Description

VWAP and 2 Bands, anchored by: h1, h4, h8, h12, D1, W1, Month1.

Designed for Performance.

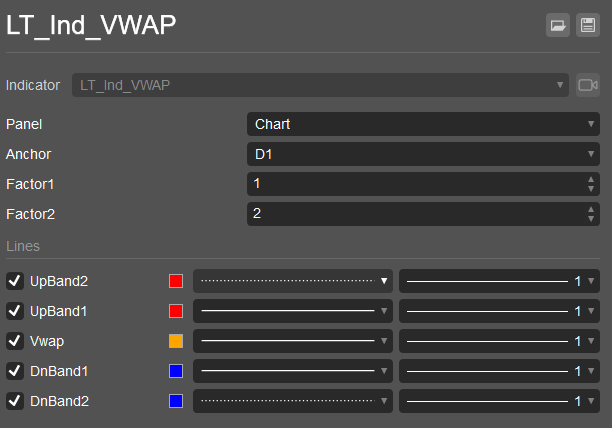

Settings:

Anchor: choose from h1, h4, h8, h12, D1, W1, Month1. E.g, if you choose h4, the VWAP and Bands are reset and calculated every 4 hours. Default is D1 (every day).

Factor1, Factor2: the multiplier factor when calculate the bands.

The source code is fully published.

using System;

using System.Collections.Generic;

using System.Linq;

using System.Text;

using cAlgo.API;

using cAlgo.API.Collections;

using cAlgo.API.Indicators;

using cAlgo.API.Internals;

namespace cAlgo

{

[Indicator(IsOverlay = true, AutoRescale = true, AccessRights = AccessRights.None)]

public class LT_Ind_VWAP : Indicator

{

[Parameter(DefaultValue = Anchors.D1)]

public Anchors Anchor { get; set; }

[Parameter(DefaultValue = 1.0)]

public double Factor1 { get; set; }

[Parameter(DefaultValue = 2.0)]

public double Factor2 { get; set; }

[Output("UpBand2", LineColor = "Red", LineStyle = LineStyle.Dots)]

public IndicatorDataSeries UpBand2 { get; set; }

[Output("UpBand1", LineColor = "Red")]

public IndicatorDataSeries UpBand1 { get; set; }

[Output("Vwap", LineColor = "Orange")]

public IndicatorDataSeries Vwap { get; set; }

[Output("DnBand1", LineColor = "Blue")]

public IndicatorDataSeries DnBand1 { get; set; }

[Output("DnBand2", LineColor = "Blue", LineStyle = LineStyle.Dots)]

public IndicatorDataSeries DnBand2 { get; set; }

Bars _hiBars;

protected override void Initialize()

{

_hiBars = MarketData.GetBars(TimeFrame.Parse(Anchor.ToString()));

_vwap.Reset();

}

Vwap _vwap = new Vwap();

int _lastIndex = -1;

int _lastIndexHigher = -1;

public override void Calculate(int index)

{

var indexHigher = _hiBars.OpenTimes.GetIndexByTime(Bars.OpenTimes[index]);

if (_lastIndexHigher != indexHigher)

{

_vwap.Reset();

_lastIndexHigher = indexHigher;

}

if (_lastIndex != index && index > 0)

{

// Cal up to last bar and update permanent

Cal(index - 1, true);

_lastIndex = index;

}

// Temporary cal at cur index

Cal(index, false);

}

void Cal(int index, bool updateCum)

{

(double vwap, double std) cal = _vwap.Cal(Bars.TickVolumes[index], Bars.TypicalPrices[index], updateCum);

Vwap[index] = cal.vwap;

UpBand1[index] = cal.vwap + Factor1 * cal.std;

DnBand1[index] = cal.vwap - Factor1 * cal.std;

UpBand2[index] = cal.vwap + Factor2 * cal.std;

DnBand2[index] = cal.vwap - Factor2 * cal.std;

}

}

public class Vwap

{

/// <summary>

/// Cummulation volume

/// </summary>

public double CumVol { get; set; }

/// <summary>

/// Cumulation price * volume

/// </summary>

public double CumPriceVol { get; set; }

/// <summary>

/// Cumulation Square of Diff (xi - xbar)2

/// </summary>

public double CumSqrDiff { get; set; }

/// <summary>

/// Cumulation Population Size

/// </summary>

public int CumPSize { get; set; }

public void Reset()

{

CumVol = 0; CumPriceVol = 0; CumSqrDiff = 0; CumPSize = 0;

}

/// <summary>

/// Calculate vwap and std

/// </summary>

/// <param name="tickVol"></param>

/// <param name="price"></param>

/// <param name="updateCum"></param>

/// <returns></returns>

public (double vwap, double std) Cal(double tickVol, double price, bool updateCum = false)

{

var cumVol = tickVol + CumVol;

var cumPriceVol = price * tickVol + CumPriceVol;

var vwap = cumVol == 0 ? price : cumPriceVol / cumVol;

var cumSqrDiff = Math.Pow(price - vwap, 2) + CumSqrDiff;

var cumPSize = 1 + CumPSize;

if (updateCum)

{

CumVol = cumVol; CumPriceVol = cumPriceVol; CumSqrDiff = cumSqrDiff; CumPSize = cumPSize;

}

var std = Math.Sqrt(cumSqrDiff / cumPSize);

return (vwap, std);

}

}

public enum Anchors { h1, h4, h8, h12, D1, W1, Month1 };

}

dhnhuy

Joined on 03.04.2023

- Distribution: Free

- Language: C#

- Trading platform: cTrader Automate

- File name: LT_Ind_VWAP.algo

- Rating: 5

- Installs: 1012

- Modified: 27/10/2023 04:43

Note that publishing copyrighted material is strictly prohibited. If you believe there is copyrighted material in this section, please use the Copyright Infringement Notification form to submit a claim.

Good indicator. I've been using indicators at TradingView.