Description

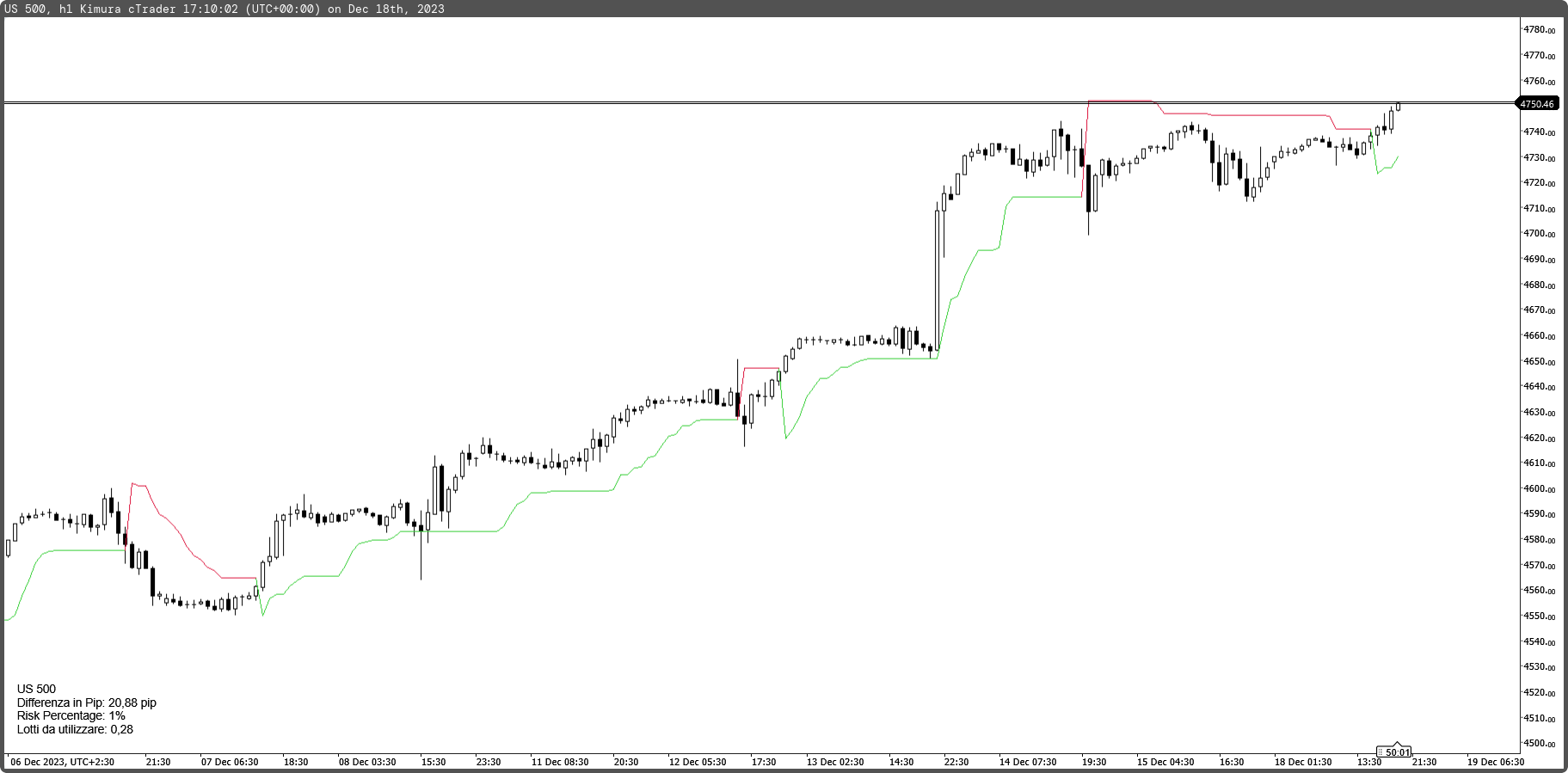

Calculate the lots to use at the supertrend level.

using System;

using cAlgo.API;

using cAlgo.API.Indicators;

namespace cAlgo.Indicators

{

[Indicator(IsOverlay = true, AccessRights = AccessRights.None)]

public class CombinedIndicator : Indicator

{

[Parameter("Supertrend Period", DefaultValue = 10)]

public int SupertrendPeriod { get; set; }

[Parameter("Supertrend Multiplier", DefaultValue = 3)]

public double SupertrendMultiplier { get; set; }

[Parameter("Risk Percentage", DefaultValue = 1, MinValue = 0.1, MaxValue = 100, Group = "Risk Params")]

public double RiskPercentage { get; set; }

[Parameter("Vertical Position", DefaultValue = VerticalAlignment.Bottom, Group = "Risk Params")]

public VerticalAlignment Valign { get; set; }

[Parameter("Horizontal Position", DefaultValue = HorizontalAlignment.Left, Group = "Risk Params")]

public HorizontalAlignment Halign { get; set; }

public enum _MyBalance

{

Balance,

Equity

}

[Parameter("Capital", DefaultValue = _MyBalance.Equity, Group = "Risk Params")]

public _MyBalance CapitalRisk { get; set; }

[Output("UpTrend", Color = Colors.LimeGreen, PlotType = PlotType.DiscontinuousLine, Thickness = 1)]

public IndicatorDataSeries UpTrend { get; set; }

[Output("DownTrend", Color = Colors.Crimson, PlotType = PlotType.DiscontinuousLine, Thickness = 1)]

public IndicatorDataSeries DownTrend { get; set; }

private IndicatorDataSeries _upBuffer;

private IndicatorDataSeries _downBuffer;

private AverageTrueRange _averageTrueRange;

private int[] _trend;

private bool _changeofTrend;

protected override void Initialize()

{

_trend = new int[Bars.Count];

_upBuffer = CreateDataSeries();

_downBuffer = CreateDataSeries();

_averageTrueRange = Indicators.AverageTrueRange(SupertrendPeriod, MovingAverageType.Simple);

Print("Combined Indicator: 1.0.0");

}

public override void Calculate(int index)

{

UpTrend[index] = double.NaN;

DownTrend[index] = double.NaN;

double median = (MarketSeries.High[index] + MarketSeries.Low[index]) / 2;

double atr = _averageTrueRange.Result[index];

_upBuffer[index] = median + SupertrendMultiplier * atr;

_downBuffer[index] = median - SupertrendMultiplier * atr;

if (index < 1)

{

_trend[index] = 1;

return;

}

if (MarketSeries.Close[index] > _upBuffer[index - 1])

{

_trend[index] = 1;

if (_trend[index - 1] == -1)

_changeofTrend = true;

}

else if (MarketSeries.Close[index] < _downBuffer[index - 1])

{

_trend[index] = -1;

if (_trend[index - 1] == 1)

_changeofTrend = true;

}

else

{

_trend[index] = _trend[index - 1];

_changeofTrend = false;

}

UpdateBuffers(index, median, atr);

UpdateTrendLines(index);

DisplaySupertrendValue(index);

if (IsLastBar)

{

string info = String.Format("{0}", SymbolName, CapitalRisk.ToString());

double myCapitalRisk = _getMyCapital(CapitalRisk);

double supertrendValue = _trend[index] == 1 ? UpTrend[index] : DownTrend[index];

double differenzaInPip = Math.Abs(supertrendValue - MarketSeries.Close[index]) / Symbol.PipSize;

info += string.Format("\nDifferenza in Pip: {0:F2} pip", differenzaInPip);

info += string.Format("\nRisk Percentage: {0}%", RiskPercentage);

info += string.Format("\nLotti da utilizzare: {0:0.00}", _getLotSize(myCapitalRisk, RiskPercentage, differenzaInPip));

Chart.DrawStaticText("RiskCalculator", info, Valign, Halign, Color.Black);

}

}

private void UpdateBuffers(int index, double median, double atr)

{

if (_trend[index] < 0 && _trend[index - 1] > 0)

_upBuffer[index] = median + (SupertrendMultiplier * atr);

else if (_trend[index] > 0 && _trend[index - 1] < 0)

_downBuffer[index] = median - (SupertrendMultiplier * atr);

if (_trend[index] < 0 && _upBuffer[index] > _upBuffer[index - 1])

_upBuffer[index] = _upBuffer[index - 1];

if (_trend[index] > 0 && _downBuffer[index] < _downBuffer[index - 1])

_downBuffer[index] = _downBuffer[index - 1];

}

private void UpdateTrendLines(int index)

{

if (_trend[index] == 1)

{

UpTrend[index] = _downBuffer[index];

if (_changeofTrend)

UpTrend[index - 1] = DownTrend[index - 1];

}

else if (_trend[index] == -1)

{

DownTrend[index] = _upBuffer[index];

if (_changeofTrend)

DownTrend[index - 1] = UpTrend[index - 1];

}

}

private void DisplaySupertrendValue(int index)

{

// Puoi fare qualcosa con il valore del Supertrend se necessario

}

private double _getLotSize(double capital, double riskPercentage, double differenceInPips)

{

double pipValue = Symbol.PipValue * Symbol.LotSize;

double moneyRisk = (capital / 100) * riskPercentage;

double stopLossInPips = differenceInPips;

double lotSize = Math.Round(moneyRisk / (stopLossInPips * pipValue), 2);

double Minim = 0.01;

return lotSize < Minim ? Minim : lotSize;

}

private double _getMyCapital(_MyBalance x)

{

switch (x)

{

case _MyBalance.Equity:

return Account.Equity;

default:

return Account.Balance;

}

}

}

}

DELETED_USER

Joined on 28.06.2022 Blocked

- Distribution: Free

- Language: C#

- Trading platform: cTrader Automate

- File name: SUPERTRENMONEYM.algo

- Rating: 0

- Installs: 314

- Modified: 18/12/2023 17:13

Comments

devi caricare l'indicatore su un sito a parte e collegare il link su questa pagina sotto ogni articolo.

I don't understand where they pay me?

I did it but I don't know why it gives two, the old one and the new one

fair enough - so why not do the reader a courtesy and put some text into the description to alert to that fact…

as i said, if we don't object to stuff like this, the crowds will just keep on walking by! I hope you understand my point.

it was just a test, I still need to understand how it works

vince -please check your uploads before committing them - this is a waste of time as there is no info, no upload, no clue as to what it does. if this demonstrates your level of attention to detail, i have some misgivings about what the PAID content quality must be like.

sorry if this sounds like an attack but if we don't self moderate rubbish, then we all suffer.

grazie Andrea