Description

.

.

.

Download Version : 2.0.0.0

https://clickalgo.com/files/trials/vendors/TLM%20ClickAlgo%20Trial%201.8.1.zip

click here => DOWNLOAD

.

.

.

cTrader Trading bots of the TLM series (The Last Move) are cBots based on new trading strategies that have different definitions for each currency pair, this cBot trades using XAUUSD (Gold). The mother of these strategies is Smart Money, which has been optimized by the programmers and analysts of Modern Andishan Jay.

- Level of Difficulty: Beginner

- Type: Windows & macOS (cTrader Platform)

- Current version: 1.8.0.1

- Updated: Monday, 29 January 2024

- Author: Modern Andishan Jay

The latest and most updated bot from the TLM series is their fusion bot known as Fusion TLM. This cBot draws structures with the help of Swings and considers their numbers for transactions. It obtains the latest BOS and ChoCh of the market and uses two RSI and Stochastic and Ichimoku indicators to enter the trade in the direction of the trend.

Swing Based Strategy

The main basis of the strategies of TLM series bots is based on the indicator made by the programmers of the Modern Andishan Jay company called Swing, which obtains the Highs and Lows (in the range) of the price chart and helps us to understand ChoCh or BOS.

When the trades are opened, their Take Profit is placed on their previous swings, but it does not have Stop Loss, and the cBot closes the trade if it sees a violation view. For example, if the BOS of XAUUSD is bullish, if we are in the last structure (between the last SwingHigh and SwingLow) and if Stochastic or RSI or Ichimoku gives us a signal, we will enter the trade, if the last BOS is bearish, we will open a sell trade and if it is bullish, we will open a buy trade. If these BOSs against the previous trend (ChoCh) occur, they will be Close to the trade.

The cBot is not optimized and we have not optimized our robots so far. I believe that optimization has many errors because it makes the bot perfect for some time, but it may not happen in the coming years. This is the default setting of our strategy, which has been tested live for a long time and has given favourable results.

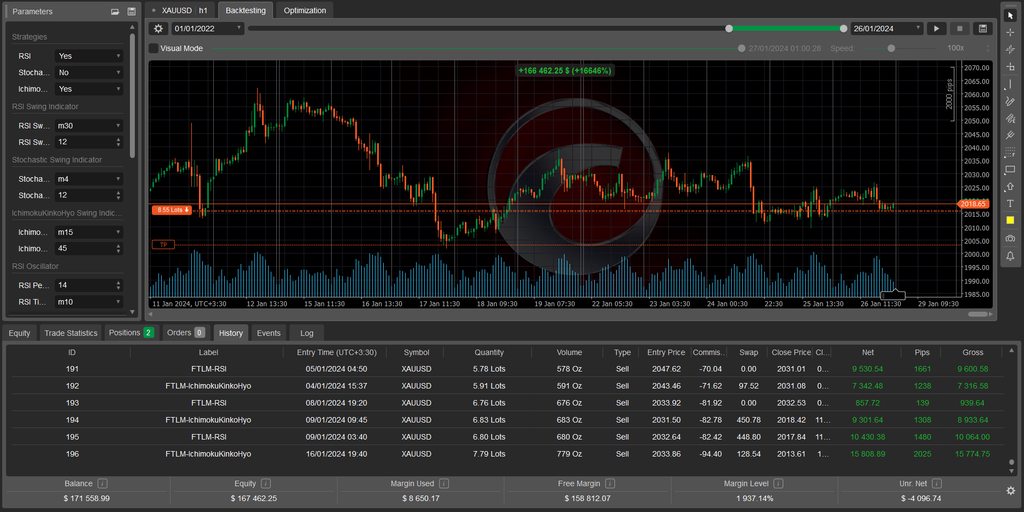

How to Test the Strategy

You can easily test this system by running a backtest over any period, you can use short or long periods, as it does not require ongoing parameter optimisation (calibration) the system should provide more winning trades than losing trades.

cBot Settings Explained

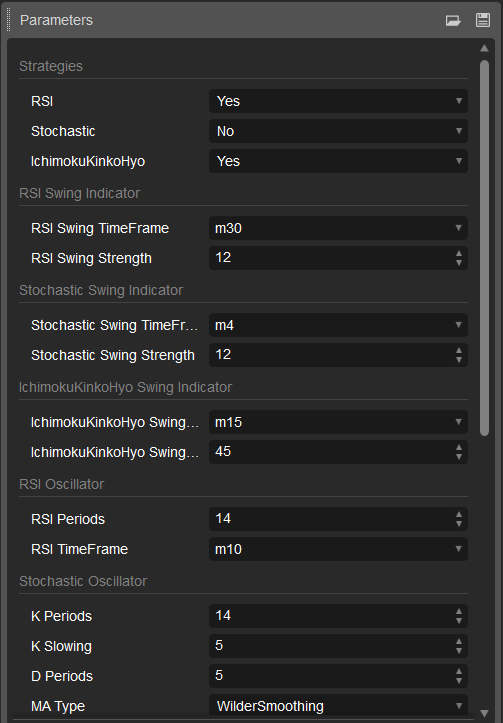

First of all, it is better to know that the bot is optimized by default and it is better not to change it. Trading is done with three indicators: RSI, Stochastic and IchimokuKinkoHyo. Therefore, in the first group of settings, that is, the Strategies group, you can turn them off or on.

- RSI: If it is "Yes", it creates a trade with this strategy.

- Stochastic: If it is "Yes", it creates a trade with this strategy.

IchimokuKinkoHyo: If it is "Yes", it creates a deal with this strategy.

Each of the above entry strategies has specific time frames and settings for the indicator, and swings are created separately for each of them.

In the RSI Swing Indicator group, the settings are as follows:

- RSI Swing TimeFrame: RSI indicator swing timeframe.

- RSI Swing Strength: Strength value (the ability to identify swings) of the RSI indicator.

In the Stochastic Swing Indicator group, the settings are as follows:

- Stochastic Swing TimeFrame: Stochastic indicator swing timeframe.

- Stochastic Swing Strength: Strength value (ability to identify swings) of the Stochastic indicator.

In the IchimokuKinkoHyo Swing Indicator group, the settings are as follows:

- IchimokuKinkoHyo Swing TimeFrame: IchimokuKinkoHyo swing time frame indicator.

- IchimokuKinkoHyo Swing Strength: Strength value (ability to identify swings) of the IchimokuKinkoHyo indicator.

Now we go to the settings of each indicator. In the RSI Oscillator group, the settings are as follows:

- RSI Periods: RSI indicator period.

- RSI TimeFrame: RSI indicator time frame.

In the Stochastic Oscillator group, the settings are as follows:

- K Periods: The value of K Periods is determined.

- K Slowing: The value of K Slowing is determined.

- D Periods: The value of D Periods is determined.

- MA Type: The type of moving average used in the desired indicator.

- Stochastic TimeFrame: Stochastic indicator time frame.

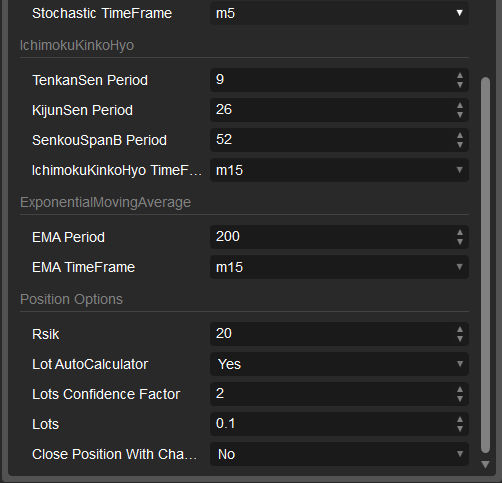

Now it's time to set the IchimokuKinkoHyo indicator:

- TenkanSen Period: Tenkan period value.

- KijunSen Period: Kijun period value.

- SenkouSpanB Period: SenkouSpanB period value.

- IchimokuKinkoHyo TimeFrame: The time frame of the indicator is set.

In version 1.7.1, an exponential moving average is used to manage wrong trades of the robot, for which you can make the following settings:

- EMA Period: EMA period which defaults to 200.

- EMA TimeFrame: The time frame in which the EMA is drawn.

Now we go to the settings related to capital management and transactions in the Position Options section:

- Risk: How much of your capital does the robot risk per trade? (By default, it is 20%.) Yes, 20% is a high risk, but it rarely happens that your transactions will be exited with this risk.

- Lot AutoCalculator: A great capital management option that is great for opening trades with the right volume. The formula for automatically calculating the volume is as follows:

- (Equity/(10000*Lot Confidence Factor))

Lot Confidence Factor: It is a confidence factor that defaults to 2. If you want it to be less risky for you, set it to three.

Lots: If "Lot AutoCalculator" is set to "No", the volume of the transaction will be read from you by this section.

Close Position With Change Trend: In very, very special circumstances, this option should be clear that the robot does this automatically, so it is better not to set it to "Yes" manually.

How to buy?

The author decided to hide the source code.

ModernAndishan

Joined on 15.02.2023

- Distribution: Free

- Language: C#

- Trading platform: cTrader Automate

- File name: TLM ClickAlgo Trial 1.8.0.1.algo

- Rating: 5

- Installs: 73017

- Modified: 30/04/2024 00:54

Comments

And also a fourth question:

In the discussion below you talk about the possibility of creating a fixed SL and.or TP. How can that be added?

It looks good so I just downloaded the trial but I have some questions:

- When I choose the suggested default settings, then I get 464 dollar loss for the past month and 1250 dollar loss for the past year. What am I doing wrong? With optimization I get much better results though.

- Close Position With Change Trend: In very, very special circumstances, this option should be clear that the robot does this automatically, so it is better not to set it to "Yes" manually.

=> I don't understand this functionality; what's the difference between yes and no?

- cTrader News Trade Manager from Clickalgo:

=> Can this be integrated into this bot by buying the service from Clickalgo? If this has been done already, did it improve the results?

tnx i buy it. so nice

yes if you need we can create fix SL and TP for you…

Would be great if the bot has an option to set up fix SL and TP.

Hi ctid7027352

Be careful, the TLM cBot enters the postion using the structures it detects, for example, if you activate it at the beginning of 2024, it will not create any postion, but if you take a backtest from the previous month, you will see that it has created a postion in 2024 as well.

It depends on how to recognize the structures and BOS at the time that it is clear that if the previous BOS have an effect on it, the postion will definitely be different.

Dear Anadish, I have tested it but i get a different result. On 16/9/2022 it losses all the money. Didn't change a thing in the settings. Is there a way to reach out and see why I get different results?

The Best

i wont link to buy this bot online