How is Grossprofit and usedmargin realy calculated.

26 Nov 2019, 22:40

Because there where Orders that were not taken that should have been and orders that where taken that should not have been I dove a little deeper in the Moneymanagement used for deciding when to take a position or when to not do so.

In scalping we talk about very small pricechanges and tiny margins that are critical to success or failure.

I wrote a little debugstuff to see what is the status when a position is openend and let it run in backtest on just the first position (notice the stop)

I took a simple situation opening EURNOK long in a EUR account.

private void OnPositionOpened(PositionOpenedEventArgs args)

{

Position pos = args.Position;

double Comm1Way = 25;

double Crossprice = 1;

double StartBalance = 1000;

double units = pos.VolumeInUnits;

double entryPrice = pos.EntryPrice;

double leverage = Account.PreciseLeverage;

double pointPrice = Symbol.Bid;

double tickSize = Symbol.TickSize;

Print("\ttickSize\t", tickSize.ToString("F7"));

double tickValue = Symbol.TickValue;

Print("\ttickValue\t", tickValue.ToString("F7"));

double symbolFactor = tickSize / tickValue;

Print("\tsymbolFactor\t", symbolFactor.ToString("F7"));

double spread = (entryPrice - pointPrice);

Print("\tspread\t", spread.ToString("F7"));

double spreadcosts = units * spread / symbolFactor;

Print("\tspreadcosts\t", spreadcosts.ToString("F2"));

double grossprofit = units * spread / symbolFactor;

Print("\tgrossprofit\t", grossprofit);

double commission1w = units * Comm1Way / 1000000;

Print("\tcommission1w\t", commission1w.ToString("F2"));

double commission2w = 2 * commission1w;

Print("\tcommission2w\t", commission2w.ToString("F2"));

double UnitsPrice = units / leverage * Crossprice;

Print("\tUnitsPrice\t", UnitsPrice.ToString("F2"));

Print("\tEquity\t" + (StartBalance - (units * spread / (tickSize / tickValue)) - (2 * units * Comm1Way / 1000000)).ToString("F2"));

Print("\tGr.Prof\t" + (-units * spread / (tickSize / tickValue)).ToString("F2"));

Print("\tNet.Prof\t", (-units * spread / (tickSize / tickValue) + (2 * -units * Comm1Way / 1000000)).ToString("F2"));

Print("\tMarginRequired/Used\t" + (((units / leverage) + (units * (entryPrice - pointPrice) / (tickSize / tickValue))) + (units * Comm1Way / 1000000)).ToString("F2"));

Print("\tFree Margin\t" + (StartBalance + (-units / leverage) + (-units * (entryPrice - pointPrice) / (tickSize / tickValue)) + (-units * Comm1Way / 1000000)).ToString("F2"));

Print("\tID\t",

"AccCurr\t",

"SymbolName\t",

"TickSize \t",

"TickValue\t",

"EntryPr.\t",

"AskPrice\t",

"BidPrice \t",

"Volume\t",

"Comm\t",

"Balance\t",

"Equity\t",

"Lev\t",

"Gr.Prof\t",

"Net.Prof\t",

"FreeMar\t",

"UsedMar");

Print("\t",

pos.Id, "\t",

Account.Currency, "\t",

SymbolName.Left(6), "\t",

Symbol.TickSize.ToString("F6"), "\t",

Symbol.TickValue.ToString("F6"), "\t",

pos.EntryPrice, "\t",

Symbol.Ask, "\t",

Symbol.Bid, "\t",

pos.VolumeInUnits, "\t",

pos.Commissions, "\t",

Account.Balance, "\t",

Account.Equity, "\t",

this.Account.PreciseLeverage, "\t",

pos.GrossProfit, "\t",

pos.NetProfit, "\t",

Account.FreeMargin, "\t",

(Account.Balance - Account.FreeMargin).ToString("F2"), "\t");

Stop();

}

This gave differences on what the calculated figures and reported figures at cTrader are. It is something I can not explain with simple rounding..

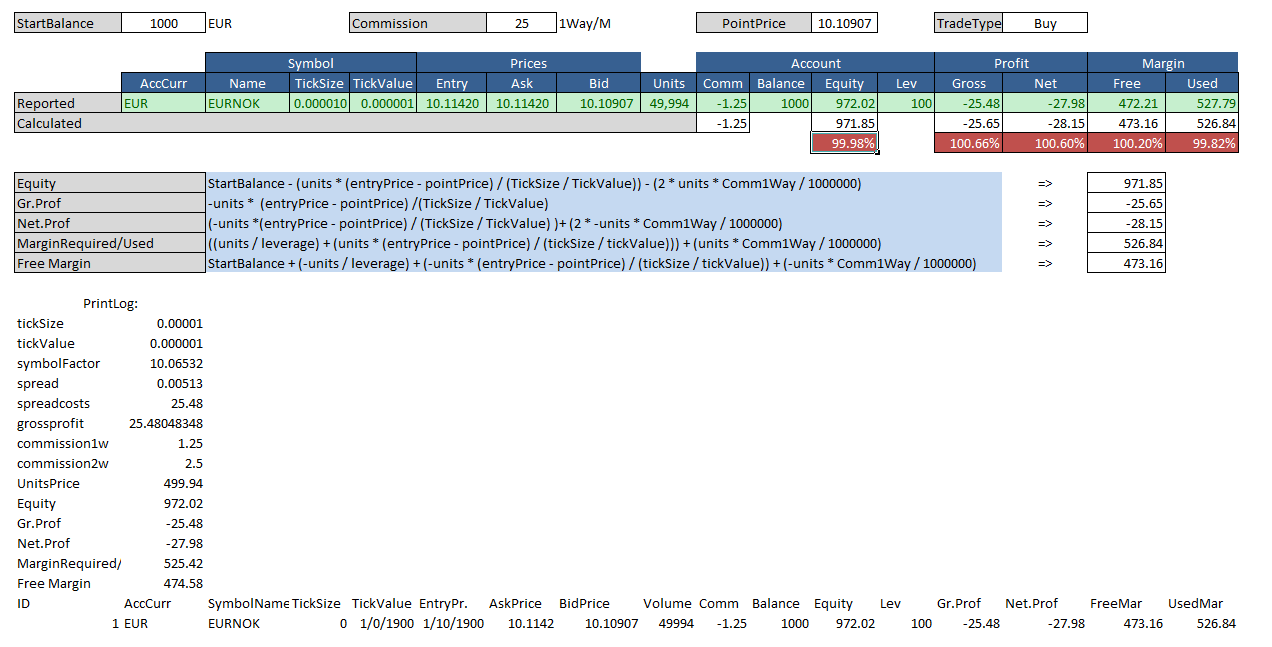

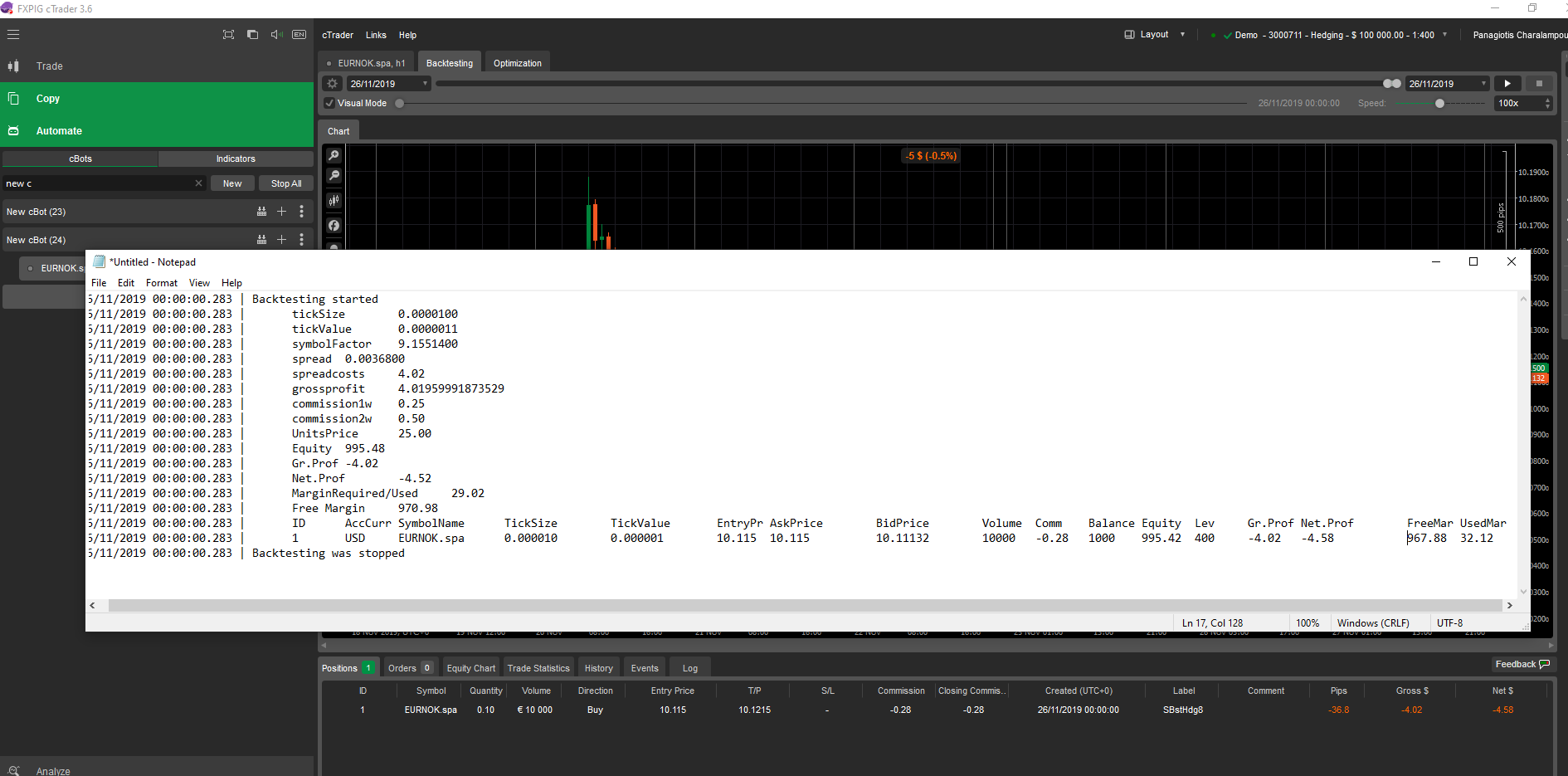

The output is:

The differences in red are significant for scalpers.

The differences in red are significant for scalpers.

So the Question is:

What formula's does cTrader really use in calculating GrossProfit and UsedMargin?

Hope someone can shed a light on the differences or the correct formula's

Best rgds,

Replies

Shares4UsDevelopment

27 Nov 2019, 10:44

( Updated at: 21 Dec 2023, 09:21 )

RE:

Hi Panagiotis,

Here is the data you need:

Broker FXpig

Feed EURONOK.mpa M15

Relevant code: (No need for the complete bot, The difference/problem is the same for every executed order)

ExecuteMarketOrderAsync(TradeType.Buy, "EURNOK", 39841, "SBstHdg8", null, 65);

private void FTMO_OnPositionOpen(PositionOpenedEventArgs args)

{

Position pos = args.Position;

double Comm1Way = 25;

double Crossprice = 1;

double StartBalance = 1000;

double units = pos.VolumeInUnits;

double entryPrice = pos.EntryPrice;

double leverage = Account.PreciseLeverage;

double pointPrice = Symbol.Bid;

double tickSize = Symbol.TickSize;

Print("\ttickSize\t", tickSize.ToString("F7"));

double tickValue = Symbol.TickValue;

Print("\ttickValue\t", tickValue.ToString("F7"));

double symbolFactor = tickSize / tickValue;

Print("\tsymbolFactor\t", symbolFactor.ToString("F7"));

double spread = (entryPrice - pointPrice);

Print("\tspread\t", spread.ToString("F7"));

double spreadcosts = units * spread / symbolFactor;

Print("\tspreadcosts\t", spreadcosts.ToString("F2"));

double grossprofit = units * spread / symbolFactor;

Print("\tgrossprofit\t", grossprofit);

double commission1w = units * Comm1Way / 1000000;

Print("\tcommission1w\t", commission1w.ToString("F2"));

double commission2w = 2 * commission1w;

Print("\tcommission2w\t", commission2w.ToString("F2"));

double UnitsPrice = units / leverage * Crossprice;

Print("\tUnitsPrice\t", UnitsPrice.ToString("F2"));

Print("\tEquity\t" + (StartBalance - (units * spread / (tickSize / tickValue)) - (2 * units * Comm1Way / 1000000)).ToString("F2"));

Print("\tGr.Prof\t" + (-units * spread / (tickSize / tickValue)).ToString("F2"));

Print("\tNet.Prof\t", (-units * spread / (tickSize / tickValue) + (2 * -units * Comm1Way / 1000000)).ToString("F2"));

Print("\tMarginRequired/Used\t" + ((units / leverage) + (units * (entryPrice - pointPrice) / (tickSize / tickValue))).ToString("F2"));

Print("\tFree Margin\t" + (StartBalance + (-units / leverage) + (-units * (entryPrice - pointPrice) / (tickSize / tickValue))).ToString("F2"));

Print("\tID\t",

"AccCurr\t",

"SymbolName\t",

"TickSize \t",

"TickValue\t",

"EntryPr.\t",

"AskPrice\t",

"BidPrice \t",

"Volume\t",

"Comm\t",

"Balance\t",

"Equity\t",

"Lev\t",

"Gr.Prof\t",

"Net.Prof\t",

"FreeMar\t",

"UsedMar");

Print("\t",

pos.Id, "\t",

Account.Currency, "\t",

SymbolName.Left(6), "\t",

Symbol.TickSize.ToString("F6"), "\t",

Symbol.TickValue.ToString("F6"), "\t",

pos.EntryPrice, "\t",

Symbol.Ask, "\t",

Symbol.Bid, "\t",

pos.VolumeInUnits, "\t",

pos.Commissions, "\t",

Account.Balance, "\t",

Account.Equity, "\t",

this.Account.PreciseLeverage, "\t",

pos.GrossProfit, "\t",

pos.NetProfit, "\t",

Account.FreeMargin, "\t",

(Account.Balance - Account.FreeMargin).ToString("F2"), "\t");

Stop();

}

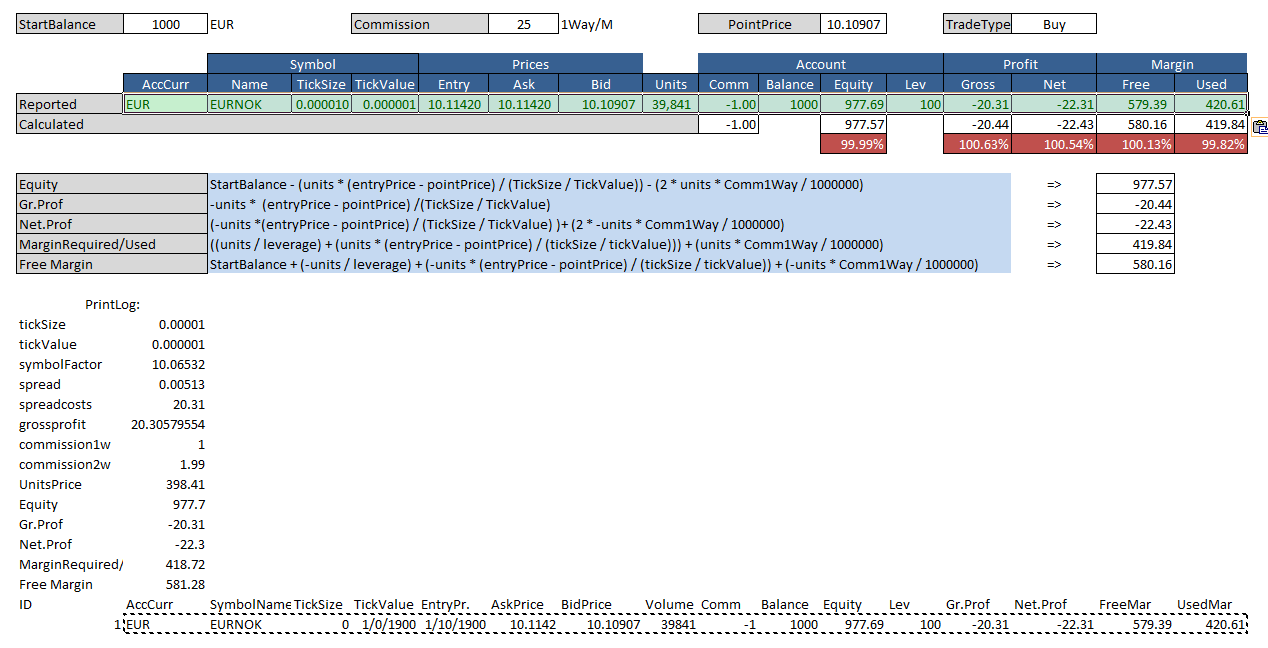

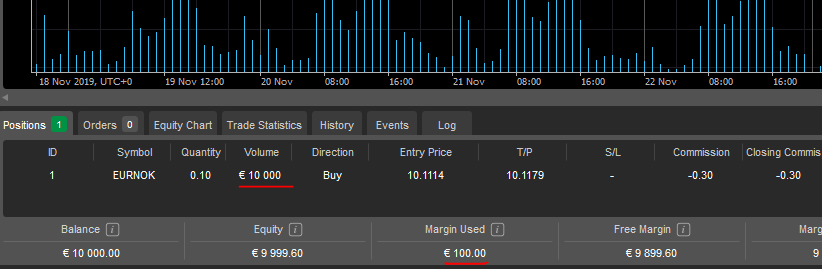

Output:

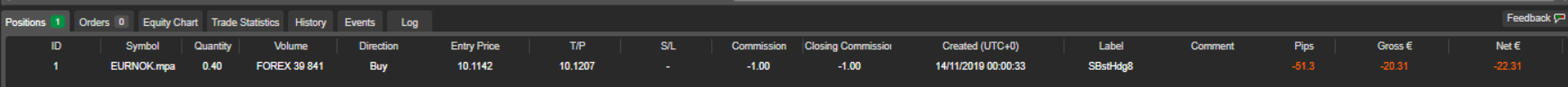

Position taken::

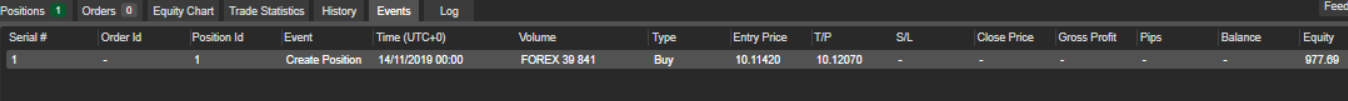

Event:

Hope it helps.

@Shares4UsDevelopment

PanagiotisCharalampous

27 Nov 2019, 11:18

( Updated at: 21 Dec 2023, 09:21 )

Hi A.R.

There is a reason I need exact information to reproduce i.e. a plug and play cBot. For example, I tried this myself and values seem to match

Best Regards,

Panagiotis

@PanagiotisCharalampous

Shares4UsDevelopment

27 Nov 2019, 16:29

RE:

Hi Panagiotis

Well that also matches at my end.

It's the outcome of the formula's I used that does not match!

I'd like to know:

Why those formula's are not OK, what is missing?

And why is there a difference in used margin/free margin when the Equity drops not that amount and the balance stays the same?

Cheers,

A.R.

BTW you used a spa feed not the mpa feed

@Shares4UsDevelopment

PanagiotisCharalampous

27 Nov 2019, 17:08

Hi A.R.

I am not sure why do you calculate margin this way

Print("\tMarginRequired/Used\t" + ((units / leverage) + (units * (entryPrice - pointPrice) / (tickSize / tickValue))).ToString("F2"));

In principle the formula for calculating the margin is the following

Margin = Units / Leverage * Conversion Rate

Where Conversion Rate is the rate between the balance currency and the quote currency

Best Regards,

Panagiotis

@PanagiotisCharalampous

Shares4UsDevelopment

27 Nov 2019, 19:12

RE:

Hi Panagiotis,

Balance currency is the same as Quote currency in the example. (EUR vs EURNOK)

So the Required Margin should be

- (RequiredMargin = Units / Leverage * Conversion Rate) = 39841 / 100 * 1 = 398.41

- (UsedMargin = Balance - FreeMargin) => 1000 - 581.28 = 418.72

So Margin taken by ctrader is 418.72 whilst the required margin is 398.41

Actualy a 1waycommission should be taken into account when determining the RequiredMargin.So:

- (RequiredMargin = (Units / Leverage * Conversion Rate) = 1wCommission)= (39841 / 100 * 1) +1 = 399.41

Still a 19 Euro Gap

Shouldn't 418.72 and 399.41 match?

@Shares4UsDevelopment

PanagiotisCharalampous

28 Nov 2019, 08:45

( Updated at: 21 Dec 2023, 09:21 )

Hi A.R.

Commissions should not be taken into account for required margin calculation. See below a simple example from Spotware Beta.

Unfortunately I cannot reproduce your numbers since I do not have enough information, like the complete cBot you are using, your account type and the symbol you are using. Can you please reproduce such a behavior on Spotware Beta and provide me a complete cBot that will allow me to see the same numbers as you?

Best Regards,

Panagiotis

@PanagiotisCharalampous

PanagiotisCharalampous

27 Nov 2019, 08:48

Hi A.R.

Please provide us with the following

We need this information in order to provide you an explanation.

Best Regards,

Panagiotis

@PanagiotisCharalampous