Description

-

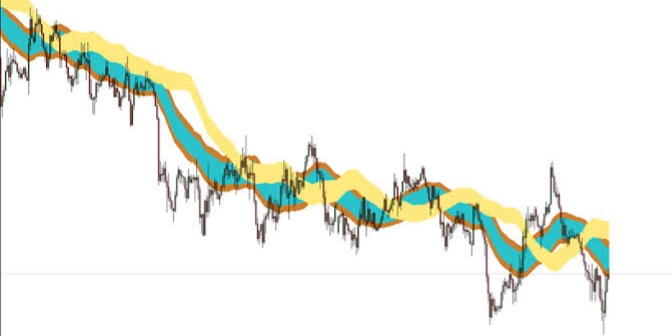

River is a visual identifications tool that can offer more information regarding market sentiment and clarity of price trend

- Used to scan through markets to spot trending opportunities or warn of ranging conditions

- Provides context to the price action and reflects support and resistance zones that can be used for trend following

- Used in combination with other technical tools and techniques for execution purposes

Interpretation

- Price action relative to the rivers

- Crossover of rivers

- Slope of rivers

- Distance between rivers

- Possible support and resistance levels

Uptrend

- Price above the blue river

- Blue river above the gold river

- And the rivers strongly upward sloping

Downtrend

- Price below the blue river

- Blue river below the gold river

- And the rivers strongly downward sloping

Weak Trend

- Lower tops and lower bottoms

- The weakness of the strength of the trend can be identified using the river

- In a weak trend, we expect to see the rivers mixing the price not remaining completely below the blue river

using cAlgo.API;

using cAlgo.API.Indicators;

namespace cAlgo

{

[Cloud("Yellowhigh", "Yellowlow"), Cloud("UpperFilterLine", "LowerFilterLine"), Cloud("Bluelow", "Bluehigh")]

[Indicator(IsOverlay = true, TimeZone = TimeZones.UTC, AccessRights = AccessRights.None)]

public class NeilRiver : Indicator

{

[Parameter("Period", DefaultValue = 45)]

public int Period { get; set; }

[Parameter("Shift", DefaultValue = 20, MinValue = -100, MaxValue = 500)]

public int Shift { get; set; }

[Parameter("MA Type", DefaultValue = MovingAverageType.Exponential)]

public MovingAverageType MAType { get; set; }

[Parameter("Deviation", DefaultValue = 0.025)]

public double Deviation { get; set; }

[Output("UpperFilterLine", LineColor = "#FF5B0204")]

public IndicatorDataSeries UpperBand { get; set; }

[Output("LowerFilterLine", LineColor = "#FF5B0204")]

public IndicatorDataSeries LowerBand { get; set; }

[Output("Bluelow", LineColor = "#0071C1")]

public IndicatorDataSeries BlueLower { get; set; }

[Output("Bluehigh", LineColor = "#0071C1")]

public IndicatorDataSeries BlueUpper { get; set; }

[Output("Yellowhigh", LineColor = "#FFBEBF00")]

public IndicatorDataSeries YellowUpper { get; set; }

[Output("Yellowlow", LineColor = "#FFBEBF00")]

public IndicatorDataSeries YellowLower { get; set; }

private MovingAverage hi;

private MovingAverage lo;

private MovingAverage high;

private MovingAverage low;

private MovingAverage Yellowhigh;

private MovingAverage Yellowlow;

protected override void Initialize()

{

hi = Indicators.MovingAverage(Bars.HighPrices, Period, MAType);

lo = Indicators.MovingAverage(Bars.LowPrices, Period, MAType);

high = Indicators.MovingAverage(Bars.HighPrices, Period, MAType);

low = Indicators.MovingAverage(Bars.LowPrices, Period, MAType);

Yellowhigh = Indicators.MovingAverage(Bars.HighPrices, Period, MAType);

Yellowlow = Indicators.MovingAverage(Bars.LowPrices, Period, MAType);

}

public override void Calculate(int index)

{

UpperBand[index] = hi.Result[index] * (1 + Deviation / 100);

LowerBand[index] = lo.Result[index] * (1 - Deviation / 100);

BlueUpper[index] = high.Result[index];

BlueLower[index] = low.Result[index];

YellowUpper[index + Shift] = high.Result[index];

YellowLower[index + Shift] = low.Result[index];

}

}

}

TR

traderfxmaster007

Joined on 09.07.2019

- Distribution: Free

- Language: C#

- Trading platform: cTrader Automate

- File name: Neil River.algo

- Rating: 0

- Installs: 1779

- Modified: 13/10/2021 09:54

Note that publishing copyrighted material is strictly prohibited. If you believe there is copyrighted material in this section, please use the Copyright Infringement Notification form to submit a claim.

Comments

Log in to add a comment.

No comments found.