Description

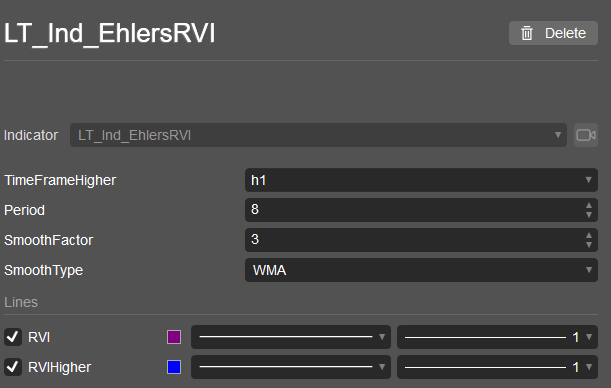

Ehlers Relative Vigor Index in 2 time frames: current time frame and a selectable time frame.

TimeFrameHigher: other time frame.

Period: period for calculating RVI.

SmoothFactor: factor to be used for selected SmoothType. For example, if SmoothType is WMA, SmoothFactor == 3 means WMA for 3 periods.

SmoothType: WMA, EMA, SMA, TwoPoles, ThreePoles, Lague, None.

- WMA, EMA, SMA: Conventions Weighted/Exponetial/Simple Moving Average.

- TwoPoles, ThreePoles: Ehlers 2, 3 Poles smoother (see Ehlers book). SmoothFactor will be the CutOff period, e.g. if CutOff == 10, those with frequency equivalent to < 10 bars will be depressed.

- Lague: Laguerre filter (see Ehlers book). SmoothFactor is the Gamma for Laguerre filter [0 - 0.99].

Ehler Relative Vigor Index (RVI, see Ehlers book), is an Osccilator type indicator. It works well in Cycle market.

The Osc run in [-1, 1] range.

using System;

using System.Collections.Generic;

using System.Linq;

using System.Text;

using cAlgo.API;

using cAlgo.API.Collections;

using cAlgo.API.Indicators;

using cAlgo.API.Internals;

using LittleTrader.Ehlers;

using LittleTrader;

using LittleTrader.Extensions;

namespace cAlgo

{

[Indicator(AccessRights = AccessRights.None)]

public class LT_Ind_EhlersRVI : Indicator

{

[Parameter(DefaultValue = "Hour")]

public TimeFrame TimeFrameHigher { get; set; }

[Parameter("Period", DefaultValue = 8)]

public int Period { get; set; }

[Parameter("SmoothFactor", DefaultValue = 3)]

public double SmoothFactor { get; set; }

[Parameter("SmoothType", DefaultValue = SmoothTypes.SMA)]

public SmoothTypes SmoothType { get; set; }

[Output("RVI", LineColor = "Purple")]

public IndicatorDataSeries RVI { get; set; }

[Output("RVIHigher", LineColor = "Blue")]

public IndicatorDataSeries RVIHigher { get; set; }

EhlersBarsRVI _rvi, _rviHigher;

IndicatorDataSeries _rviHigherOutput;

Bars _barsHigher;

protected override void Initialize()

{

_rvi = new EhlersBarsRVI(Bars, RVI, CreateDataSeries, Period, SmoothType, SmoothFactor);

_rviHigherOutput = CreateDataSeries();

_barsHigher = MarketData.GetBars(TimeFrameHigher);

_rviHigher = new EhlersBarsRVI(_barsHigher, _rviHigherOutput, CreateDataSeries, Period, SmoothType, SmoothFactor);

}

public override void Calculate(int index)

{

_rvi.Calculate(index);

RVIHigher.ReflectHigherTF(_rviHigherOutput, Bars, _barsHigher, index, i => _rviHigher.Calculate(i));

}

}

}

dhnhuy

Joined on 03.04.2023

- Distribution: Free

- Language: C#

- Trading platform: cTrader Automate

- File name: LT_Ind_EhlersRVI.algo

- Rating: 0

- Installs: 557

- Modified: 03/04/2023 03:12

Note that publishing copyrighted material is strictly prohibited. If you believe there is copyrighted material in this section, please use the Copyright Infringement Notification form to submit a claim.

Comments

Log in to add a comment.

No comments found.