Topics

Replies

trdrn

17 Nov 2020, 20:22

RE:

PanagiotisCharalampous said:

Hi trdrn,

Your calculations are wrong. You assume that ROI is equal to P&L change but this is not the case. You can read more about how ROI is calculated here.

Best Regards,

Panagiotis

Ok I understand...

I would like to split the amount to 2 same strategies. How can I have 2 subaccounts copying the same strategy? Is that possible?

@trdrn

trdrn

16 Nov 2020, 18:08

( Updated at: 21 Dec 2023, 09:22 )

RE:

PanagiotisCharalampous said:

Hi trdrn,

Can you please provide more information about this issue e.g. email screenshots, history screenshots etc? You need to explain to us in detail you did you calculate the 389 balance.

Best Regards,

Panagiotis

Hello Panagiotis,

below I shall explain with screenshots the curent state of the account:

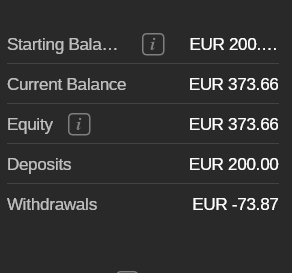

So we have an Account with 200 Eur deposit that made till today +134.26% profit. Meaning that the profit + initial ballance = 468.52

Now the withdraws as strategy fees are 73.87. So 468.52-73.87 = 394.65. That should be the ballance. But the ballance is 373.66. and that is my question , how can this be happenig?

Thank you

@trdrn

trdrn

02 Dec 2020, 20:38 ( Updated at: 02 Dec 2020, 20:45 )

RE:

PanagiotisCharalampous said:

It is not the topc but I thing is a great opportunity to pass you this:

i think that it is mandatory to implement the Relative Drawdown in the Copy Trader Stats. There is only max ballance DD that do not shows us a clear picture. Only relative DD will show the real risk involved with the specific copy profile and make us able to choose. To know what is the risk and not only see the profits. I have seen many accounts that were doing good for months Blown in a day. If there was R DD those accounts should have been avoided.

my point is that winnings are worthless if we do not take into account the risk we have to take in order to make those results. Relative Drawdown is the first thing an experienced trader looks for.

Thank you

@trdrn