Topics

Replies

Forex19

29 Jun 2014, 18:19

RE:

Jimmy said:

You could try the one of the Math functions first compare the first two then you get one end result then compare that with the third and what comes out of that with the fourth and so untill you are left with the result you want.

How? An example please.

Take a look at the Heiken Ashi formula which is an excellent example.

Like this:

/algos/indicators/show/60

or other?

@Forex19

Forex19

27 Jun 2014, 18:58

RE: RE:

breakermind said:

Forex19 said:

Hi,

I need to compare the closing price of four or more candlesticks.What is the best way?

Hi,

This is one of those things whose probably can not do :D

I think you can compare only two things ;)

Bye.

Waiting to see if you get other suggestions.

How would you compare two things?

@Forex19

Forex19

26 Jun 2014, 19:13

RE:

leo8three said:

@ Forex19: concerning the bad TP calculation, I think the problem is in

private int LotStep = 3000;you can change it to LotStep = 1000 or 10000

Do you think that the error is in the value "3000" or variable declared "private" ?

@ Spotware: Forex19's robot places an order than modifies it, using old API classes "Trade.Create***MarketOrder(...)", and OnPositionOpened(...) where a new TP is set up; what is the best way to update this system to the new API?

I think a solution could be to try the following methods: ExecuteMarketOrderAsync(TradeType.***, Symbol, Volume, "My Label", OnExecuted); and

private void OnExecuted(TradeResult result) { if (result.IsSuccessful) { ModifyPosition(position, position.StopLoss, TakeProfitPrice); } }does it can be a good solution?

Kind regards

Could you better indicate which parts of the code update? And how exactly?

Thank you very much.

@Forex19

Forex19

26 Mar 2014, 11:32

RE:

Spotware said:

Please look at the following example:

var eurUsdPositionsCount = Positions.Count(p => p.SymbolCode == "EURUSD");

So if I want to have separate count for two Symbol, should I use:

var eurUsdPositionsCount = Positions.Count(p => p.SymbolCode == "EURUSD");

and

var eurGbpPositionsCount = Positions.Count(p => p.SymbolCode == "EURGBP");

is correct?

@Forex19

Forex19

11 Mar 2014, 14:47

RE: RE: RE:

ronald1711 said:

Forex19 said:

Spotware said:

The problem is that you use obsolete OnPositionOpened method with new ExecuteMarketOrder method. OnPositionOpened method works only if you create position using old trading API.

Instead of using OnPositionOpened method you need to subscribe to Positions.Opened event. But please keep in mind that it will be raised for all positions:

I modified the code and used PositionOnOpened, and it seems to work properly.

Thanks.

Can you post the "new" working code here?

I'm also using this cbot and made some changes in so you can set the lotsize and lotstep size.

Thanks

Ronald

The code in post n° 3 is the my starting point.

It is some time that I'm trying various modifications (as I discussed in this topic /forum/cbot-support/2475) but but without solving the problem.

@Forex19

Forex19

05 Mar 2014, 16:17

RE:

Spotware said:

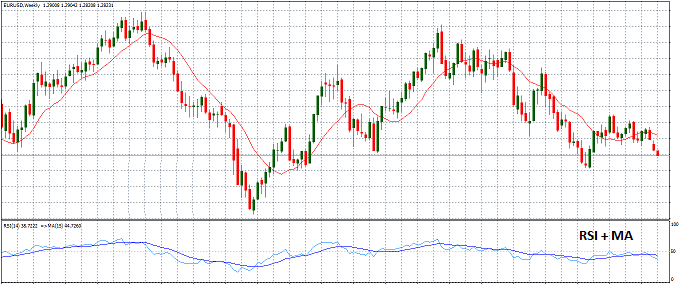

It seems like calculating SMA over RSI doesn't suit your needs. If you want to display SMA and RSI into the same panel you need to write a custom indicator. In this case you will need to normalize somehow values of SMA to fit RSI scale.

The calculating SMA over RSI is good but I would like to have this so you can use it in other ways and not only on chart.

Starting from the exact calculation would be easier to write a custom indicator.

Can you help me, please?

@Forex19

Forex19

05 Mar 2014, 15:47

( Updated at: 21 Dec 2023, 09:20 )

RE: RE: RE:

Spotware said:

Forex19 said:

Spotware said:

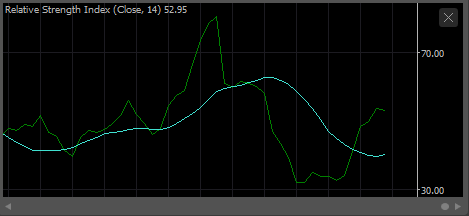

First of all, add RSI to the chart:

.........

Second of all, add Moving Average with source "Relative Strength Index":

.........

As a result you will see moving average built over RSI:

It works. thanks

Can you tell me which formula is used to normalize the SMA chart, on the scale of 0 -100 RSI chart?

In that example SMA is not normalized. SMA is build over RSI data series. That means that SMA[i] = (RSI[i] + RSI[i - 1] + ... RSI[i - period + 1]) / period

I don't understand the calculation to build SMA over RSI data series.

You can actually see me please?

Suppose, at this time, to have a RSI (14) = 65 and you want to build over the SMA (20) = 140.350 (for the currency Euro / Yan).

What is the calculation?

Thank you.

@Forex19

Forex19

05 Mar 2014, 15:45

( Updated at: 21 Dec 2023, 09:20 )

RE: RE: RE:

Spotware said:

Forex19 said:

Spotware said:

First of all, add RSI to the chart:

.........

Second of all, add Moving Average with source "Relative Strength Index":

.........

As a result you will see moving average built over RSI:

It works. thanks

Can you tell me which formula is used to normalize the SMA chart, on the scale of 0 -100 RSI chart?

In that example SMA is not normalized. SMA is build over RSI data series. That means that SMA[i] = (RSI[i] + RSI[i - 1] + ... RSI[i - period + 1]) / period

@Forex19

Forex19

05 Mar 2014, 11:29

RE: RE: RE: RE:

AimHigher said:

AimHigher said:

Forex19 said:

Spotware said:

Probably you do not filter positions by the label somewhere in your code.

As I said he made several tests to filter the label in the various parts of the code.

But I think there is another problem because the two cbots (as I have shown in the screenshot) are two different locations with the right label.

The problem is in TP, which is not assigned.

Do you have any suggestions on how and where to change the code?Thanks

You have defined Point using Symbol.TickSize while the API Guide uses Symbol.PipSize to set a stop loss price when the stop loss is specified as a number of pips, which your trailing stop is. However, I am very new to cAlgo so I don't know if that solves it.

Nevermind. When I tested it, Symbol.Bid - 50 * Symbol.TickSize still appears to generate a valid price so I don't think that is it.

As I said I did several tests but I've always found the same error.

Also I'm not an expert on cAlgo, but it would be important to understand whether this error comes from a bug or other.

@Forex19

Forex19

05 Mar 2014, 11:00

( Updated at: 21 Dec 2023, 09:20 )

RE:

Spotware said:

First of all, add RSI to the chart:

.........

Second of all, add Moving Average with source "Relative Strength Index":

.........

As a result you will see moving average built over RSI:

It works. thanks

Can you tell me which formula is used to normalize the SMA chart, on the scale of 0 -100 RSI chart?

@Forex19

Forex19

28 Feb 2014, 14:42

RE:

Spotware said:

Probably you do not filter positions by the label somewhere in your code.

As I said he made several tests to filter the label in the various parts of the code.

But I think there is another problem because the two cbots (as I have shown in the screenshot) are two different locations with the right label.

The problem is in TP, which is not assigned.

Do you have any suggestions on how and where to change the code?

Thanks

@Forex19

Forex19

26 Feb 2014, 16:15

RE:

Spotware said:

TRADING_BAD_STOPS means that you have a mistake in the calculation of SL or TP levels

Hi,I have done several tests, using as suggested

Position position = args.Position; if (position.Label! = RF_Label) return;

But if I run the two CBOT, together, the error occurs on the TP in one of the two CBOT (as I showed), while if I run only one of the two CBOT's okay.

Why? How can I fix?

@Forex19

Forex19

20 Feb 2014, 12:11

RE:

Spotware said:

TRADING_BAD_STOPS means that you have a mistake in the calculation of SL or TP levels

I understood that the error is in the calculation of TP levels. Why?

If I filter positions with the label, the two CBOT should be independent and don't check what it does the other CBOT.

Thanks.

@Forex19

Forex19

04 Jul 2014, 13:48

RE: RE: RE:

Jimmy said:

I would be interested to compare the closing or the average of the last 4 candles and then use it in the logic for opening positions.

Thank you. I apologize if I did not specify well before I remembered to have said.

@Forex19