Description

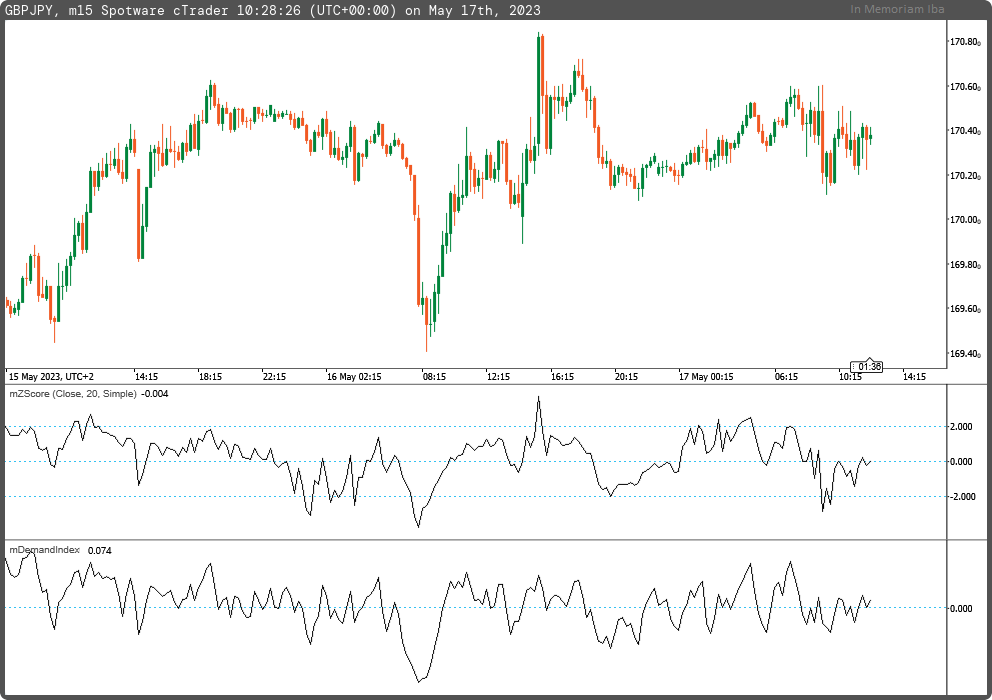

The Demand Index indicator, developed by James Sibbet, combines price and volume and is often considered a leading indicator of price changes.

It has one configurable parameter: Period - calculation periods.

James Sibbet defined six "rules" for the Demand Index:

- Divergence between the Demand Index and the price indicates an upcoming price reversal.

- The price often reaches new highs after an extreme peak in the Demand Index, as the index acts as a leading indicator.

- A high price accompanied by a lower peak in the Demand Index usually coincides with an important peak, serving as a confirmation indicator.

- The Demand Index breaking the zero level indicates a trend change, although with a delay, making it a confirmation indicator.

- If the Demand Index consistently fluctuates around zero, it suggests that the current price trend has weak potential and is unlikely to last long.

- A significant long-term divergence between prices and the Demand Index indicates an important market top or bottom.

using System;

using cAlgo.API;

using cAlgo.API.Indicators;

using cAlgo.API.Internals;

namespace cAlgo

{

[Levels(0)]

[Indicator(IsOverlay = false, AccessRights = AccessRights.None)]

public class mDemandIndex : Indicator

{

[Parameter("Period (5)", DefaultValue = 5, MinValue = 2)]

public int inpPeriod { get; set; }

[Output("Demand Index", LineColor = "Black", PlotType = PlotType.Line, Thickness = 1)]

public IndicatorDataSeries outDemandIndex { get; set; }

private IndicatorDataSeries _di, _tr, _ratiopr, _ratiovol, _constant, _buypreassure, _sellpreassure, _bulls, _bears, _sign, _raw;

private MovingAverage _travg, _volavg;

protected override void Initialize()

{

_di = CreateDataSeries();

_tr = CreateDataSeries();

_travg = Indicators.MovingAverage(_tr, inpPeriod, MovingAverageType.Simple);

_volavg = Indicators.MovingAverage(Bars.TickVolumes, inpPeriod, MovingAverageType.Simple);

_ratiopr = CreateDataSeries();

_ratiovol = CreateDataSeries();

_constant = CreateDataSeries();

_buypreassure = CreateDataSeries();

_sellpreassure = CreateDataSeries();

_bulls = CreateDataSeries();

_bears = CreateDataSeries();

_sign = CreateDataSeries();

_raw = CreateDataSeries();

}

public override void Calculate(int i)

{

_tr[i] = i>1 ? Math.Max(Bars.HighPrices[i],Bars.HighPrices[i-1]) - Math.Min(Bars.LowPrices[i],Bars.LowPrices[i-1]) : Bars.HighPrices[i] - Bars.LowPrices[i];

if(i>1 && Bars.WeightedPrices[i] != 0 && Bars.WeightedPrices[i-1] != 0 && _travg.Result[i] !=0 && _volavg.Result[i] != 0)

{

_ratiopr[i] = i>1 ? (Bars.WeightedPrices[i] - Bars.WeightedPrices[i-1]) / Math.Min(Bars.WeightedPrices[i],Bars.WeightedPrices[i-1]) : 0.01;

_ratiovol[i] = Bars.TickVolumes[i] / _volavg.Result[i];

_constant[i] = _ratiovol[i] /Math.Exp(Math.Min(3.0 * Math.Abs(_ratiopr[i]) * Bars.WeightedPrices[i] / _travg.Result[i], 88.0));

_buypreassure[i] = _ratiopr[i] > 0 ? _ratiovol[i] : _constant[i];

_sellpreassure[i] = _ratiopr[i] > 0 ? _constant[i] : _ratiovol[i];

_bulls[i] = ((i>inpPeriod ? _bulls[i-1] : 0) * (inpPeriod - 1) + _buypreassure[i]) / inpPeriod;

_bears[i] = ((i>inpPeriod ? _bears[i-1] : 0) * (inpPeriod - 1) + _sellpreassure[i]) / inpPeriod;

_raw[i] = 1;

_sign[i] = 0;

if(_bears[i] > _bulls[i])

{

_sign[i] = -1;

if(_bears[i] != 0)

_raw[i] = _bulls[i] / _bears[i];

}

else

{

_sign[i] = +1;

if(_bulls[i] != 0)

_raw[i] = _bears[i] / _bulls[i];

}

_di[i] = (_raw[i] * _sign[i] < 0 ? (-1.0 - (_raw[i] * _sign[i])) : (1.0 - (_raw[i] * _sign[i])));

}

else

_di[i] = 0;

outDemandIndex[i] = _di[i];

}

}

}

mfejza

Joined on 25.01.2022

- Distribution: Free

- Language: C#

- Trading platform: cTrader Automate

- File name: mDemandIndex.algo

- Rating: 5

- Installs: 579

- Modified: 17/05/2023 10:34

Note that publishing copyrighted material is strictly prohibited. If you believe there is copyrighted material in this section, please use the Copyright Infringement Notification form to submit a claim.

Comments

Log in to add a comment.

No comments found.