Description

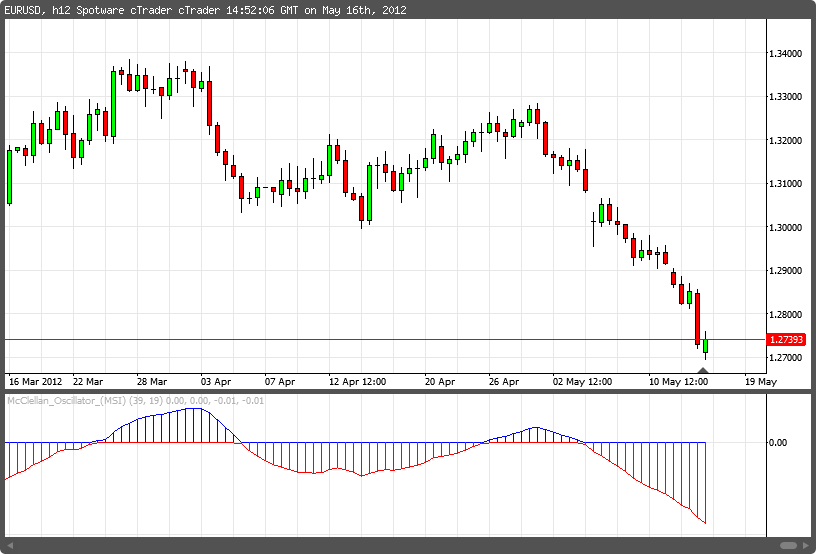

The McClellan oscillator is a market breadth indicator used by financial analysts to evaluate the rate of money entering or leaving the market and interpretively indicate overbought or oversold conditions of the market.

Developed by Sherman and Marian McClellan in 1969, the oscillator is computed using the EMA of the daily ordinal difference of advancing issues (stocks which gained in value) from declining issues (stocks which fell in value) over 39 trading day and 19 trading day periods.

u

qualitiedx2

Joined on 30.09.2011

- Distribution: Free

- Language: C#

- Trading platform: cTrader Automate

- File name: McClellan_Oscillator_(MSI).algo

- Rating: 5

- Installs: 4169

- Modified: 13/10/2021 09:54

Note that publishing copyrighted material is strictly prohibited. If you believe there is copyrighted material in this section, please use the Copyright Infringement Notification form to submit a claim.

Comments

Log in to add a comment.

No comments found.