Joined 21.07.2017

Ctrader Stop Limit not triggering / triggering late

21 Jul 2017, 09:48

Dear ctrader support

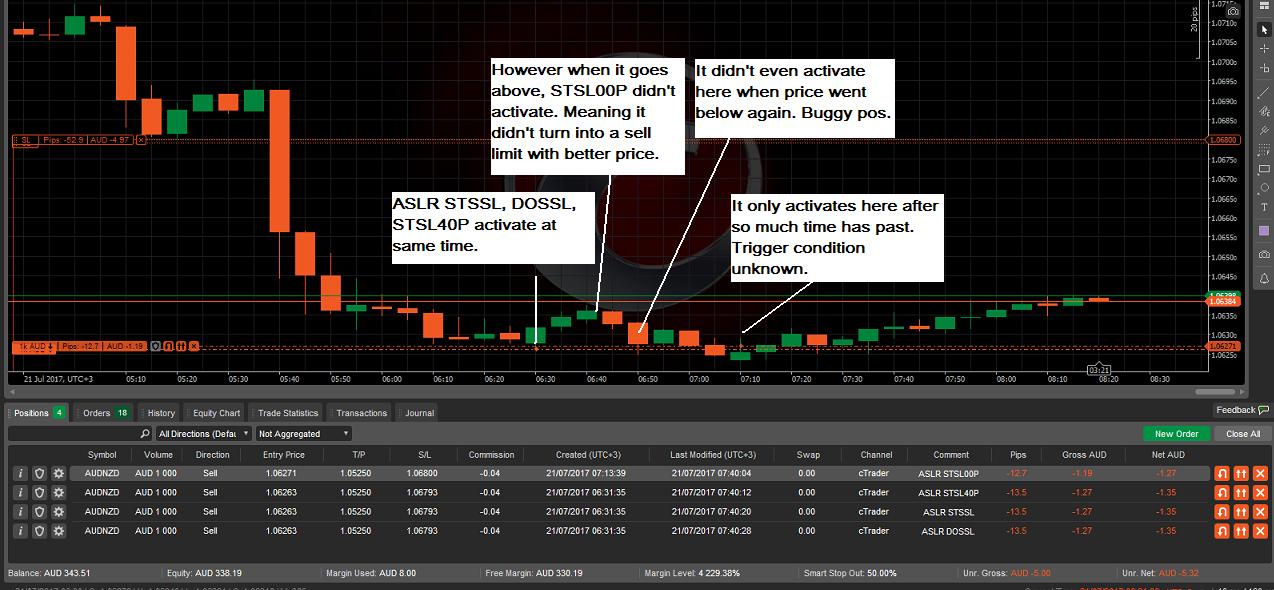

After testing the new stop limit feature, it looks like the stop limit order isn't turning into a limit order after it goes past the trigger price.

Note the ASLR STSL00P order, which is a sell stop limit order with 0p range. After prices went below the 1.06270 trigger pt @ 06:31, it seems it never turned into a sell limit like it was suppose to. You can tell as the price went above from 06:31-06:50 without activating the order.

Even after it went below again @ 06:50, it still didn't activate.

Only after the 3rd time 40 mins later @ 07:13 did it finally trigger.

What's the logic behind this? Why did it not activate previously and why did it finally activate so late?

Replies

thearrymail-ct

21 Jul 2017, 18:23

Dear Spotware

after going below the trigger price of 1.06270, there was a whole 30min period from 06:31 - 07:00 where price was above 1.06270. Surely there would of been ample time for liquidity providers to fill? It would of even given me a better entry if it had as well. Or do you mean the logic of the ctrader stop limit order is set that it can only give worst prices?

On another platform I use (TWS), with a 0 deviation sell stop limit order @ 1.06270, it would of created a sell limit order at exactly 1.06270 as soon as it goes below 1.06270. Even if the next avaliable price gaps above 1.06270, the sell limit will still activate and fill (with positive slippage).

Is this not case with the ctrader stop limit order?

@thearrymail-ct

Spotware

24 Jul 2017, 09:48

Dear thearrymail-ct,

A stop limit order can also be described as a stop order with a limit. This means that when the trigger price for a sell stop limit order is set at 1.06270, all prices below are considered worse than the requested price, since a sell stop order assumes that you expect prices to continue moving downwards. Therefore if you set a market range at 0 and the requested price is not available, then the order will be rejected and will be resent when the order triggers again i.e. the next time the price crosses 1.06270 downwards. The sell stop limit order is not triggered when the price crosses the requested price level upwards and that is why your order was not filled between 06:31-07:00.

Note: During the weekend we have applied a change that cancels a stop limit order if the order is rejected the first time. So the bold part of the above explanation does not apply anymore and cases like this one should not occur.

Best Regards,

cTrader Team

@Spotware

thearrymail-ct

28 Jul 2017, 20:56

Dear Spotware

thanks for the response. However I think my problem with the order is not that I want it to be canceled but moreso that didn't trigger the first 2 times and that it didn't act as a sell limit after trigger price was reached.

Or to put it another way, I wanted it so that after it passes the trigger price downwards and misses fill, if it goes upward again it MUST trigger (preferrably with exact or better price if on a 0p dev as a sell limit).

Where as in your description, you seem to be indicating that if it goes downward past the trigger price, if it can't fill during the downmove, then when it goes up again it MUST NOT trigger. Is this correct?

If this is case, it sounds more like an Immediate Or Cancel order (IOC) rather than a stop limit order to me.

@thearrymail-ct

thearrymail-ct

28 Jul 2017, 21:03

Basically the change is the OPPOSITE of what I wanted lol.

@thearrymail-ct

Spotware

31 Jul 2017, 13:03

Dear thearrymail-ct,

In brief, a stop limit order is triggered as a stop order and executed as a limit order. Therefore, when the direction of the stop limit order is Sell it is triggered when the price crosses the stop price in a downwards direction. On the opposite side, when the direction of the stop limit order is Buy it is triggered when the price crosses the stop price in a upwards direction.

The change applied the previous week had to do with the order's duration. The duration was changed from Good Till Cancelled to Immediate or Cancel. The order's duration is not conflicting with the order type.

Regarding your comment

" it didn't act as a sell limit after trigger price was reached"

Stop limit order does not act like limit order after triggering, it is only executed as Limit order. If not executed, It will continue to act like a Stop Limit order, which is an extension of the Stop Order. Acting as Limit order means the order needs to be triggered when the price satisfies the limit price. But acting as as Stop order (and Stop Limit order) means it is going to be triggered when the price satisfies the stop price.

Concluding, Stop Limit order is an extension of the Stop Order that allows a more accurate execution of the order.

We hope that the above clarifies the way that Stop Limit orders behave.

Best Regards,

cTrader Team,

@Spotware

thearrymail-ct

01 Aug 2017, 12:42

Dear Spotware team,

I know what a stop limit order is, I've been using it on other platforms for a long time. I don't know why you guys are trying so hard to redefine what a stop limit order is.

Here's the definition from the SEC (https://www.sec.gov/fast-answers/answersstoplimhtm.html):

A stop-limit order is an order to buy or sell a stock that combines the features of a stop order and a limit order. Once the stop price is reached, a stop-limit order becomes a limit order that will be executed at a specified price (or better).

Here's the definition from TDAmeritrade (https://papermoney.thinkorswim.com/tos/displayPage.tos;jsessionid=4D0702EA204D25611A1112CAC0FD1A6B.tos2_w9c5?webpage=servicesOrderTypes#)

STOP LIMIT - order used to open or close a position by buying if the market rises or selling if the market falls, but that turns into a limit order when the stop price is triggered. Stop limit orders have a stop price and a limit price. When the stop price is triggered, the limit order is activated. The stop price for buy orders is placed above the current market price. The stop price for sell orders is placed below the current market price. The stop price does not need to be the same as the limit price. Just as with a limit order, the stop limit order will be filled at the limit price or better, but may not be filled at all.

Here's the definition from Interactive Brokers (https://www.interactivebrokers.com.au/en/index.php?f=608)

A Stop-Limit order is an instruction to submit a buy or sell limit order when the user-specified stop trigger price is attained or penetrated. The order has two basic components: the stop price and the limit price. When a trade has occurred at or through the stop price, the order becomes executable and enters the market as a limit order, which is an order to buy or sell at a specified price or better.

Right now what you guys seem to be defining as a stop limit order is actually an Immediate Or Cancel (IOC) stop order with a deviation range, which can only give exact or worse prices.

Guess I'll just leave it at that then.

If other trader are wondering why their stop limit order isn't working, they can read here and find out the Ctrader stop limit order isn't actually a stop limit order.

@thearrymail-ct

Spotware

04 Aug 2017, 17:27

Dear thearrymail-ct,

Our implementation of the Stop Limit Order(SLO) is similar and inline with the SLOs of most major trading platforms. At the same time, we are aware that some trading platforms interpret SLOs differently than us and this seems to cause the confusion and the different expectations. However, we will not be changing the logic behind our SLO because this is the correct implementation. Instead, we are considering of extending the current logic in a way that will satisfy your expectations as well.

In any case, it was an interesting conversation and we would like to thank you for the valuable feedback.

Best Regards,

cTrader Team

@Spotware

sine8181

23 Aug 2017, 23:28

I agree with thearrymail-ct, a stop-limit order should turn into a limit order once the specified stop price is hit. I was thinking of signing up with Trader's Way with cTrader as an alternative to MT4 because its Stop Orders can sometimes lead to unnecessary slippages on entry-orders but it looks like, cTrader can't exactly do what I thought it could with Stop-Limit Orders.

Another thing, I wish the "Limit Range" could be specified in points (5th decimal) instead of just pips.

@sine8181

anaperez201790

23 Dec 2021, 04:31

Stop limit; limit range fail

Demo Account: I had a stop limit (sell) order, "limit range" of 1 pip. The order is executed with 2 pips of slippage. 0.1 lots eurusd. Surprised!

I tried it with a "limit range" of 0 pips. It didn't work.

I tried it with a "limit range" of 0.5 pips. It didn't work.

@anaperez201790

muratsur

24 Mar 2022, 12:31

( Updated at: 28 Mar 2022, 12:03 )

i have also noticed certain delay in trigger. riteaid survey surveyzop

@muratsur

Spotware

21 Jul 2017, 14:35

Dear thearrymail-ctm,

Thanks for your post. From the information provided it seems that the Stop Limit order was not triggered because a market range of 0 was requested. The other orders seem to have been executed at worse prices han 1.06270. Therefore the STSL00P order was kept until the price became available for execution. This is natural to happen because, even if the prices are streamed to you by the liquidity provider, until the order reaches the liquidity provider the price might not be available any more so the order is not executed and kept on the server for later.

You can find more information about how Stop Limit orders work here http://help.spotware.com/trading/orders#Types

Best Regards,

cTrader Team

@Spotware