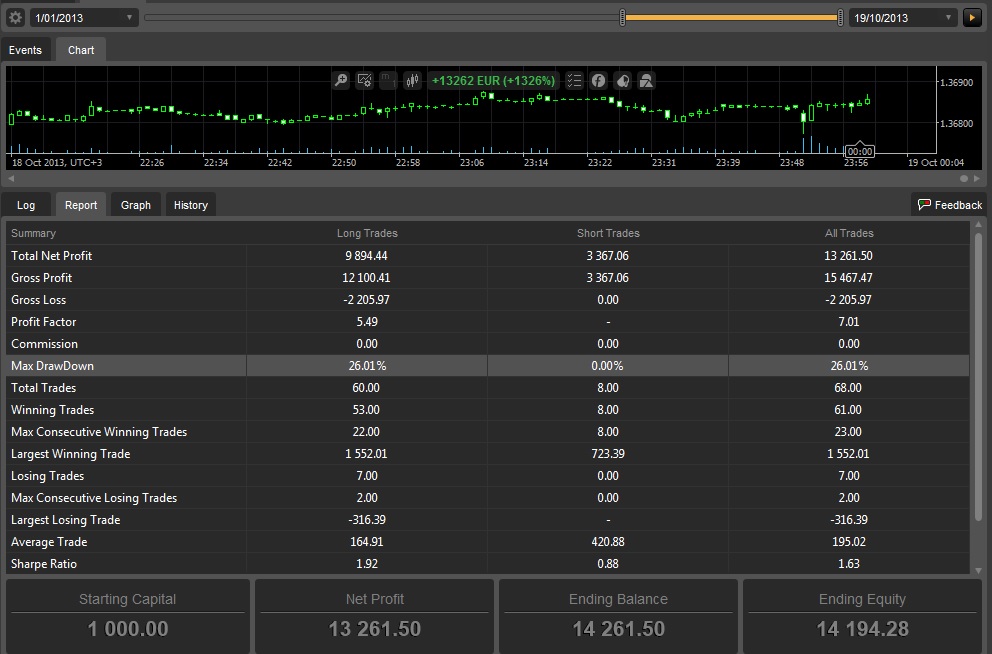

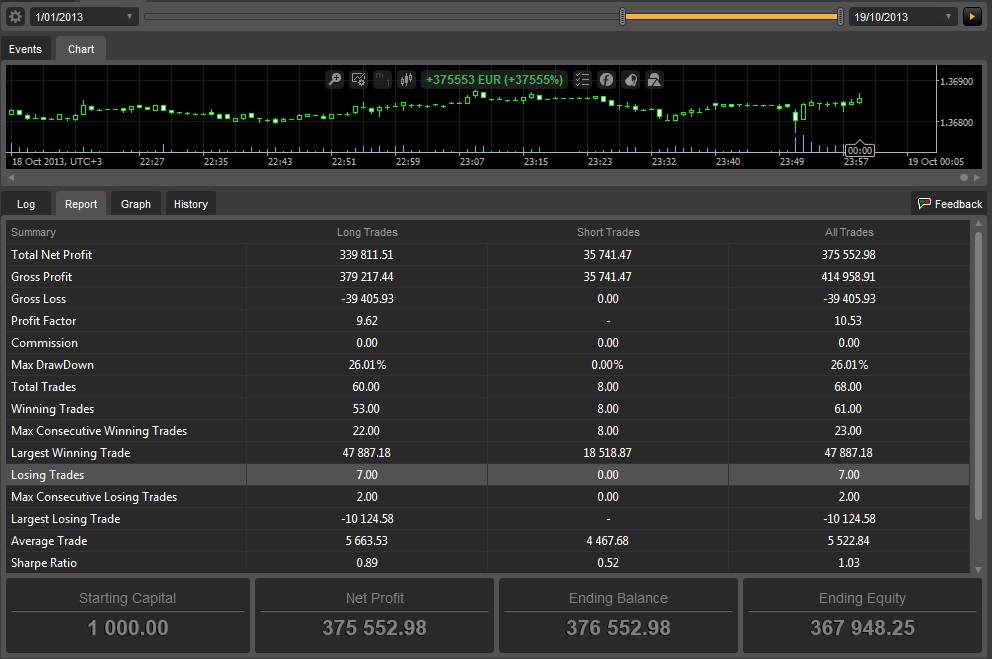

Kate – Can you give me some numbers to work with? I have used a 1000 euro capital with a fixed 1.0 lot per position, intentionally making the robot risky, to see if I can make a substantial return with a very small start-up. In doing so, I focused on keeping a low maximum draw down, a high win to lose ratio and low consecutive losses while being as profitable as possible. Therefore if I decide to use a larger capital with the same trading volume and parameters the overall risk will be significantly lower. For example, in reference to the 2000% return you mentioned, if I use a capital of 10,000 euros, the max drawdown is only 3% with a profit of 20,000, totalling 30,000. I am also currently using these robots to trade live since all the live testing has been consistent.

Virtuesoft – Thank you. The robots do not perform that well if I put any dates before the 1/12/2012. I believe these robots will soon reach their expiration date. Just got to keep finding an edge!

Cerunnos – Thank you aswell. There is a good reason why I don’t use commissions in the back testing but even if I did, it would only have a minor effect on the profits and not on the trades since they are not scalping systems. As I mentioned before, I have lived tested and it remained consistent, that included commissions (65 euros per million) and normal spreads. I use NO indicators, oscillators or any tools. My strategies are based purely on price analysis since that doesn’t lag!

@supafly

supafly

28 Oct 2013, 23:07

I have removed the cache from both the computers (I only use 1m EURUSD) and the new data was re-downloaded. The results from the backtests were exactly the same as before and they varied between the two computers. But I decided to take the EURUSD_Minute.ctb from one computer's cache and copy it to the other and when I ran the backtest on that computer, the results were 100% match for both computers. How can this in-consistency be fixed?

@supafly

supafly

25 Oct 2013, 17:25

Correction for the last message. The reason why the results vary is that for some bizarre reason, most of the trades executed on both computers using fxpro calgo are the same but some are different. Some trades are skipped on one calgo while they are executed on the other calgo and vice versa.

What solution can spotware provide for this issue?

@supafly

supafly

24 Oct 2013, 18:02

One other thing which i have noticed that is happening recently is that I might run my algo on 2 computers connected to the same network, they both use fxpro calgo but the results somewhat vary. The settings are exactly the same on both calgos, where all the parameters are preconfigured.

@supafly

supafly

24 Oct 2013, 16:35

I would advise you guys to download the platforms, run your algos on them and see the results for yourself. I am using MarketSeries and my system is NOT a scalping system that can be affected by broker commisions, floating spreads and even a price difference of 5 pips.

@supafly

supafly

19 Oct 2013, 22:41

( Updated at: 21 Dec 2023, 09:20 )

lec0456,

you seem to have the most decent system that I have seen on these forums. i have noticed u have an

impressive sharpe ratio of >3.0, i would also like to share one of my systems, it has 0 commisions since it used to generate signals, spreads are normal.

the same system with lot size increasing while profits accumulate, the other systems dont respond well to leverage

@supafly

supafly

10 Oct 2013, 19:20

( Updated at: 15 Jan 2024, 14:51 )

RE: RE:

Cerunnos, thanks for the reply, seems legit!

The method that I used stored is similar, where the stoploss and takeprofit is stored in variables and if there was a buy trade to compare the Symbol.Ask to the take profit/stop loss and vice versa if there is a sell trade.

- [Sign out]

Cerunnos said:

supafly said:

Is there a simple way to create a notification email when a take profit or stop loss has been hit?

Thanks

Maybe something like that:

protected override void OnPositionClosed(Position closedPosition)

{

if (closedPosition.TradeType == TradeType.Buy && closedPosition.Pips >= TakeProfit)

Notifications.SendEmail("xy@domain.com", "xy@domain.com", "TP hit", "TP hit - buy order closed");

else if ...

}

@supafly

supafly

28 May 2016, 20:36

RE: Impressive

ampalermo@gmail.com said:

I think everybody on this forum creates their own robots.

@supafly