Description

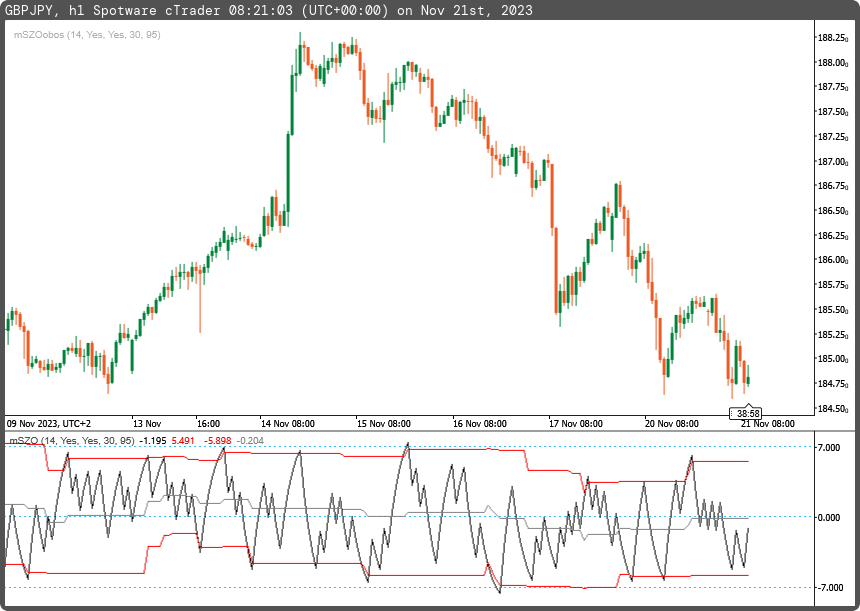

The SZO (Sentiment Zone Oscillator) indicator shows the market sentiment (activity and direction) and zones of excessive activity (overbought/oversold zones). It can display a dynamic channel, beyond which deals are seen as undesirable because of the high probability of a change in sentiment and of reversal.

If the indicator line moves beyond the channel and at the same time enters the overbought/oversold zone, this may mean that the market trend can change soon. The indicator often warns of such a possible change in advance, so it is advisable to use it in combination with another confirmation indicator.

using System;

using cAlgo.API;

using cAlgo.API.Collections;

using cAlgo.API.Indicators;

using cAlgo.API.Internals;

namespace cAlgo

{

[Levels(0, -7, +7)]

[Indicator(IsOverlay = false, AccessRights = AccessRights.None)]

public class mSZO : Indicator

{

[Parameter("Period SZO (14)", DefaultValue = 14)]

public int inpPeriodSZO { get; set; }

[Parameter("Show Levels (yes)", DefaultValue = true)]

public bool inpShowDLev { get; set; }

[Parameter("Show Mid Level (yes)", DefaultValue = true)]

public bool inpShowMidLev { get; set; }

[Parameter("Period Levels (30)", DefaultValue = 30)]

public int inpPeriodLevels { get; set; }

[Parameter("Percent Level (95.0)", DefaultValue = 95.0)]

public double inpPercentLevel { get; set; }

[Output("SZO", IsHistogram = false, LineColor = "Black", PlotType = PlotType.Line, LineStyle = LineStyle.Solid, Thickness = 1)]

public IndicatorDataSeries outSZO { get; set; }

[Output("Top", IsHistogram = false, LineColor = "Red", PlotType = PlotType.Line, LineStyle = LineStyle.Solid, Thickness = 1)]

public IndicatorDataSeries outTop { get; set; }

[Output("Bottom", IsHistogram = false, LineColor = "Red", PlotType = PlotType.Line, LineStyle = LineStyle.Solid, Thickness = 1)]

public IndicatorDataSeries outBottom { get; set; }

[Output("Middle", IsHistogram = false, LineColor = "Gray", PlotType = PlotType.Line, LineStyle = LineStyle.Solid, Thickness = 1)]

public IndicatorDataSeries outMiddle { get; set; }

private IndicatorDataSeries _score, _szo, _hhlvl, _lllvl, _range, _rangeproc;

private ExponentialMovingAverage _smooth1, _smooth2, _smooth3;

protected override void Initialize()

{

_score = CreateDataSeries();

_szo = CreateDataSeries();

_hhlvl = CreateDataSeries();

_lllvl = CreateDataSeries();

_range = CreateDataSeries();

_rangeproc = CreateDataSeries();

_smooth1 = Indicators.ExponentialMovingAverage(_score, inpPeriodSZO);

_smooth2 = Indicators.ExponentialMovingAverage(_smooth1.Result, inpPeriodSZO);

_smooth3 = Indicators.ExponentialMovingAverage(_smooth2.Result, inpPeriodSZO);

}

public override void Calculate(int i)

{

_score[i] = (i>1 && Bars.ClosePrices[i] > Bars.ClosePrices[i-1] ? +1 : -1);

_szo[i] = 100.0 * ((3 * _smooth1.Result[i] - 3 * _smooth2.Result[i] + _smooth3.Result[i]) / inpPeriodSZO);

_hhlvl[i] = _szo.Maximum(inpPeriodLevels);

_lllvl[i] = _szo.Minimum(inpPeriodLevels);

_range[i] = _hhlvl[i] - _lllvl[i];

_rangeproc[i] = _range[i] * (inpPercentLevel / 100.0);

outSZO[i] = _szo[i];

outTop[i] = inpShowDLev ? _lllvl[i] + _rangeproc[i] : double.NaN;

outBottom[i] = inpShowDLev ? _hhlvl[i] - _rangeproc[i] : double.NaN;

outMiddle[i] = inpShowDLev && inpShowMidLev ? (_lllvl[i] + _rangeproc[i] + _hhlvl[i] - _rangeproc[i]) / 2 : double.NaN;

}

}

}

mfejza

Joined on 25.01.2022

- Distribution: Free

- Language: C#

- Trading platform: cTrader Automate

- File name: mSZO.algo

- Rating: 0

- Installs: 398

- Modified: 21/11/2023 08:21

Note that publishing copyrighted material is strictly prohibited. If you believe there is copyrighted material in this section, please use the Copyright Infringement Notification form to submit a claim.

Comments

Log in to add a comment.

No comments found.