Take profit price and trailing stop not working

12 Feb 2025, 18:03

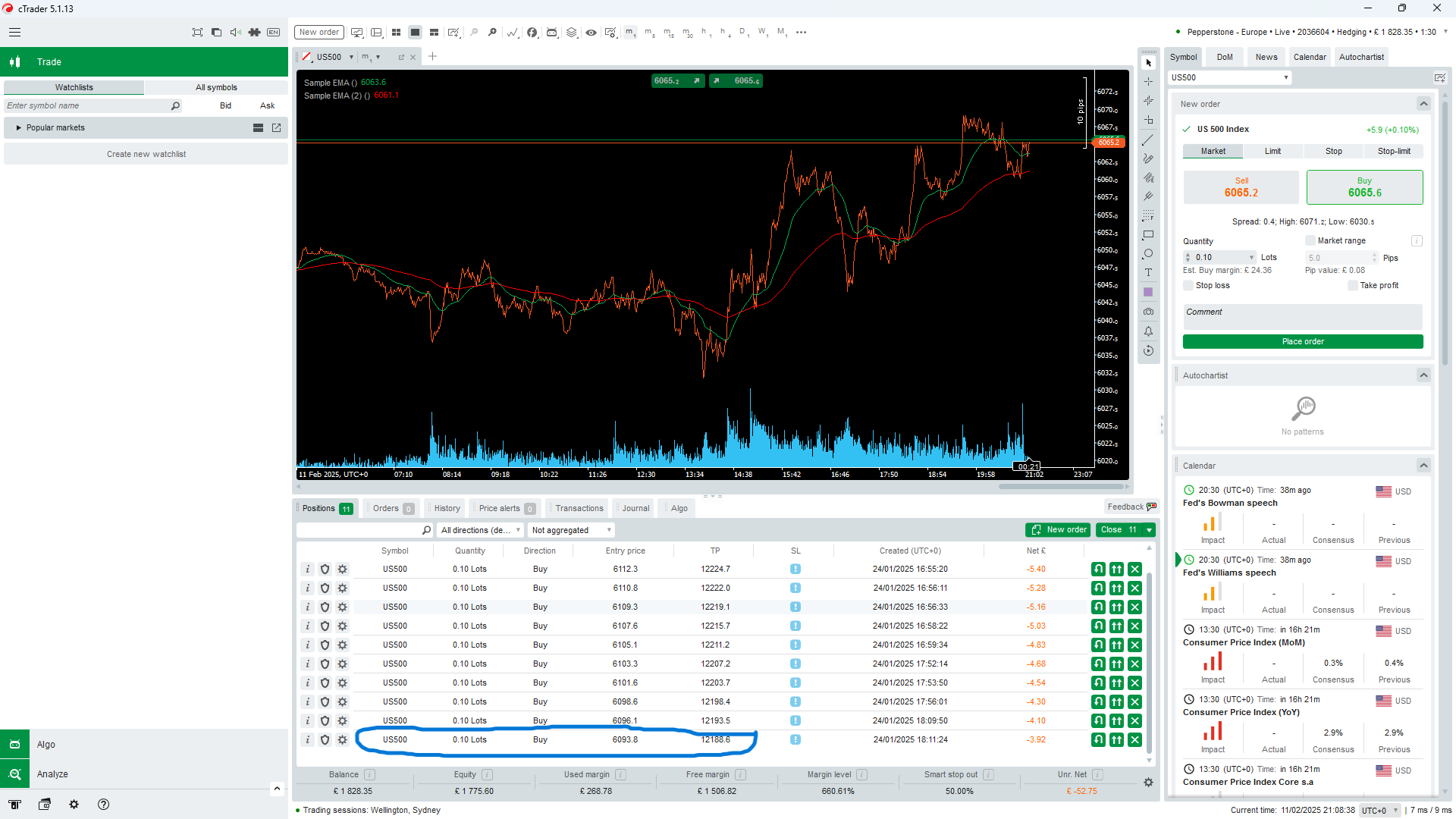

Considering the code below: whenever the bot places a buy order and applies the values for take profit and trailing stop, the values don't work, but the ctrader platform shows a Take profit value that is twice the entry price. Example Entry price = 6000 and TP = 12000. See attached screenshot

using cAlgo.API;

using cAlgo.API.Indicators;

using cAlgo.API.Internals;

using System;

namespace cAlgo.Robots

{

[Robot(TimeZone = TimeZones.UTC, AccessRights = AccessRights.None)]

public class US500DropBuyBot : Robot

{

private double _entryPrice;

private double _priceDrop;

private double _takeProfitDistance;

private double _trailingStopDistance;

private AverageTrueRange _atr;

private bool _isWaitingForClose;

protected override void OnStart()

{

_atr = Indicators.AverageTrueRange(14, MovingAverageType.Simple);

Positions.Closed += OnPositionClosedHandler;

_isWaitingForClose = false;

}

protected override void OnTick()

{

if (_isWaitingForClose)

return;

double currentPrice = Symbol.Bid;

double atrValue = _atr.Result.LastValue;

double pipSize = Symbol.PipSize;

// Adjust Take Profit & Trailing Stop Based on Market Volatility

if (atrValue > 50) // High Volatility Market

{

_takeProfitDistance = atrValue * 0.50;

_trailingStopDistance = atrValue * 0.30;

}

else if (atrValue >= 10 && atrValue <= 50) // Moderate Volatility Market

{

_takeProfitDistance = atrValue * 0.30;

_trailingStopDistance = atrValue * 0.20;

}

else // Low Volatility Market

{

_takeProfitDistance = atrValue * 0.15;

_trailingStopDistance = atrValue * 0.10;

}

// Convert ATR values into actual price distances

_takeProfitDistance *= pipSize;

_trailingStopDistance *= pipSize;

_priceDrop = atrValue * 1.50 * pipSize; // ATR multiplier for price drop

Print($"ATR: {atrValue}, TP: {_takeProfitDistance}, SL: {_trailingStopDistance}");

try

{

if (_entryPrice == 0 || _entryPrice - currentPrice >= _priceDrop)

{

double volumeInUnits = Symbol.QuantityToVolumeInUnits(0.1);

double takeProfitPrice = currentPrice + _takeProfitDistance;

var position = ExecuteMarketOrder(TradeType.Buy, SymbolName, volumeInUnits, "Buy", null, takeProfitPrice);

if (position == null)

{

Print("Error: Order execution failed.");

}

else

{

_entryPrice = currentPrice;

_isWaitingForClose = true;

}

}

}

catch (Exception ex)

{

Print("An error occurred during order execution: " + ex.Message);

}

try

{

foreach (var position in Positions)

{

if (position.TradeType == TradeType.Buy)

{

double newStopLossPrice = currentPrice - _trailingStopDistance;

if (position.TakeProfit.HasValue && newStopLossPrice >= position.TakeProfit.Value)

{

newStopLossPrice = position.TakeProfit.Value - pipSize;

}

if (currentPrice > position.EntryPrice + _trailingStopDistance &&

(position.StopLoss == null || position.StopLoss < newStopLossPrice))

{

position.ModifyStopLossPrice(newStopLossPrice);

}

}

}

}

catch (Exception ex)

{

Print("An error occurred while modifying the stop loss: " + ex.Message);

}

}

private void OnPositionClosedHandler(PositionClosedEventArgs args)

{

_entryPrice = 0;

_isWaitingForClose = false;

Print($"Position closed: {args.Position.Id}, P/L: {args.Position.GrossProfit}, Reason: {args.Reason}");

}

protected override void OnStop()

{

Positions.Closed -= OnPositionClosedHandler;

}

}

}

Any help, please.

firemyst

18 Feb 2025, 01:10

You didn't show the output of:

Print($"ATR: {atrValue}, TP: {_takeProfitDistance}, SL: {_trailingStopDistance}");

So basically, nobody knows what the numbers are along the way as it calculates the TP price you're setting. Have you tried debugging the code and/or used Visual studio to run in debug mode to see what the values are along the way to make sure they tee up to what you're expecting?

@firemyst