Topics

Replies

Spotware

07 Jun 2016, 15:05

Dear Trader,

Please have a look at the Positions.FindAll Method.

We hope, it will help you with your query.

@Spotware

Spotware

07 Jun 2016, 14:56

Dear Trader,

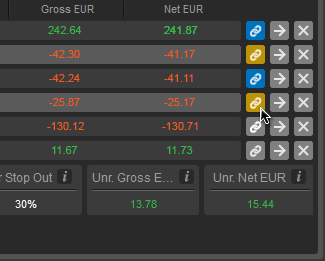

The details you mentioned are available when you open a hegding account in cTrader.

We kindly invite you to use our Spotware demo, download cTrader Desktop or use cTraderWeb and check out the latest features offered in cTrader.

@Spotware

Spotware

03 Jun 2016, 09:51

Dear Trader,

Currently we don't provide users with the ability to apply templates programmatically. We will consider providing it in the future. Stay tuned.

Additionally, you can post your ideas/suggestions to http://vote.spotware.com/

@Spotware

Spotware

31 May 2016, 15:56

Dear Trader,

As you can also see in the Schema the balance is monetary type, which contains the monetary amount in cents, penny, etc and is represented using long (int64) data type.

Example: balance:100000, depositCurrency:USD => balance: 1000 USD

The big problem is that it cuts even the 0. So for 150.10 it gives 1501 so I can't just divide everything by 100 as a quick fix

Could you please send us the request/response example showing the above mentioned issue?

@Spotware

Spotware

31 May 2016, 10:05

Dear Trader,

Please have a look at the "Unlink Trading account from cTID" section of our User support site.

You can check, which trading accounts are connected to your cTID by logging in to cMirror. You can also unlink all trading accounts including the live accounts in cMirror by right clicking on the account and select the "Unlink" field.

@Spotware

Spotware

30 May 2016, 12:00

Dear Traders,

Thank you for your suggestion. We will consider it. Additionally, you can post your ideas/suggestions to http://vote.spotware.com/

@Spotware

Spotware

30 May 2016, 11:54

( Updated at: 21 Dec 2023, 09:20 )

Dear Traders,

We would like to inform you about the new order types that will be introduced in the upcoming releases of cTrader.

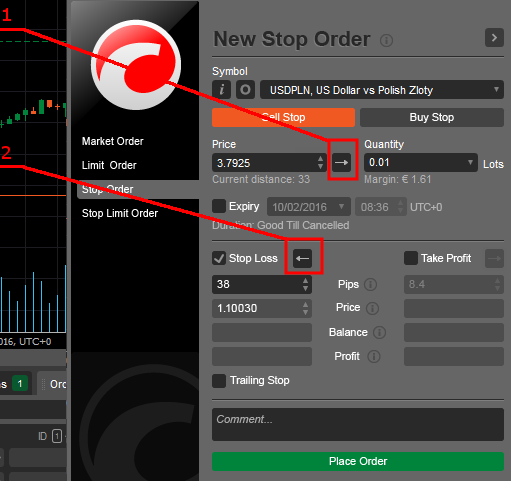

1. Trigger side for Stop Orders:

The trader will be able to choose the trigger side for Stop and Stop Loss orders using the new trigger side buttons illustrated below.

Behavior:

- Stop Order (#1 on Fig)

- Buy order

- Trade Side (Default) - the order will be triggered by the Ask price higher or equal to the order price

- Opposite Side - the order will be triggered by the Bid price higher or equal to the order price

- Sell order

- Trade Side (Default) - the order will be triggered by the Bid price less or equal to the order price

- Opposite Side - the order will be triggered by the Ask price less or equal to the order price

- Buy order

- Stop Loss Order (#2 on Fig)

- Buy position

- Trade Side (Default) - the order will be triggered by the Bid price higher or equal to the order price

- Opposite Side - the order will be triggered by the Ask price higher or equal to the order price

- Sell position

- Trade Side (Default) - the order will be triggered by the Ask price less or equal to the order price

- Opposite Side - the order will be triggered by the Bid price less or equal to the order price

- Buy position

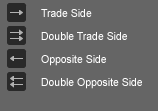

2. Double Trigger Method for pending orders

Behaviour:

- Stop Order/Stop Limit Order

- Buy order

- Double Trade Side - the order will be triggered by the two consecutive Ask prices higher or equal to the order price

- Double Opposite Side - the order will be triggered by the two consecutive Bid prices higher or equal to the order price

- Sell order

- Double Trade Side - the order will be triggered by the two consecutive Bid prices less or equal to the order price

- Double Opposite Side - the order will be triggered by the two consecutive Ask prices less or equal to the order price

- Buy order

- Stop Loss Order

- Buy position

- Double Trade Side - the order will be triggered by the two consecutive Bid prices less or equal to the order price

- Double Opposite Side - the order will be triggered by the two consecutive Ask prices less or equal to the order price

- Sell position

- Double Trade Side - the order will be triggered by the two consecutive Ask prices higher or equal to the order price

- Double Opposite Side - the order will be triggered by the two consecutive Bid prices higher or equal to the order price

- Buy position

- Limit Order

- Buy order

- Double Trade Side - the order will be triggered by the two consecutive Ask prices less or equal to the order price

- Sell order

- Double Trade Side - the order will be triggered by the two consecutive Bid prices higher or equal to the order price

- Buy order

- Take Profit Order

- Buy position

- Double Trade Side - the order will be triggered by the two consecutive Bid prices higher or equal to the order price

- Sell position

- Double Trade Side - the order will be triggered by the two consecutive Ask prices less or equal to the order price

- Buy position

Limit and Take Profit orders won't support the single/double Opposite Side trigger method. A full list of available trigger methods and trigger sides are shown below:

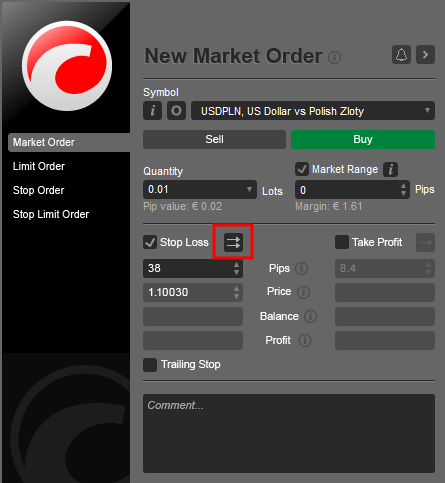

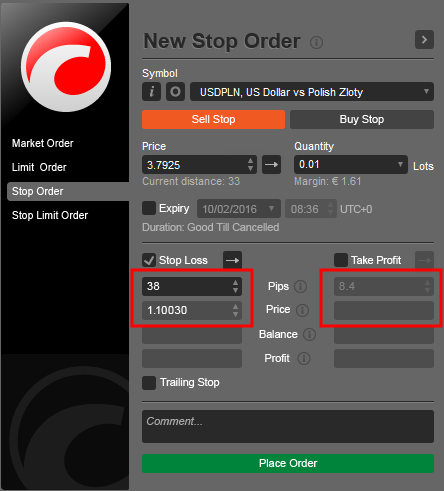

Relative Protection Levels:

Traders will use either relative or absolute values when applying their Stop Loss, Trailing Stop Loss or Take Profit.

A trader may set the protection level in either Pips or absolute price . When the trader clicks the Pips field or the Price field, the field is becomes editable. The other field is disabled and changes value automatically depending on field which is actively being edited.

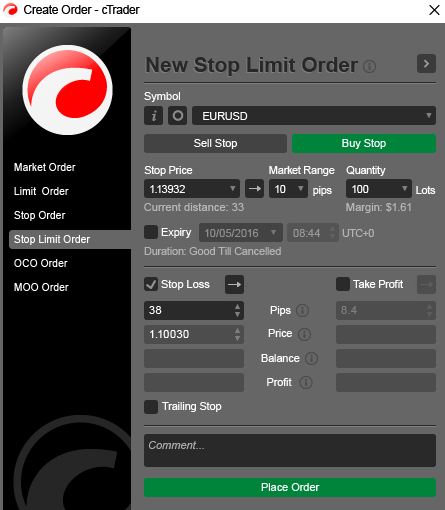

Stop Limit Orders:

Stop Limit Orders will be a newly introduced order type accessible through a new tab.

Behaviour:

Trader sets stop price and market range for limit order. Limit price will be above stop price for buy orders and below stop price for sell orders.

When the market reaches a specific rate the order is triggered like Stop Order.

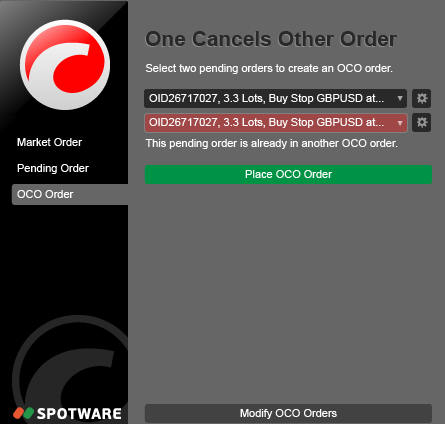

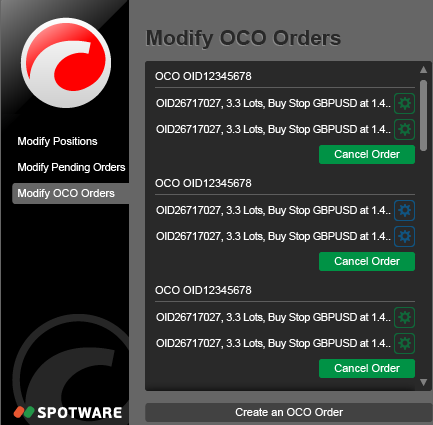

One Cancels Other Orders (OCO):

OCO Orders will be introduced and can be managed from OCO order windows and the Tradewatch in cTrader.

Behaviour:

A Trader can link 2 pending orders to become one OCO Order

If one order changes status from Accepted to Filled, the linked order is cancelled. The OCO Order is executed

If one order changed status from Accepted to Cancelled or Rejected, the OCO Order should be cancelled

@Spotware

Spotware

30 May 2016, 11:19

Dear Trader,

the code editor of cAlgo provides you with the ability to code using the c# programming language. Please have a look at the Spotware Connect site, where you can use the Open.API and build your own app using Java.

@Spotware

Spotware

27 May 2016, 09:37

Dear Trader,

Currently we don't provide users with the ability to set the default Workspace they would like to be loaded on cTrader start up. We will consider providing it in the future. Stay tuned.

Additionally, you can post your ideas/suggestions to http://vote.spotware.com/

@Spotware

Spotware

26 May 2016, 18:01

( Updated at: 19 Mar 2025, 08:57 )

Dear Trader,

Could you please provide us with more information regarding your issue and a code example that causes it?

You can post the code example here or send an email at support@ctrader.com.

@Spotware

Spotware

07 Jun 2016, 15:12

Dear Trader,

As said through our support channel.

As you most probably already know buy positions open on ask prices and close on bid prices. The bars on chart are drawn based on the bid prices. That's why the position entry price is above the high price of the bar.

We kindly ask you to contact your Broker regarding any price,price feed queries you may have.

@Spotware