Topics

Replies

PanagiotisCharalampous

27 May 2019, 09:50

Hi goodlynataly,

Thanks for posting in our forum. You should be able to see your strategy now.

Best Regards,

Panagiotis

@PanagiotisCharalampous

PanagiotisCharalampous

27 May 2019, 09:48

Hi sky pips,

In cTrader Copy you invest in strategies and not in positions. You allocate an amount you want to invest to a strategy and the strategy provider is managing this investment for you. At any moment, you can stop following the strategy and receive the value of your investment at that moment. It works in the same way as if you invested your money in an investment fund.

Best Regards,

Panagiotis

@PanagiotisCharalampous

PanagiotisCharalampous

27 May 2019, 09:39

Hi abc,

There is no such feature at the moment in cTrader. You can suggest it if you wish in the Suggestions section.

Best Regards,

Panagiotis

@PanagiotisCharalampous

PanagiotisCharalampous

27 May 2019, 09:32

Hi tgjobscv,

Buy orders are triggered by Ask prices. Bars are drawn based on Bid prices. So when you pending order was triggered, it was triggered by the Ask price which was higher than the Bid price.

Best Regards,

Panagiotis

@PanagiotisCharalampous

PanagiotisCharalampous

24 May 2019, 16:16

Hi erik,

I don't see any obstacle in doing this. All the required infromation is there.

Best Regards,

Panagiotis

@PanagiotisCharalampous

PanagiotisCharalampous

24 May 2019, 15:46

Hi again,

Ok I read your description again. What you describe is possible. You can write a cBot to read entries from a csv file and place orders accorningly. However timestamp and entry price are bit contradicting. Either you will specify an entry time and get the market price or you will specify a trigger price enter the market whenever the condition is met.

Best Regards,

Panagiotis

@PanagiotisCharalampous

PanagiotisCharalampous

24 May 2019, 15:36

Hi Erik,

I am not sure what do you mean with trade setups. Could you please give us an example of what would be in the csv file?

Best Regards,

Panagiotis

@PanagiotisCharalampous

PanagiotisCharalampous

24 May 2019, 10:29

Hi lec0456,

Same as above. The plan is for v3.7 but still no commitments.

Best Regards,

Panagiotis

@PanagiotisCharalampous

PanagiotisCharalampous

23 May 2019, 16:59

Hi marshalmax9,

Thanks for posting in our forum. There is no such functionality in the built-in price alerts. However if you are familiar with programming, you could write a cBot that would send you a notification when this happens. Else you could reach out to a consultant to help you.

Best Regards,

Panagiotis

@PanagiotisCharalampous

PanagiotisCharalampous

23 May 2019, 16:53

Hi mukkacow,

We tried this on iOS 12.4 but seems to be working fine. Could you please send us some troubleshooting information. To do so please tap seven times on the logo in the main menu and then press Submit.

Best Regards,

Panagiotis

@PanagiotisCharalampous

PanagiotisCharalampous

23 May 2019, 14:26

Hi alex_mihail,

Y parameter is the price level you want to print the text and for x parameter you have a choice between the bar index and and date.

If you have no idea what you are doing then a good idea would be to contact Ahmad(AlgoDeveloper) to do this for you :)

Best Regards,

Panagiotis

@PanagiotisCharalampous

PanagiotisCharalampous

23 May 2019, 10:15

Hi tomopeov,

It would look something like this

protected override void OnStart()

{

Positions.Closed += Positions_Closed;

}

private void Positions_Closed(PositionClosedEventArgs obj)

{

if (obj.Reason == PositionCloseReason.TakeProfit)

{

if (obj.Position.TradeType == TradeType.Buy)

{

PlaceStopOrder(TradeType.Sell, Symbol, obj.Position.VolumeInUnits, obj.Position.EntryPrice);

}

else

{

PlaceStopOrder(TradeType.Buy, Symbol, obj.Position.VolumeInUnits, obj.Position.EntryPrice);

}

}

}

Best Regards,

Panagiotis

@PanagiotisCharalampous

PanagiotisCharalampous

23 May 2019, 10:02

Hi alex_mihail,

If you just want to print text on the chart then you can use Chart.DrawText() function.

Best Regards,

Panagiotis

@PanagiotisCharalampous

PanagiotisCharalampous

23 May 2019, 09:58

Hi wisegprs,

Calculate() gets triggered on each tick, that's why. You need to run your code only when the bar count changes.

Best Regards,

Panagiotis

@PanagiotisCharalampous

PanagiotisCharalampous

23 May 2019, 09:56

Hi yosifiv,

StopOutLevel is related with the level your margin has to reach in order for the stop out process to start. If you just want to modify your position when your equity reaches 50% of the balance just use a condition like below

if(Account.Equity < Account.Balance * 0.5)

If you want to start stopping out your positions when margin falls below StopOutLevel then you first need to calculate the margin used. In this case, this discussion might be helpful.

Best Regards,

Panagiotis

@PanagiotisCharalampous

PanagiotisCharalampous

22 May 2019, 15:42

( Updated at: 21 Dec 2023, 09:21 )

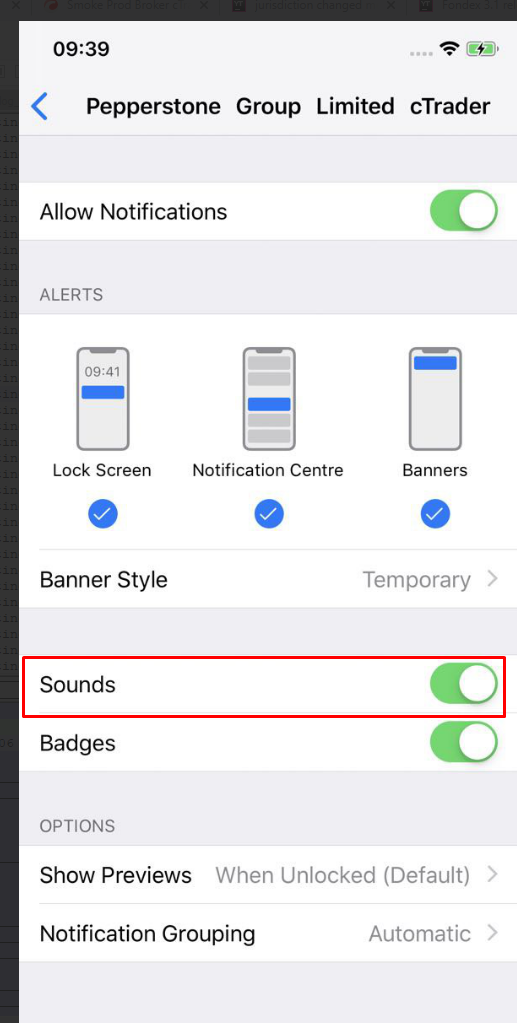

Hi mukkacow,

Thanks for posting in our forum. Please make sure that the notifications sound is turned on for the application. See below

Best Regards,

Panagiotis

@PanagiotisCharalampous

PanagiotisCharalampous

22 May 2019, 15:38

Hi UFO1,

Thanks for posting in our forum. There is no such property in the Position class at the moment.

Best Regards,

Panagiotis

@PanagiotisCharalampous

PanagiotisCharalampous

22 May 2019, 15:36

Hi yosifov,

Your request is not clear. What do you want to use this for?

Best Regards,

Panagiotis

@PanagiotisCharalampous

PanagiotisCharalampous

22 May 2019, 09:51

Hi Eliezer,

Even though we are trying to make backtesting results as close as possible to the real time execution, it is not always possible. At the moment we do not have historical data about the swaps. commissions or market depth therefore you should expect some deviation of the backtesting results when compared to real time execution.

Best Regards,

Panagiotis

@PanagiotisCharalampous

PanagiotisCharalampous

27 May 2019, 17:52

Hi wisegprs,

We will check this but it seems to be just a rounding issue. I don't think it will affect your results.

Best Regards,

Panagiotis

@PanagiotisCharalampous