Description

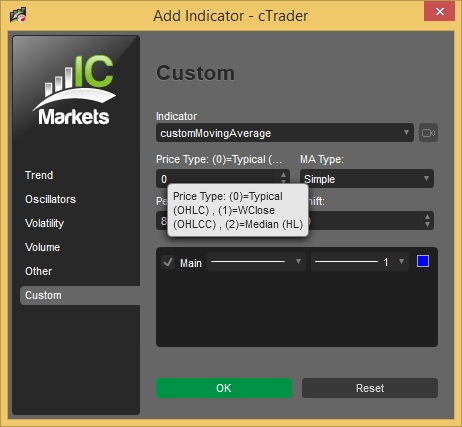

custom MovingAverageV02

Moving Average with shift for different price types;

(0) = Typical Price

(1) = Weighted Close Price

(2) = Median Price

Typical Price = (O+H+L+C) /4

Weighted Close Price = (O+H+L+C+C) /5

Median Price = (H+L) /2

using cAlgo.API;

using cAlgo.API.Internals;

using cAlgo.API.Indicators;

using cAlgo.Indicators;

using System;

namespace cAlgo.Indicators

{

[Indicator(IsOverlay = true, AccessRights = AccessRights.None)]

public class customMovingAverageV02 : Indicator

{

[Parameter("Price Type: (0)=Typical (OHLC) , (1)=WClose (OHLCC) , (2)=Median (HL)", DefaultValue = 0, MinValue = 0, MaxValue = 2)]

public int PriceType { get; set; }

[Parameter("MA Type:", DefaultValue = MovingAverageType.Simple)]

public MovingAverageType MAType { get; set; }

[Parameter("Period:", DefaultValue = 8)]

public int Period { get; set; }

[Parameter("Shift:", DefaultValue = 0, MinValue = -100, MaxValue = 500)]

public int Shift { get; set; }

[Output("Main", Color = Colors.Blue)]

public IndicatorDataSeries MAResult { get; set; }

private MovingAverage movingAverage;

private IndicatorDataSeries dataSeries;

protected override void Initialize()

{

dataSeries = CreateDataSeries();

movingAverage = Indicators.MovingAverage(dataSeries, Period, MAType);

}

public override void Calculate(int index)

{

if (Shift < 0 && index < Math.Abs(Shift))

return;

if (PriceType == 0)

{

dataSeries[index] = (MarketSeries.Open[index] + MarketSeries.High[index] + MarketSeries.Low[index] + MarketSeries.Close[index]) / 4;

}

else if (PriceType == 1)

{

dataSeries[index] = (MarketSeries.Open[index] + MarketSeries.High[index] + MarketSeries.Low[index] + MarketSeries.Close[index] + MarketSeries.Close[index]) / 5;

}

else if (PriceType == 2)

{

dataSeries[index] = (MarketSeries.High[index] + MarketSeries.Low[index]) / 2;

}

MAResult[index + Shift] = movingAverage.Result[index];

}

}

}

ozan

Joined on 07.11.2015

- Distribution: Free

- Language: C#

- Trading platform: cTrader Automate

- File name: customMovingAverage.algo

- Rating: 5

- Installs: 5491

- Modified: 13/10/2021 09:54

Note that publishing copyrighted material is strictly prohibited. If you believe there is copyrighted material in this section, please use the Copyright Infringement Notification form to submit a claim.

Comments

Log in to add a comment.

For a better Source Price Type Selection with dropdown list , please vote for enum parameters support in cAlgo.

Hi Ozan,

Regarding your TradeManagerV03 ( /algos/cbots/show/1080 ) :

Is it possible to use that cBot and set the 'Maximum DrawDown %' parameter – so that my open trades get closed, once I reach a specific Equity profit target ?

For example: When I make 8% in equity growth, then my open trades have their Stop Losses moved up close to lock in the profit.

Thanks.