Description

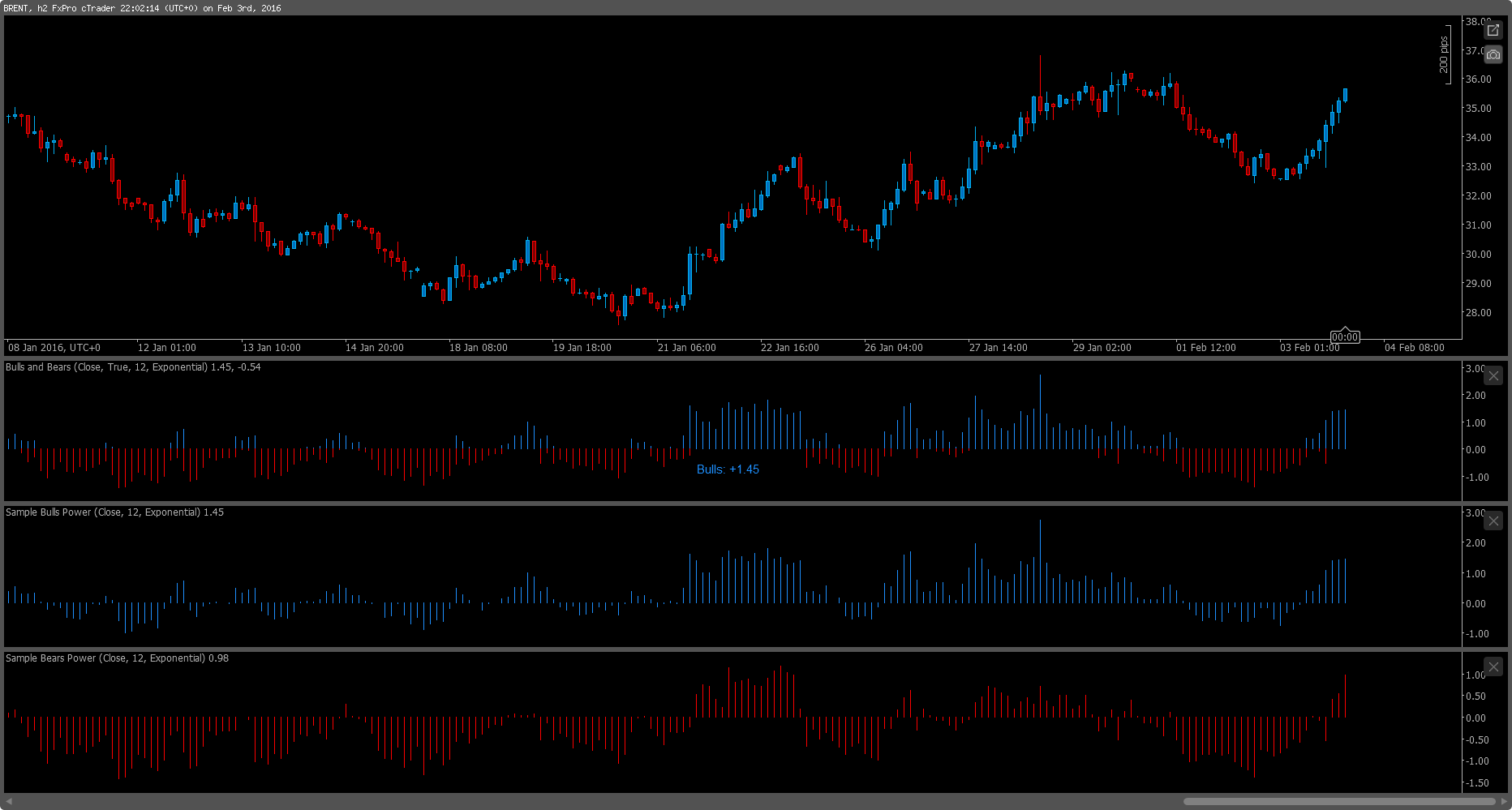

This Bulls and Bears indicator consolidates the Bulls and Bears Power sample indicators in one indicator.

Based on the original Bulls and Bears Power sample indicators from cTrade.

v2

+ Verbose: Allows the option to display the current values of Bulls and Bears.

v1

Public release

// -------------------------------------------------------------------------------------------------

//

// This code is a cAlgo API consolidation indicator provided by njardim@email.com on Dec 2015.

//

// Based on the original Bulls and Bears Power sample indicators from cTrade.

//

// -------------------------------------------------------------------------------------------------

using System;

using cAlgo.API;

using cAlgo.API.Internals;

using cAlgo.API.Indicators;

using cAlgo.Indicators;

namespace cAlgo

{

[Indicator(TimeZone = TimeZones.UTC, AccessRights = AccessRights.None)]

public class BullsandBears : Indicator

{

[Parameter("Source")]

public DataSeries Source { get; set; }

[Parameter("Verbose", DefaultValue = true)]

public bool OnVerbose { get; set; }

[Parameter(DefaultValue = 12, MinValue = 2)]

public int Periods { get; set; }

[Parameter("MA Type", DefaultValue = MovingAverageType.Exponential)]

public MovingAverageType MAType { get; set; }

[Output("Bulls", Color = Colors.DodgerBlue, PlotType = PlotType.Histogram)]

public IndicatorDataSeries Bulls { get; set; }

[Output("Bears", Color = Colors.Red, PlotType = PlotType.Histogram)]

public IndicatorDataSeries Bears { get; set; }

private MovingAverage movingAverage;

protected override void Initialize()

{

movingAverage = Indicators.MovingAverage(Source, Periods, MAType);

}

public override void Calculate(int index)

{

if (MarketSeries.High[index] - movingAverage.Result[index] > 0)

{

Bulls[index] = MarketSeries.High[index] - movingAverage.Result[index];

}

if (MarketSeries.Low[index] - movingAverage.Result[index] < 0)

{

Bears[index] = MarketSeries.Low[index] - movingAverage.Result[index];

}

if (OnVerbose)

{

if (MarketSeries.High[index] - movingAverage.Result[index] > 0.0001)

{

var nBulls = String.Format("{0}", Math.Round(MarketSeries.High[index] - movingAverage.Result[index], Symbol.Digits));

ChartObjects.DrawText("Bulls", "Bulls: +" + nBulls + "\n \n", StaticPosition.BottomCenter, Colors.DodgerBlue);

}

else

{

ChartObjects.DrawText("Bulls", "", StaticPosition.BottomCenter, Colors.DodgerBlue);

}

if (MarketSeries.Low[index] - movingAverage.Result[index] < -0.0001)

{

var nBears = String.Format("{0}", Math.Round(MarketSeries.Low[index] - movingAverage.Result[index], Symbol.Digits));

ChartObjects.DrawText("Bears", "Bears: " + nBears, StaticPosition.BottomCenter, Colors.Red);

}

else

{

ChartObjects.DrawText("Bears", "", StaticPosition.BottomCenter, Colors.Red);

}

}

}

}

}

NJ

njardim

Joined on 06.12.2015

- Distribution: Free

- Language: C#

- Trading platform: cTrader Automate

- File name: Bulls and Bears.algo

- Rating: 5

- Installs: 5422

- Modified: 13/10/2021 09:54

Note that publishing copyrighted material is strictly prohibited. If you believe there is copyrighted material in this section, please use the Copyright Infringement Notification form to submit a claim.

Comments

Log in to add a comment.

AN

This is a lot to take in. - Rancho Cordova Roof Installation

RA

Muy bueno, Gracias

RA

Muy bueno, Gracias

IT

thank you!!!! awesome stuff

But it is really interesting to read. | Metal Roof Repair Boise