Topics

Replies

iForex2015

18 Jan 2022, 22:38

RE: RE: RE:

amusleh said:

IGForex said:

Hi,

Thank you for the code. It kinda works. Is there a way to show CustomMACD from the last index without stretching or contracting?

Thank you

Regards

IvanHi,

Not sure what do you mean, it's not stretching or contracting, usually a larger time frame bar contains multiple shorter time frame bars, that's why you see the same value for multiple bars.

Hi

This is how it is showing on my system.

What I was asking was is it possible to show CustomMACD without stretching as seen in the first image I posted but without a gap between current time and CustomMACD end point. Every point of CustomMACD does not have to be aligned with the time/index, but only the end of it being aligned with last index.

Thanks

@iForex2015

iForex2015

17 Jan 2022, 22:31

RE:

amusleh said:

Hi,

Each time frame uses different index, you can't use the current time frame bars index on another time frame.

You have to first get the other time frame bar index by using current time frame bar Open Time, try this:

using cAlgo.API; using cAlgo.API.Internals; using cAlgo.API.Indicators; namespace cAlgo { [Indicator(IsOverlay = false, TimeZone = TimeZones.UTC, AccessRights = AccessRights.None)] public class CustomMACD : Indicator { public MacdCrossOver _macd; private Bars _bars; [Output("Histogram Up", PlotType = PlotType.Histogram, Color = Colors.DodgerBlue)] public IndicatorDataSeries HistogramPositive { get; set; } [Output("Histogram Down", PlotType = PlotType.Histogram, Color = Colors.DodgerBlue)] public IndicatorDataSeries HistogramNegative { get; set; } [Output("MACD", Color = Colors.DodgerBlue, LineStyle = LineStyle.Lines)] public IndicatorDataSeries MACD { get; set; } [Output("Signal", Color = Colors.Red, LineStyle = LineStyle.Lines)] public IndicatorDataSeries Signal { get; set; } [Parameter("Time Frame", DefaultValue = "Hour")] public TimeFrame tFrame { get; set; } protected override void Initialize() { _bars = MarketData.GetBars(tFrame); _macd = Indicators.MacdCrossOver(_bars.ClosePrices, 26, 12, 9); } public override void Calculate(int index) { var seriesIndex = _bars.OpenTimes.GetIndexByTime(Bars.OpenTimes[index]); if (_macd.Histogram[seriesIndex] > 0) { HistogramPositive[index] = _macd.Histogram[seriesIndex]; } else if (_macd.Histogram[seriesIndex] < 0) { HistogramNegative[index] = _macd.Histogram[seriesIndex]; } Signal[index] = _macd.Signal[seriesIndex]; MACD[index] = _macd.MACD[seriesIndex]; } } }

Hi,

Thank you for the code. It kinda works. Is there a way to show CustomMACD from the last index without stretching or contracting?

Thank you

Regards

Ivan

@iForex2015

iForex2015

21 Jun 2021, 18:36

RE: RE:

Symposium said:

IGForex said:

Hi Panagiotis,

I think it is absurd calculation because ,10 ten lot sell position summing upto 100 lots will determmine market direction compared to 90 micro lot buy positions summing upto 0.9 lot. But still market sentiment will show up like 90% buying. Wouldn't you agree ? I say this because recently I noticed many symbol showing 90 + % open buy or sell positions and price goes opposite. THis is a useless feature or even misleading.Thanks

IGForex, all data can be useful in these markets...... maybe look at sentiment when volumes are generally low (Asian, Early Monday, Late Friday Sessions) and you may notice the contrarians (or LP's) trading the opposite direction to market sentiment......

Possible strategy? Useful? Think about it........ Definetly not absurd.......

Thanks for the input. I tried as you suggested and its all 50-50. I realized it is not absurd. It s just an indicator and best option in front of me is to find a way to use it to my advantage.

@iForex2015

iForex2015

21 Jun 2021, 18:29

RE:

PanagiotisCharalampous said:

Hi 3047070,

It is neither absurd nor something intelligent. It is just a metric that says what it says. And what it says is that x% of traders believe that the market will go up and z% of traders believe that will go down. It is up to you to decide if this information is helpful for you or not and if you should consider it in any way. If you are not happy with this feature you can always use more advanced third part sentiment tools that consider volume of open positions as well.

Best Regards,

Panagiotis

I want to thank you for this most valuable information which I could not understand at first. It is neither absurd not intelligent, but just a metric. It took me a while and a lot of research and study to realize, all these indicators are just output shown based on current and/or past data. Beginner traders tend to hunt for that one perfect intelligent indicator that would show future results based on past data which simply does not exist. It s all about how do we interpret and use information to our advantage.

Regards.

@iForex2015

iForex2015

13 Jan 2021, 06:19

Done

It is possible to do so by enabling multiple profiles from Settings--> start up.

I dont know since when was this available.

Anyway big thanks

@iForex2015

iForex2015

13 Feb 2020, 13:22

RE:

PanagiotisCharalampous said:

Hi Ivan,

We have restored this option in Spotware cTrader Beta. It will be pushed to brokers soon.

Best Regards,

Panagiotis

Thats great. Thanks for the message.

@iForex2015

iForex2015

12 Feb 2020, 18:52

RE:

catalin.rimaru said:

Add the option to close All Filtered Positions.

Now, If I have 20 positions opened And I filter only the "EURUSD" ones or whatever filter I choose, the "Close All Positions" buton closes all 20 positions. I would like to Close All Filtered.

thanks

A must have facility.

I have closed positions accidentally thinking only filtered positions would be closed.

@iForex2015

iForex2015

12 Feb 2020, 18:47

How to remove market sentiment without removing quick trade buttons

Hi Panagiotis ,

Is there a way to hide market sentiment without removing quick trade buttons ?

@iForex2015

iForex2015

05 Aug 2019, 23:26

( Updated at: 21 Dec 2023, 09:21 )

Dear Panagiotis,

Thanks for your message. I have contacted my broker regarding the issue and this is the message I received.

------------------------

Dear Ivan,

Kindly inform that trading time currently based on GMT+3 time frame.

However you should be able to set your prefer time on ctrader platform.

If you want to set the same time zone as trading time please set by clicking the button as I show you in this attach document.

Please set it as UTC+3 and it should be the same time zone as trading time.

Should you need any further help do not hesitate to contact us.

Wish you have a nice day!

Kind Regards,

---------------------------------

I have changed platform time to UTC+3 as suggested and it didnt resolve the issue. By the way I checked ctrader from other brokers as well like FxPro and Pepperstone and all three platforms has the same issue showing Trading sesson inactive when market is open. I am very sure that this was not the case before. The platform was showing accurate session timings before a year or so, but I started noticing this glitch later on. I am checking the web ctrader platform now and it shows Trading session: Inactive(Starts in 145:41:00) and also the web ctrader shows green dot near to Trading session while desktop platforms shows red dot.

Thanks

@iForex2015

iForex2015

22 Jul 2019, 19:50

( Updated at: 21 Dec 2023, 09:21 )

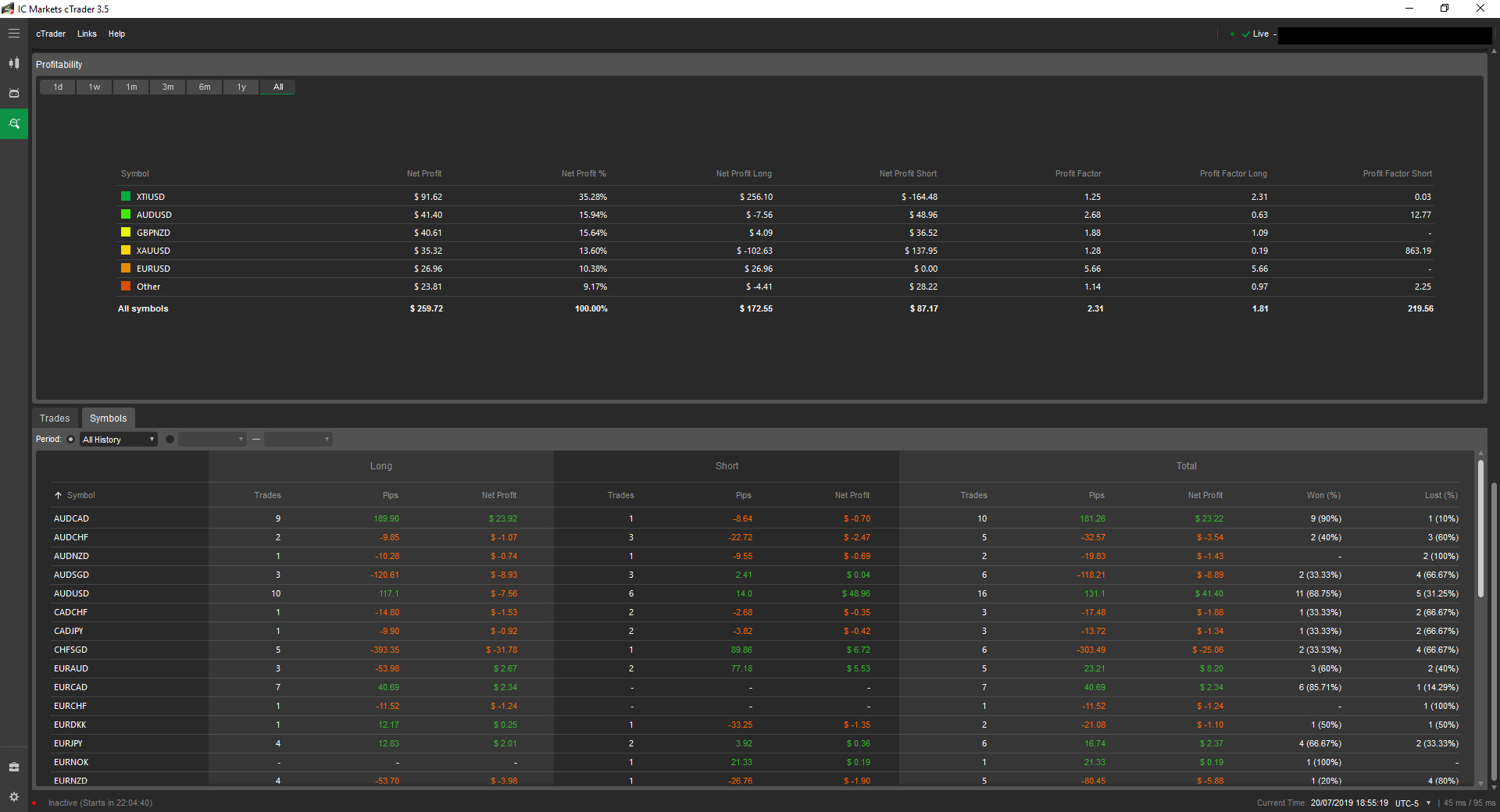

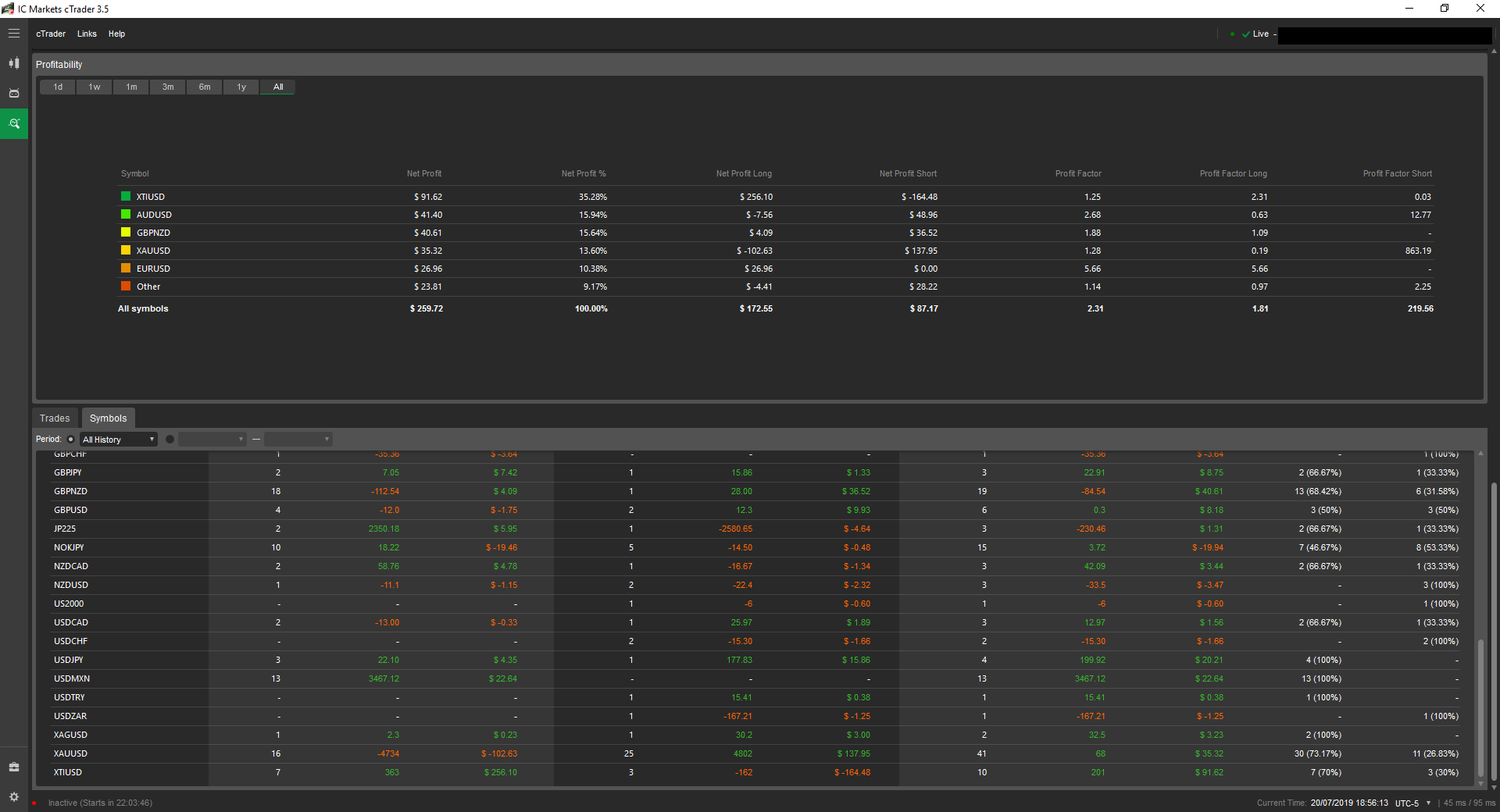

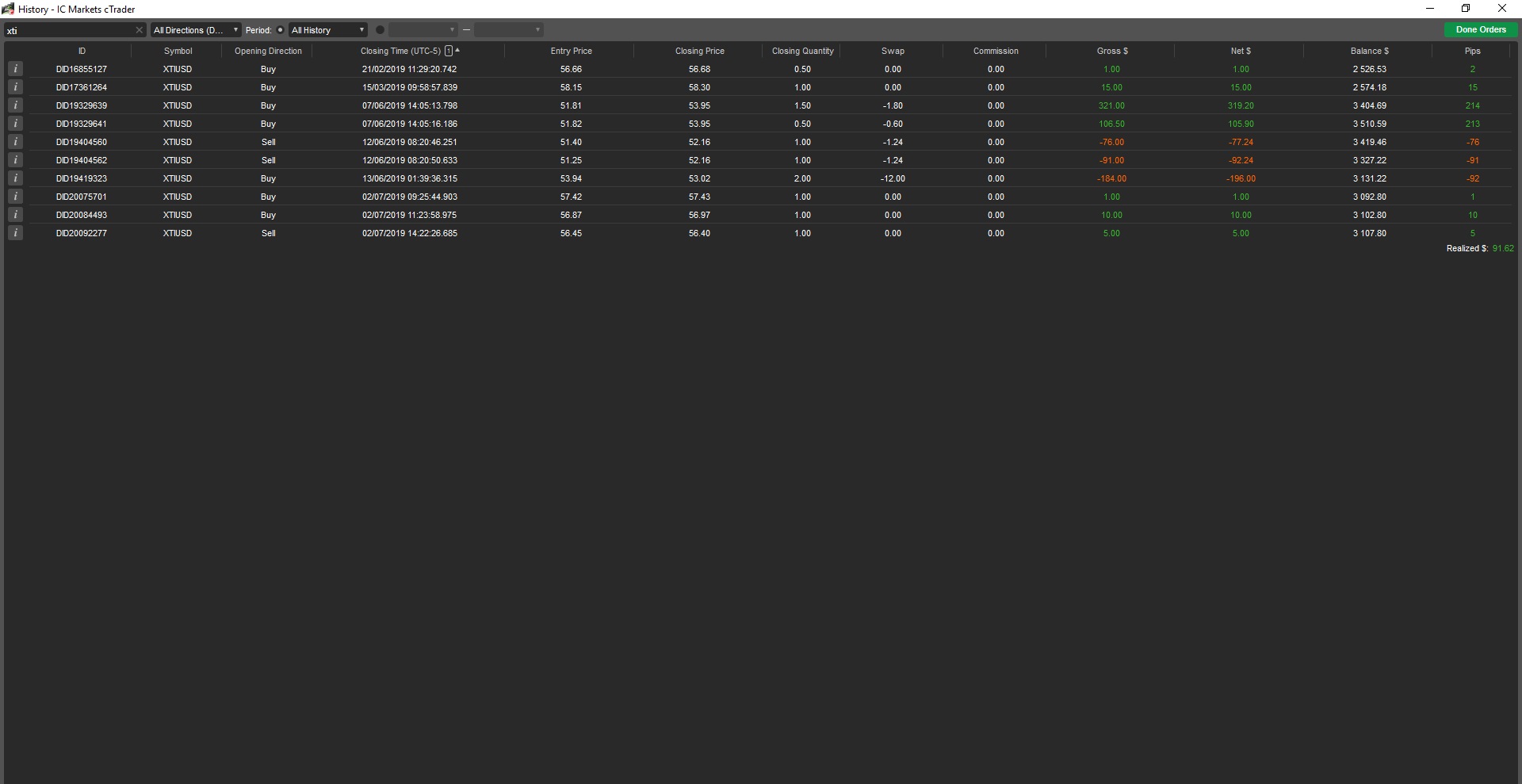

Hi Panagiotis,

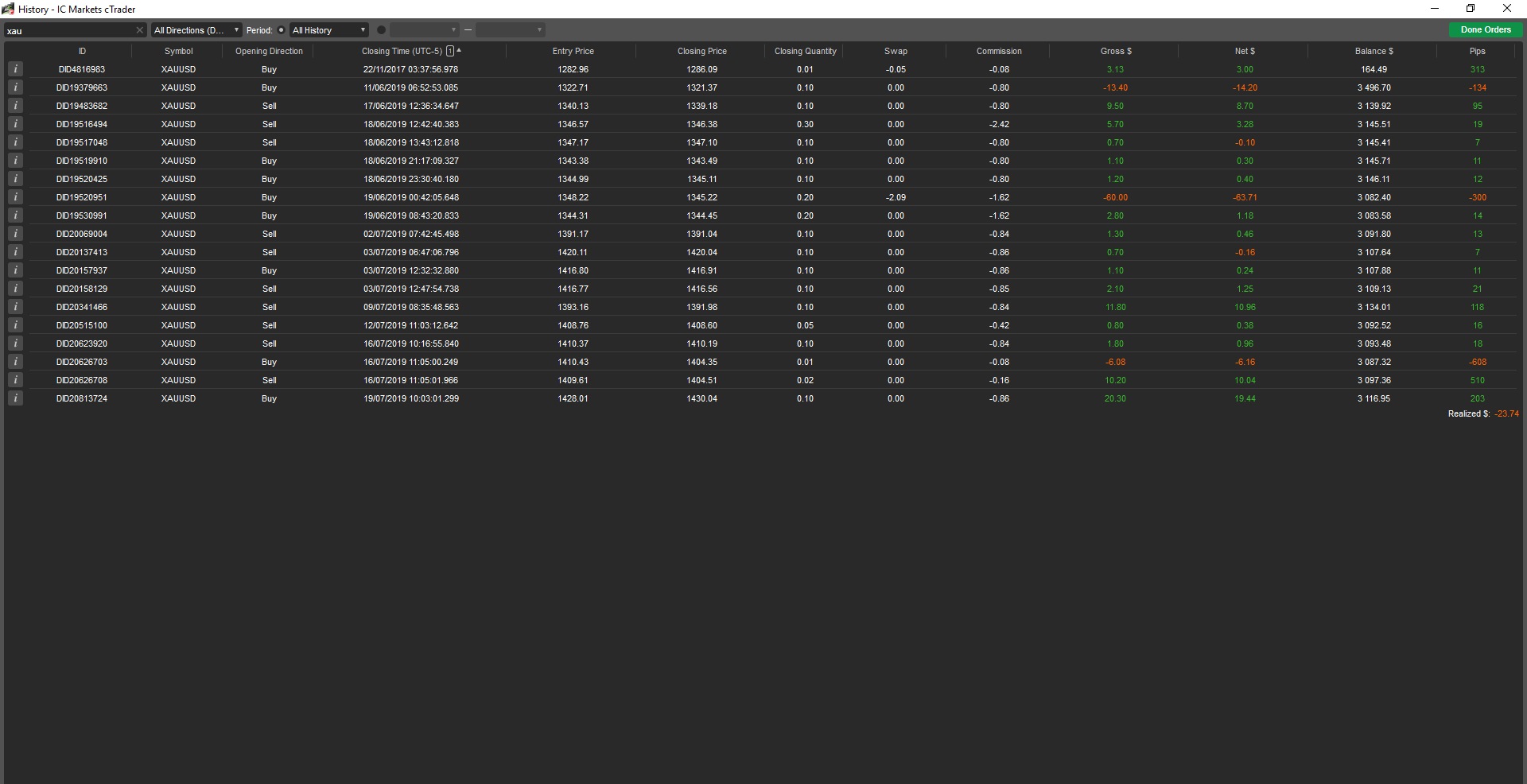

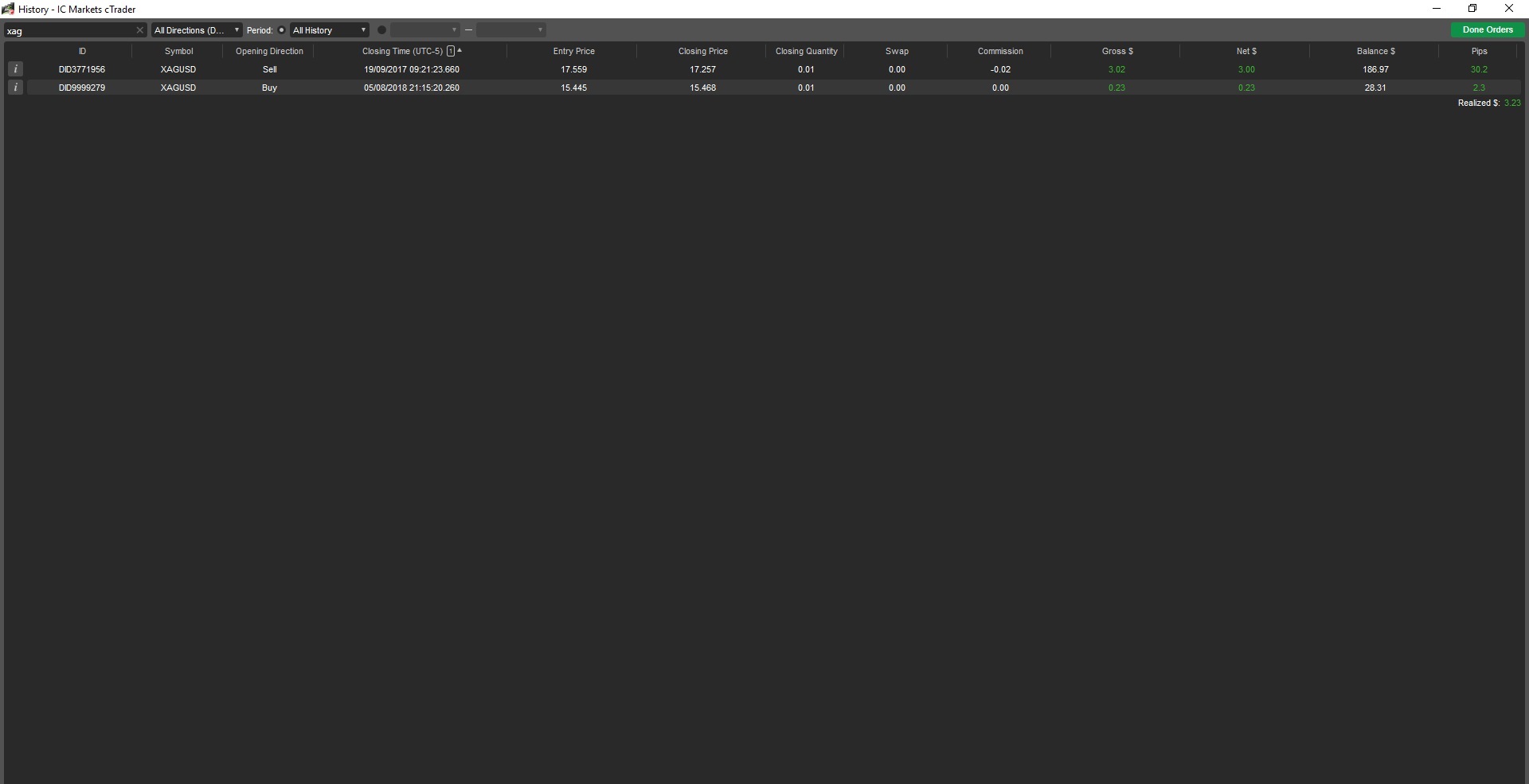

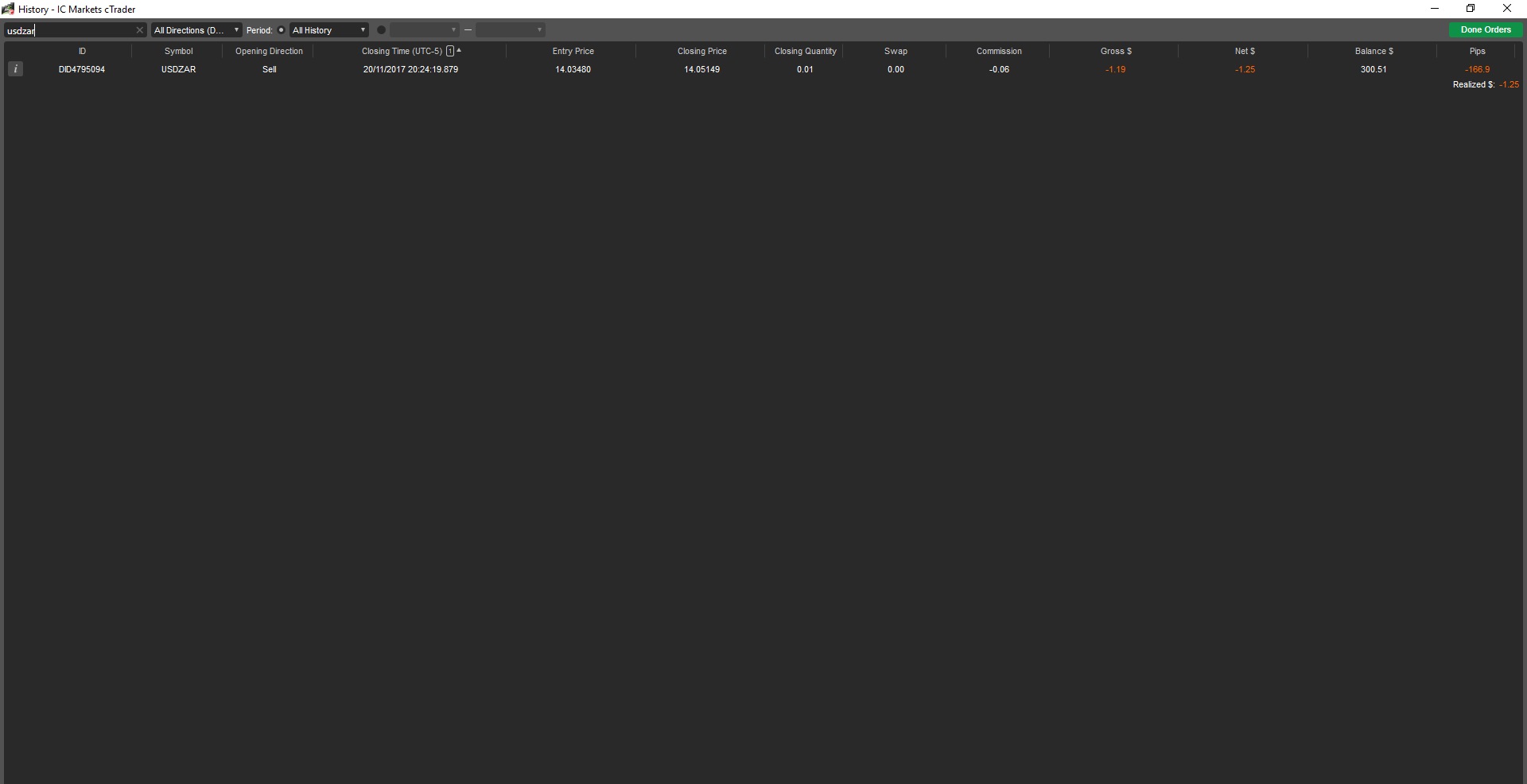

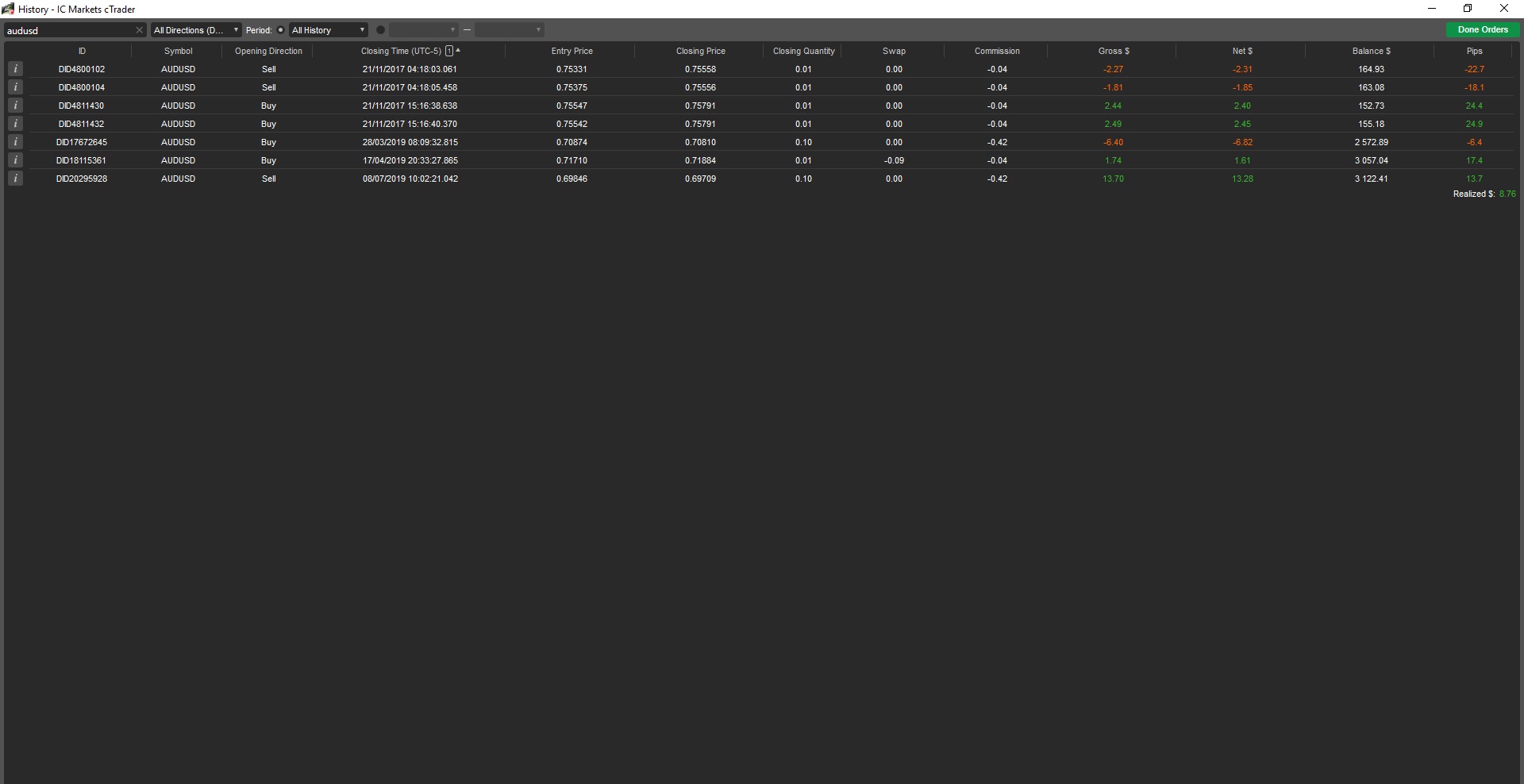

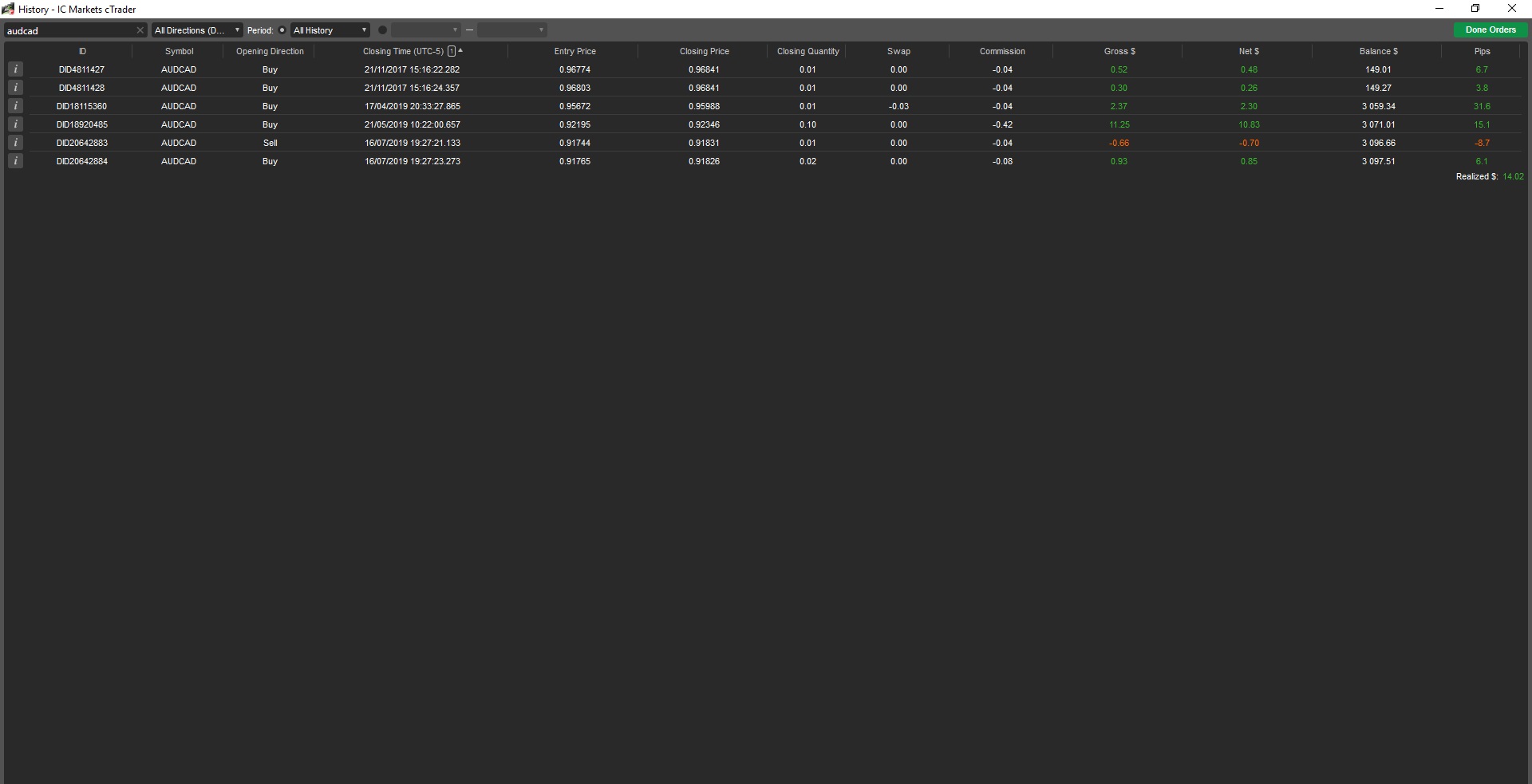

Here are some screenshots of the pairs I mentioned earlier. They refer to the same period.

Regards

Ivan

@iForex2015

iForex2015

18 Sep 2018, 18:16

Hi ,

Yes, I need help to calculate todays profit. For example I have this code for history net profit

var history = History.Where(t => t.SymbolCode == Symbol.Code);

var historyProfit = (int)(history.Sum(t => t.NetProfit));

and I want to show net profit between a particular time (system time) something like this ?

var profitToday = History.Where(t => t.SymbolCode == Symbol.Code && t.ClosedDate.Date == DateTime.Now.Date).Sum(t => t.NetProfit);

Thanks

@iForex2015

iForex2015

28 Jun 2018, 16:04

Hi Panagiotis,

I think it is absurd calculation because ,10 ten lot sell position summing upto 100 lots will determmine market direction compared to 90 micro lot buy positions summing upto 0.9 lot. But still market sentiment will show up like 90% buying. Wouldn't you agree ? I say this because recently I noticed many symbol showing 90 + % open buy or sell positions and price goes opposite. THis is a useless feature or even misleading.

Thanks

@iForex2015

iForex2015

27 Jun 2018, 18:39

Hi Panagiotis,

Thanks for the reply. When I hover that indicator it says for example, 10% of client accounts with openpositions in this symbol expect the price to fall. Could you please clarify if this is percentage of absolute positions ==> (number of buy or sell positions / all positions ) *100 ?

Thanks

@iForex2015

iForex2015

26 Jun 2018, 16:36

This is a horrible change, like OP stated, the cross hair data box is hiding the pip value when a candle-overlay-indicator is used.

@iForex2015

iForex2015

22 Mar 2017, 02:38

Hi lucian,

I changed the bot accordingly and its working fine so far. Thank you for your help .

@iForex2015

iForex2015

17 Mar 2017, 23:18

Dear BeardPower

Yes I was meaning thickness of candlestick. Thanks for the message.

@iForex2015

iForex2015

11 Mar 2025, 04:50 ( Updated at: 19 Mar 2025, 08:57 )

RE: Discrepancies in net profit calculation.

PanagiotisCharalampous said:

Holy oops. Missed the msg and opportunity to collaborate.

Active trader here. You can contact me on anything you think I might be able to collaborate.

Thank you.

@iForex2015