Topics

Replies

Stokes Bay

22 May 2016, 11:40

This will not work for Martingale, as the original 1 lot that was opened will have double the potential drawdown if it is not closed at that point.

why cant you just change the stop level when you open the new trade?

but i agree re martingale, i am just trying to learn how calgo behaves

@Stokes Bay

Stokes Bay

21 May 2016, 02:31

Current method. Open 1 lots pay $2 commission, say. Close 1 lot. Open 2 lots pay $4 commission. Total $6

Suggested method. Open 1 lot pay $2 commission. Open another 1 lot, pay $2 commission. Total $4.

@Stokes Bay

Stokes Bay

12 May 2016, 01:18

RE:

sorry wrong category, please ignore

Paul Cookson said:

Please vote for my latest suggestion:

Alerts and messages to allow configuring

Currently the price alert will appear on the centre of the screen and the trader clicks okay button to recognise and clear.

Currently the order and position messages appear on the top right of the screen and disappear after a few seconds.

When managing many positions and orders the ability to freeze messages would be of use. When receiving many messages at once I often do not have the time to read which order was filled as well as clearing price alerts and monitoring numerous charts. Even when I hold the cursor over the message it still disappears after the time ctrader controls.

I would like the ability to have order/ position messages all appear on the top right of the screen together with price alerts.

I would like to be able to control whether messages disappear after x seconds or remain on screen until cleared. I also want the message to remain on screen if i hold the cursor over it.

@Stokes Bay

Stokes Bay

11 May 2016, 22:00

RE: RE:

Thanks for your help cyfer

cyfer said:

cyfer said:

Basically , It will be something Like this

using System; using System.Linq; using cAlgo.API; using cAlgo.API.Indicators; using cAlgo.API.Internals; using cAlgo.Indicators; namespace cAlgo { [Robot(TimeZone = TimeZones.UTC, AccessRights = AccessRights.None)] public class Cyf_ROB_BollyBand_Bounce : Robot { private BollingerBands bb; private Position position; private bool CanOpenTrade; [Parameter(DefaultValue = 20)] public int bb_Periods { get; set; } [Parameter(DefaultValue = 2.0)] public double bb_stdDev { get; set; } [Parameter("Source")] public DataSeries bb_Source { get; set; } [Parameter("Volume", DefaultValue = 10000, MinValue = 1000, Step = 1000)] public int Volume { get; set; } [Parameter("Stop at", DefaultValue = 20)] public int StopLoss { get; set; } protected override void OnStart() { CanOpenTrade = true; bb_Source = CreateDataSeries(); bb = Indicators.BollingerBands(MarketSeries.Close, bb_Periods, bb_stdDev, MovingAverageType.Simple); } protected override void OnBar() { if (MarketSeries.Close.Last(0) < bb.Top.Last(0) && MarketSeries.Close.Last(1) > bb.Top.Last(1) && CanOpenTrade) { var result = ExecuteMarketOrder(TradeType.Sell, Symbol, Volume, "BollyBand_Sell", StopLoss, null); if (result.IsSuccessful) { position = result.Position; CanOpenTrade = false; } } /////////////////// if (MarketSeries.Close.Last(0) > bb.Bottom.Last(0) && MarketSeries.Close.Last(1) < bb.Bottom.Last(1) && CanOpenTrade) { var result = ExecuteMarketOrder(TradeType.Buy, Symbol, Volume, "BollyBand_Buy", StopLoss, null); if (result.IsSuccessful) { position = result.Position; CanOpenTrade = false; } } } protected override void OnTick() { // Put your core logic here if (Positions.Count != 0 && position.TradeType == TradeType.Sell) { if (MarketSeries.Close.Last(0) >= bb.Main.Last(0))// Main or Bottom ???? ClosePosition(position); CanOpenTrade = true; } if (Positions.Count != 0 && position.TradeType == TradeType.Buy) { if (MarketSeries.Close.Last(0) <= bb.Main.Last(0)) // Main or TOP ????? ClosePosition(position); CanOpenTrade = true; } } protected override void OnStop() { // Put your deinitialization logic here } } }But This is so simplified and there is no Real TP or SL Targets here .

usually the best SL & TP is related to ATR of that TF .

I Don't think it's a winning strategy , Bollinger bands are based on volatility .. So if Price Goes UP till it hits the upper band and then reverses to the lower band .. and then

exceeds the lower band and then reverses and Goes Up again and hit the upper band again .. and keep doing this imaginary cycle .. This could be a winning strategy

obviously this doesn't happen

@Stokes Bay

Stokes Bay

25 Apr 2016, 17:31

RE:

Spotware said:

Dear Trader,

Please have a look at the Workspaces section of our User support site.

I should have found that - thanks.

@Stokes Bay

Stokes Bay

20 Apr 2016, 19:20

( Updated at: 21 Dec 2023, 09:20 )

Thanks, sorry for not being clear.

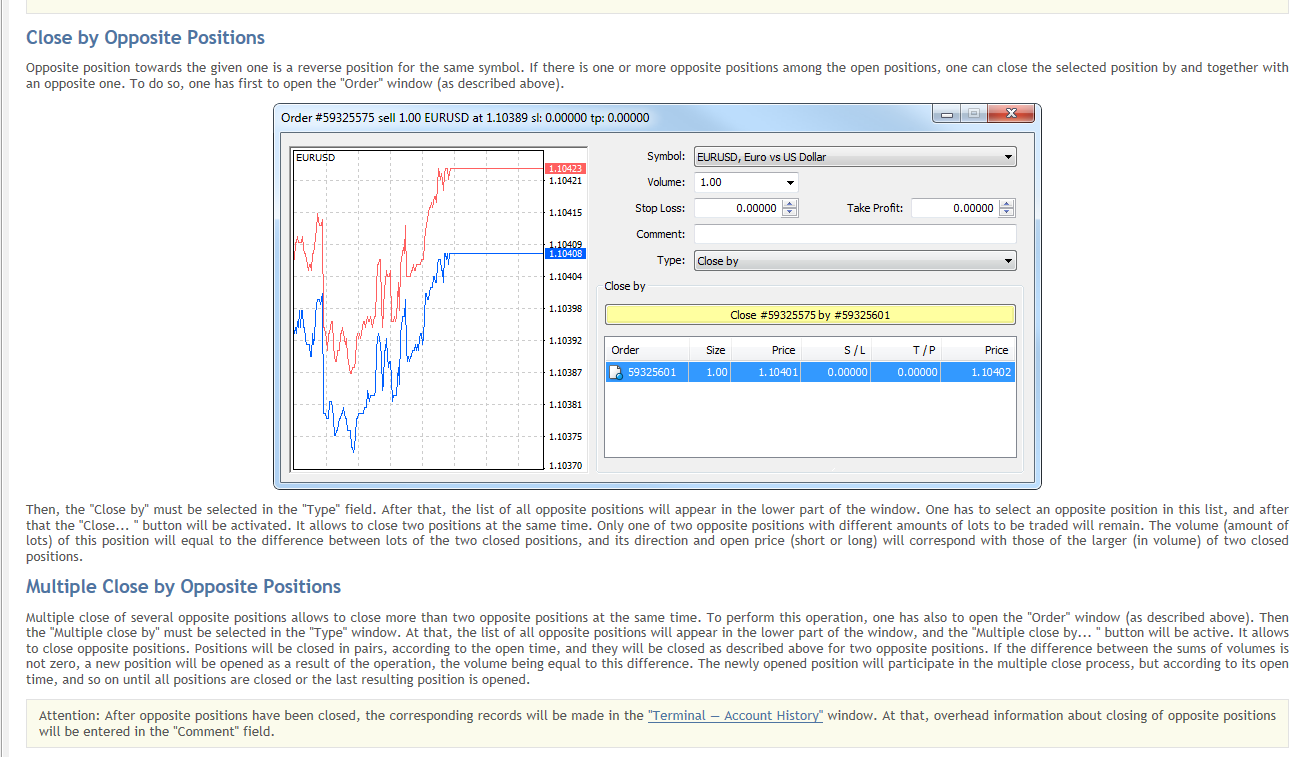

I have used MT4 and lets say i go long 5 lots. I want to scale out so i short 1 lot 5 times at each level i want to exit on.

In MT4 i am not partial closing but opening new contra orders. I can then right click and chose modify and offset the opening position with the new one - see below screenshot from MT4.

In ctrader can i only enter take profit orders when hedging? I cannot enter new orders and offset them?

Obviously i can open new orders and then close the orders but this will double commissions.

I am not making this about MT4 as i would prefer to use your software but just exploring how to use it.

Thanks.

t click on a position in the MT4 terminal and chose Modify and cancel out the original position

t click on a position in the MT4 terminal and chose Modify and cancel out the original position

@Stokes Bay

Stokes Bay

20 Apr 2016, 16:02

RE:

actually best way i found to do this is add multiple take profit orders via the modify order button once entry made - these can then be dragged on the chart to whereever/ whenever

- would be good to be able to preset multiple TP levels when entering just as you can in the quick settings mode for 1 TP level.

thanks

Spotware said:

Dear Trader,

Currently the is no option to select where the QuickTrade settings will be applied. We will consider providing it in the future. Stay tuned.

Additionally, you can post your ideas/suggestions to http://vote.spotware.com/

For your information, there is no SL,TP predefined, when you create a new market through the Create Order window.

@Stokes Bay

Stokes Bay

22 May 2016, 11:47

out of interest, do you have one? not to sell or reveal, but im interested to know how common having a profitable algo is?

you say 50-100% return a year. with x100 leverage thats 0.5%-1% a year return so im interested in the deviation of this return over time? correct me on the leverage used of course, but how do you consider robustness when the size of return is so slim it could simply be market conditions.

im guessing you'd need to have 25+ years of data to have any comfort that such a small return was not market conditions?

would love to hear your views on this,,,,,,,,,as i say, im trying to learn

@Stokes Bay