Topics

Replies

trend_meanreversion

04 Nov 2020, 09:33

( Updated at: 21 Dec 2023, 09:22 )

First trade on US election day and locked in TP !

Sell Signal generated at 04/11/2020 03:10:05 UTC for AUS200 at Bid/Ask Price: 6083.01 / 6084.21 [ TP: 6076.93 , SL: 6157.36 , Exit: EoD ]

@trend_meanreversion

trend_meanreversion

04 Nov 2020, 06:15

( Updated at: 21 Dec 2023, 09:22 )

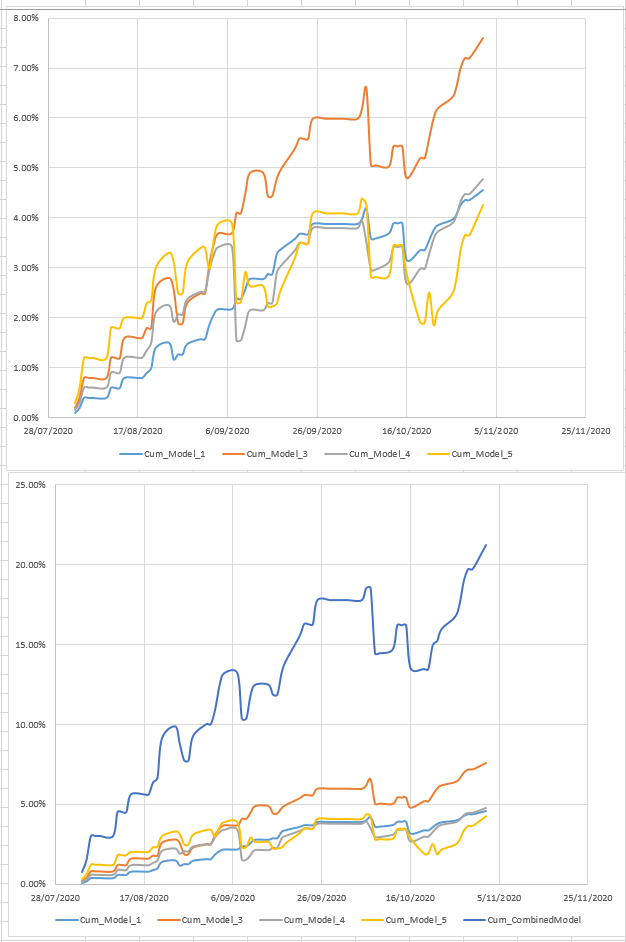

Please find the equity curve as requested by some:

@trend_meanreversion

trend_meanreversion

02 Nov 2020, 11:20

( Updated at: 21 Dec 2023, 09:22 )

Quite active..second trade taken by cBot and locked in TP ! https://twitter.com/TMeanreversion

Sell Signal generated at 02/11/2020 09:03:44 UTC for UK100 at Bid/Ask Price: 5610.5 / 5611.8 [ TP: 5604.89 , SL: 5694.67 , Exit: EoD ]

@trend_meanreversion

trend_meanreversion

02 Nov 2020, 09:16

( Updated at: 21 Dec 2023, 09:22 )

Nov month traded with a bang. First trade and locked in TP !

Sell Signal generated at 02/11/2020 06:42:13 UTC for DE30 at Bid/Ask Price: 11622.5 / 11628.5 [ TP: 11610.88 , SL: 11840.94 , Exit: EoD ]

@trend_meanreversion

trend_meanreversion

01 Nov 2020, 11:09

( Updated at: 21 Dec 2023, 09:22 )

October month finally ended with high volatility in last few sessions due to ongoing worsening situation of COVID in EU/UK while US presidential elections are bringing new waves of uptick in vol.

October was a tough month for the model and few bad trades did the damage ( Already known and well aware due to skewed risk reward in my model which I had already highlighted ). In any case default model (Model_1) posted 48bps profit while all models in total gave us 1.95%. I would still call it a win ![]()

Here are the performance stats

@trend_meanreversion

trend_meanreversion

29 Oct 2020, 10:11

( Updated at: 21 Dec 2023, 09:22 )

Wow..DAX again !! Locked in TP ![]()

Sell Signal generated at 29/10/2020 08:03:06 UTC for DE30 at Bid/Ask Price: 11643 / 11644 [ TP: 11631.36 , SL: 11858.8 , Exit: EoD ]

@trend_meanreversion

trend_meanreversion

28 Oct 2020, 23:24

( Updated at: 21 Dec 2023, 09:22 )

Wow..what a crazy session !! Bot generated 1 more trade and locked in finally !

Sell Signal generated at 28/10/2020 17:10:40 UTC for US30 at Bid/Ask Price: 26577.5 / 26580 [ TP: 26550.92 , SL: 26939.66 , Exit: EoD ]

@trend_meanreversion

trend_meanreversion

28 Oct 2020, 12:47

( Updated at: 21 Dec 2023, 09:22 )

Somehow everyday DAX trades are being generated. Taken 1 DAX trade and locked in TP ! [https://twitter.com/TMeanreversion ]

Sell Signal generated at 28/10/2020 08:22:55 UTC for DE30 at Bid/Ask Price: 11670.5 / 11671.5 [ TP: 11658.83 , SL: 11888.21 , Exit: EoD ]

@trend_meanreversion

trend_meanreversion

27 Oct 2020, 11:15

( Updated at: 21 Dec 2023, 09:22 )

First trade of volatile session. Locked in TP !

Sell Signal generated at 27/10/2020 08:26:37 UTC for DE30 at Bid/Ask Price: 12133.3 / 12134.3 [ TP: 12121.17 , SL: 12325.64 , Exit: EoD ]

@trend_meanreversion

trend_meanreversion

26 Oct 2020, 22:53

( Updated at: 21 Dec 2023, 09:22 )

Sharp moves today but only one trade generated and locked in TP ! ! [ https://twitter.com/TMeanreversion ]

Sell Signal generated at 26/10/2020 17:14:04 UTC for DE30 at Bid/Ask Price: 12152 / 12154 [ TP: 12139.85 , SL: 12345.89 , Exit: EoD ]

@trend_meanreversion

trend_meanreversion

24 Oct 2020, 02:28

( Updated at: 21 Dec 2023, 09:22 )

One trade generated yesterday and locked in TP !

Sell Signal generated at 23/10/2020 07:31:33 UTC for DE30 at Bid/Ask Price: 12637.6 / 12638.6 [ TP: 12624.96 , SL: 12800.11 , Exit: EoD ]

@trend_meanreversion

trend_meanreversion

23 Oct 2020, 00:07

( Updated at: 21 Dec 2023, 09:22 )

Great ! Another 2 trades for the day and locked in TP !![]()

Buy Signal generated at 22/10/2020 14:33:55 UTC for US30 at Bid/Ask Price: 28079 / 28081.5 [ TP: 28109.58 , SL: 27813.72 , Exit: EoD ]

Sell Signal generated at 22/10/2020 15:14:42 UTC for DE30 at Bid/Ask Price: 12548.1 / 12549.1 [ TP: 12535.55 , SL: 12707.52 , Exit: EoD ]

@trend_meanreversion

trend_meanreversion

21 Oct 2020, 23:14

( Updated at: 21 Dec 2023, 09:22 )

2 Trades taken for today and both hit TP !

Sell Signal generated at 21/10/2020 08:54:29 UTC for DE30 at Bid/Ask Price: 12578.3 / 12579.3 [ TP: 12565.72 , SL: 12729.83 , Exit: EoD ]

Buy Signal generated at 21/10/2020 15:04:24 UTC for US30 at Bid/Ask Price: 28305 / 28307.5 [ TP: 28335.81 , SL: 28039.3 , Exit: EoD ]

@trend_meanreversion

trend_meanreversion

19 Oct 2020, 16:39

( Updated at: 21 Dec 2023, 09:22 )

2 Trades generated for the day and both locked in TP ! [ https://twitter.com/TMeanreversion ]

Sell Signal generated at 19/10/2020 07:17:41 UTC for UK100 at Bid/Ask Price: 5951 / 5952.3 [ TP: 5945.05 , SL: 6010.88 , Exit: EoD ]

Buy Signal generated at 19/10/2020 08:08:41 UTC for DE30 at Bid/Ask Price: 12937.1 / 12938.1 [ TP: 12951.04 , SL: 12799.45 , Exit: EoD ]

@trend_meanreversion

trend_meanreversion

17 Oct 2020, 08:14

( Updated at: 21 Dec 2023, 09:22 )

This month is turning out to be difficult . Another trade that didn't hit TP and is down ~75bps ![]() . But losing trades is part and parcel of trading so let's not lose focus on big picture here !

. But losing trades is part and parcel of trading so let's not lose focus on big picture here !

Sell Signal generated at 16/10/2020 03:32:22 UTC for HK50 at Bid/Ask Price: 24232.9 / 24240.4 [ TP: 24208.67 , SL: 24505.7 , Exit: EoD ]

@trend_meanreversion

trend_meanreversion

13 Oct 2020, 17:08

( Updated at: 21 Dec 2023, 09:22 )

2nd Trade of the day and it locked in TP as well ![]()

Sell Signal generated at 13/10/2020 13:04:24 UTC for UK100 at Bid/Ask Price: 5971.4 / 5972.5 [ TP: 5965.43 , SL: 6030.06 , Exit: EoD ]

@trend_meanreversion

trend_meanreversion

13 Oct 2020, 11:43

( Updated at: 21 Dec 2023, 09:22 )

First trade of the day and hit TP ! [ https://twitter.com/TMeanreversion ]

Buy Signal generated at 13/10/2020 07:17:47 UTC for DE30 at Bid/Ask Price: 13085.2 / 13086.2 [ TP: 13099.29 , SL: 12964.42 , Exit: EoD ]

@trend_meanreversion

trend_meanreversion

12 Oct 2020, 14:27

( Updated at: 21 Dec 2023, 09:22 )

Slow session due to US holiday but first trade taken and locked in TP !

Sell Signal generated at 12/10/2020 08:26:55 UTC for UK100 at Bid/Ask Price: 6034.2 / 6035.4 [ TP: 6028.17 , SL: 6094.55 , Exit: EoD ]

@trend_meanreversion

trend_meanreversion

12 Oct 2020, 05:28

RE: RE: "Bid" price change

snowchilli said:

trend_meanreversion said:

Hi mate,

I use tick charts extensively in my research and trading so possibly might be able to answer your questions (which I think you already know answers to).

1) Yes tick charts are based only on "Bid" price change, so only bid price change is considered as tick change. This is intended feature I suppose as possibly incorporating both bid and ask change to be considered as a tick might be computationally expensive and doesn't align with how ctrader/other platforms treat their charts ( even in simple timebased TimeFrames such as 5min, 30mins etc ). OHLC data on charts that you see corresponds to bid price so I am afraid it is just how tick is defined -> any change in bid price is defined as a valid tick.

2) Personally, I would have preferred change in "mid-price" as a valid tick definition but I suppose I can live with current definition as well. You can create own DataSeries within a cBot which only stores "N-tick" information whenever bid price changes or ask price changes and thus can work with your own definition of "Ticks".

Hope it helps. Happy Trading :)

-TRMR

@TRMR

1) by "Bid" price change, do you mean a bid price has changed due to a position being opened / closed?

otherwise, it would be sounding as if you are referring to what the "Market Depth" view offers, ie many ask and bid prices staggered by price live with each price point being augmented with aggregate volume (that the liquidity provider of the broker can show),2) wouldn't you need the positions's volume as well to evaluate the "weight" of a tick?

A 50 lot position could be thought of as more telling where the money is headed than a 0.01 lot position.

Hi mate,

1) by "Bid" price change, do you mean a bid price has changed due to a position being opened / closed?

otherwise, it would be sounding as if you are referring to what the "Market Depth" view offers, ie many ask and bid prices staggered by price live with each price point being augmented with aggregate volume (that the liquidity provider of the broker can show),

When I said "Bid" price change , it meant the best Bid price level change. If best bid level is changed, then only a tick is counted in cTrader. It doesn't provide any information about the position open or close. It is purely based on price change (which can be driven by anything executed buy/sell trade or no trade at all at times in underlying)

2) wouldn't you need the positions's volume as well to evaluate the "weight" of a tick?

Ideally yes but when you are dealing with CFDs , then you don't get the liberty to get underlying prices, ticks, trades data etc. So actual market makers on exchange ( read HFTs ) do analyze all the information about market microstructure for their market making / trading algorithms. But I have seen even tick data ( as per defined by cTrader platform ) also shows some alpha and can be used in advanced trading algorithms. ( Stand-alone tick analysis may or may not be helpful, but combining it with other sophistication could help..at least it did for me). Hope it helps !

@trend_meanreversion

trend_meanreversion

04 Nov 2020, 14:57 ( Updated at: 21 Dec 2023, 09:22 )

Wow..too many trades today . 3 more trades taken for today and locked in TP !

Buy Signal generated at 04/11/2020 07:47:43 UTC for HK50 at Bid/Ask Price: 24799.5 / 24807 [ TP: 24831.81 , SL: 24498.23 , Exit: EoD ]

Sell Signal generated at 04/11/2020 07:48:11 UTC for UK100 at Bid/Ask Price: 5662.3 / 5664.8 [ TP: 5656.64 , SL: 5759.17 , Exit: EoD ]

Sell Signal generated at 04/11/2020 09:37:49 UTC for DE30 at Bid/Ask Price: 12171.4 / 12172.4 [ TP: 12159.23 , SL: 12427.22 , Exit: EoD ]

@trend_meanreversion